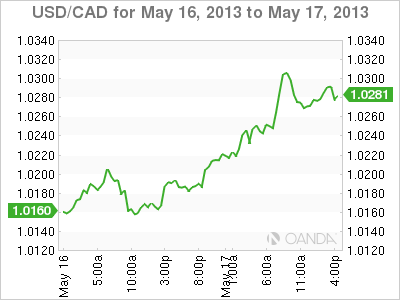

The US dollar edged higher on Friday against its Canadian counterpart, as the pair briefly dipped above the 1.03 level early in the North American session. The pair has not traded at these high levels since early March. USD/CAD moved higher following the release of weaker than expected inflation numbers out of Canada. US numbers have not impressed this week, and the trading week wraps up with the US UoM Consumer Sentiment later today.

Canada released inflation data earlier on Friday, and the figures disappointed the markets. Core CPI, a key event, posted a weak gain of 0.1%, missing the estimate of 0.2%. CPI recorded its first decline since January, dropping by 0.2%. The estimate stood at 0.0%. These numbers point to weak activity in the Canadian economy, and could increase speculation about a rate cut by the Bank of Canada.

US releases have looked unimpressive this past week, and Thursday’s events did not bring any relief. Core CPI posted a weak gain of 0.1%, missing the forecast of a 0.2% gain. Unemployment Claims had looked impressive in recent readings, but the key indicator slumped, as new claims jumped to 360 thousand, blowing past the estimate of 332 thousand. The Philly Fed Manufacturing Index dropped into negative territory, posting a reading of -5.2 points. The markets had expected a gain of 2.5 points. Housing Starts fell sharply, from 1.04 million to 0.85 million. This was well below the estimate of 0.98 million. There was some positive news, as Building Permits, which rose to 1.02 million, beating the estimate of 0.94 million. The disappointing numbers will again bring into question the health of the US economy, which has not been able to churn out continuous positive releases.

The US dollar has enjoyed some broad strength against the major currencies of late, in part due to speculation that the Federal Reserve might terminate its current round of quantitative easing. On Thursday, John Williams, president of the Federal Reserve Bank of San Francisco, said that the Fed could begin reducing its quantitative easing program this summer and wind up bond buying late in 2013. As QE is dollar-negative, these remarks gave a boost to the US dollar. The markets will be all ears to what the Fed has to say, as comments about QE will likely have an impact on the currency markets.

USD/CAD May 17 at 14:15 GMT

1.0297 H: 1.0307 L: 1.0260 USD/CAD Technical" title="USD/CAD Technical" width="600" height="81">

USD/CAD Technical" title="USD/CAD Technical" width="600" height="81">

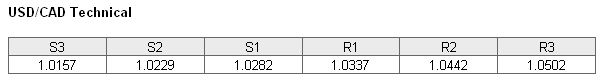

USD/CAD has moved higher, and is trading close to the 1.03 line. The pair is receiving support at 1.0282. This is a weak line, and could be tested if the Canadian dollar shows any improvement. There is a stronger line of support at 1.0229. On the upside, the pair is facing resistance at 1.0337. This is followed by a stronger line of resistance at 1.0442.

- Current range: 1.0282 to 1.0337

- Below: 1.0282, 1.0229, 1.0157, 1.01, 1.0041 and 1.00

- Above: 1.0337, 1.0442, 1.0502 and 1.0658.

USD/CAD ratio is pointing to strong movement towards short positions. This movement can be explained by the fact that as the US dollar pushes higher, more long positions are being covered and taken out of the ratio. As a result of this movement, a majority of the open positions are now short. If the pair continues to show activity, we can expect continuing movement from the ratio as well.

The US dollar capitalized on some weak Canadian inflation numbers, and the pair is close to the 1.03 level. Will the pair’s upward trend continue?