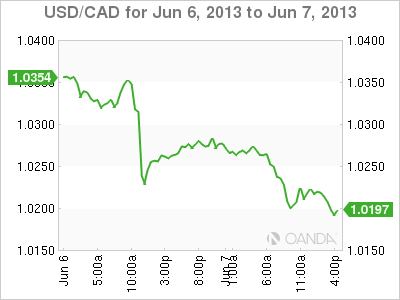

The US dollar was broadly weaker on Thursday, and the loonie made sure not to miss the party. The Canadian dollar picked up around 70 points, and briefly pushed below the 1.02 line. USD/CAD has bounced back up, and was trading in the 1.0250 range in Friday’s European session. In economic news, it could be a busy day for the pair, with both Canada and the US releasing the Unemployment Rate and Employment Change.

The naysayers have been quite vocal lately about the Canadian economy, but there was excellent news earlier on Thursday, as Ivey PMI shot higher. The key index jumped from 52.2 to 63.1 points, blowing past the estimate of 55.3 points. This was the best showing by the index since March 2012. Ivey PMI is noted for its sharps rises and drops, which makes accurate predictions a tricky task. If Canada’s employment numbers look good on Friday, the loonie could make more inroads against the greenback.

The markets continue to have trouble figuring out the direction of the US economy. The US continues to post mixed numbers, and on Wednesday, ADP Non-Farm Payrolls looked sluggish. The key indicator has struggled, and has now missed the estimate for three consecutive releases. The indicator came in at 135 thousand, well off the forecast of 171 thousand. However, Unemployment Claims bounced back, posting a reading of 346 thousand, very close to the estimate of 345 thousand. We’ll get a clearer picture of the employment picture later today, as the US releases the Unemployment Rate and Non-Farm Payrolls.

Will the Federal Reserve scale back QE? Although the Fed hasn’t made any changes so far, Fed policymakers, including Fed Chair Bernanke, continue to hint that QE could be scaled back in the next few months. With the US continuing to alternate between good and bad economic releases, the Fed may continue to hold off on any changes to QE before it is convinced that the US economy is improving. The Fed has repeatedly stated that it wants to see an improvement in the labor picture before taking any action, so Friday’s key employment releases could play a major role in what action, if any, the Fed takes with regard to QE.

USD/CAD June 7 at 14:10 GMT

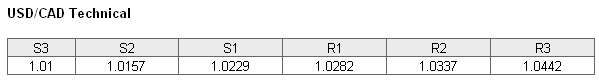

USD/CAD 1.0250 H: 1.0288 L: 1.0248 USD/CAD Technical" title="USD/CAD Technical" width="599" height="80">

USD/CAD Technical" title="USD/CAD Technical" width="599" height="80">

USD/CAD continues to drop, as the pair trades in the mid-1.02 range. USD/CAD is receiving support at 1.0229. This line is a weak line and could be tested if the Canadian dollar continues to improve. The next support level is at 1.0157. On the upside, the pair faces resistance at 1.0282. This is followed by resistance at 1.0337.

- Current range: 1.0229 to 1.0282

- Below: 1.0229, 1.0157, 1.01 and 1.00

- Above: 1.0282, 1.0337, 1.0442, 1.0502 and 1.0658

USD/CAD ratio is pointing to movement towards long positions. We are not seeing this in the pair’s current movement, as the Canadian dollar continues to improve against the US currency. Short positions continue to enjoy a substantial majority, indicating a strong bias that the Canadian dollar will continue to rally.

USD/CAD Fundamentals

- 12:30 Canadian Employment Change. Estimate 16.1K.

- 12:30 Canadian Unemployment Rate. Estimate 7.2%.

- 12:30 Canadian Labor Productivity. Exp. 0.3%.

- 12:30 US Non-Farm Employment Change. Estimate 167K.

- 12:30 US Unemployment Rate. Estimate 7.5%.

- 12:30 US Average Hourly Earnings. Estimate 0.2%.

- 19:00 US Consumer Credit. Estimate 13.4B.