The US dollar is declining amid poor data on the US retail sales. On Wednesday the pair fell to the level of 1.1928, which are the five-month lows.

On Friday, important data for the pair is scheduled for release– this is the volume of sales in the manufacturing sector of Canada. This is a leading indicator, demonstrating economic state of the country. According to the forecast, the index will grow by 0.5%, which will trigger strengthening in the Canadian dollar.

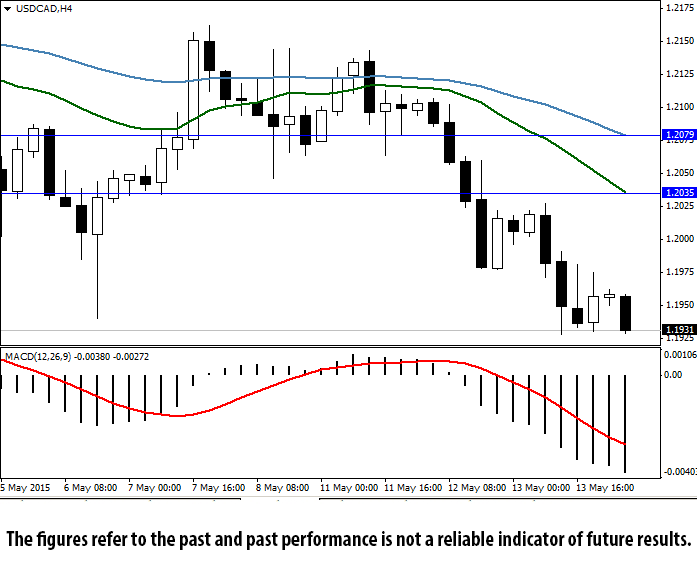

On the four-hour chart moving average lines are above the current price. They are directed downwards, which indicates downtrend. MACD histogram is in the negative zone; its volumes are increasing, which is also an indicator of the negative dynamics of the price. As soon as the line of histogram crosses the signal line from bottom to top, we will get a sell signal.

The nearest resistance level is 1.2035 (moving average with the period 20).

Next resistance level is 1.2079 (moving average with the period 50).

Support levels: 1.1865 и 1.1725 (local lows).