USD/CAD has been marked by strong volatility this week, but the pair has settled down early in Wednesday’s North American session, where it is trading in the mid-1.03 range. The Canadian dollar posted some gains on Monday, but gave up most of these gains on Tuesday. On Wednesday, the US released disappointing employment numbers, as ADP Non-Farm Employment Change fell way below expectations. The US also released ISM Non-Manufacturing PMI, which came in slightly above the forecast. There are no Canadian releases on Wednesday.

In the US, another key indicator posted a weak reading, as ADP Non-Farm Employment Change rose to 135 thousand, but was way off the forecast of 171 thousand. This was the third consecutive release to miss expectations, and will likely raise concerns about the extent of the US recovery, given the cloudy employment picture. Today’s other key release, ISM Non-Manufacturing PMI, fared better, coming in at 53.7 points, which beat the estimate of 53.4 points.

Will the US Federal Reserve scale back its current QE program? This question has been preoccupying the markets for some time now. Although the Fed hasn’t made any changes so far, Fed policymakers, including Fed Chair Bernanke, continue to hint that QE could be scaled back in the next few months. With the US continuing to alternate between good and bad economic releases, the Fed may continue to hold off on any changes to QE before it is convinced that the US economy is improving. The currency markets have reacted sharply to talk about terminating QE, and any moves related to QE will likely impact USD/CAD.

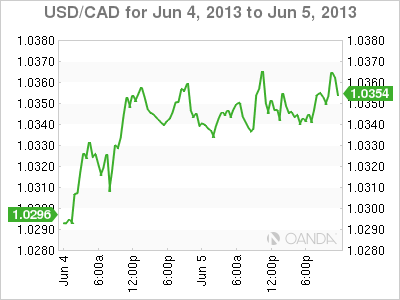

USD/CAD June 5 at 14:10 GMT

USD/CAD 1.0350 H: 1.0366 L: 1.0328 USD/CAD Technical" title="USD/CAD Technical" width="599" height="83">

USD/CAD Technical" title="USD/CAD Technical" width="599" height="83">

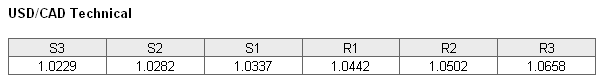

USD/CAD is almost unchanged in Wednesday trading, as the pair sticks close to the 1.0350 level. USD/CAD is receiving support at 1.0337. This is a weak line and was briefly breached earlier. It could see more activity during the day. The next support level is at 1.0292. On the upside, the pair faces strong resistance at 1.0442. This line has held firm since June 2012.

- Current range: 1.0337 to 1.0442

Further levels in both directions:

- Below: 1.0337, 1.0282, 1.0229, 1.0157 and 1.01

- Above: 1.0442, 1.0502, 1.0658 and 1.0758

USD/CAD ratio has shifted directions on Wednesday, and is pointing to movement towards short positions. We are not seeing this movement from the pair, which has shown very little activity. The activity in the ratio could be a sign that the loonie will break out and will post some gains at the expense of the US dollar.

USD/CAD has quieted down after two days of strong movement. The pair has so far shrugged off a weak US employment release earlier in the day. However, the US will be releasing a PMI later today, and the pair could break out of its narrow range if the reading is not in line with market expectations.

USD/CAD Fundamentals

- 12:15 US ADP Non-Farm Employment Change. Estimate 171K. Actual 135K

- 12:30 US Revised Non-Farm Productivity. Estimate 0.7%. Actual 0.5%

- 12:30 US Revised Unit Labor Costs. Estimate 0.5%. Actual -4.3%

- 14:00 US ISM Non-Manufacturing PMI. Estimate 53.4 points. Actual 53.7 points

- 14:00 US Factory Orders. Estimate 1.6%. Actual 1.0%

- 14:30 US Crude Oil Inventories. Estimate -0.8M

- 18:00 US Beige Book.