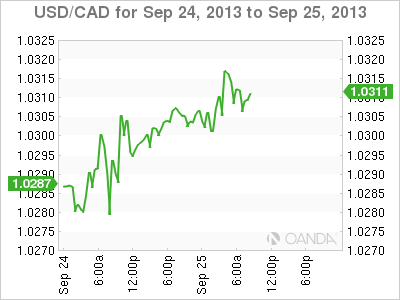

USD/CAD continues to trade close to the 1.03 level in Wednesday trading. On Tuesday, Canada posted strong retail sales data, while US consumer confidence numbers were sluggish. Later today, the US releases two key events - Core Durable Goods Orders and New Home Sales. The markets are expecting both releases to improve, which would likely give a boost to the US dollar. There are no Canadian releases on Wednesday.

The currency markets have settled down after the US Federal Reserve stunned the markets in deciding not to taper QE at its policy meeting last week. Most analysts had expected the Fed to announce a scaling down of the present bond-buying program of $85 billion/mth by $10-15 billion. However, the Fed was of the opinion that US economic data, particularly employment numbers, did not justify scaling down QE at this time. After the FOMC Statement, Federal Reserve Bank of St. Louis President James Bullard shed some light on the dramatic move (or lack of) by the Federal Reserve. Bullard said the vote was close, but weaker US numbers led to a decision not to taper. He added that the Fed may go ahead with “small” reductions to QE at its next policy meeting in October.

In Canada, there was some good economic news on Tuesday, as retail sales numbers were solid. Core Retail Sales, a key event, rebounded from a -0.8% decline last month, posting a healthy gain of +1.0% in August. This easily beat the estimate of 0.6%. Retail Sales also looked sharp, improving from -0.6% to +0.6% in August. However, the Canadian dollar failed to take advantage of the strong releases, and posted modest losses against its US cousin. With no additional Canadian releases this week, US events could have a major impact on the fortunes of the Canadian dollar for the remainder of the week. USD/CAD" width="400" height="300">

USD/CAD" width="400" height="300">

USD/CAD Technicals" title="USDCAD Technical" width="599" height="81">

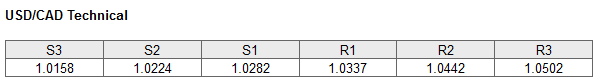

USD/CAD Technicals" title="USDCAD Technical" width="599" height="81">- USD/CAD has edged higher in Wednesday trading. The pair has been testing the 1.03 line in the Asian and European sessions.

- The pair continues to face resistance at 1.0337. This weak line could face strong pressure if the US dollar moves higher. This is followed by a strong resistance line at 1.0442.

- The pair is receiving weak support at 1.0282. This is followed by a stronger support line at 1.0224.

- Current range: 1.0282 to 1.0337

- Below: 1.0282, 1.0224, 1.0158 and 1.0068

- Above 1.0337, 1.0442, 1.0502, 1.0573, 1.0652 and 1.0758

USD/CAD ratio is pointing to movement in the direction of long positions in Wednesday trading. This is reflected in the current movement of the pair, as the US dollar has posted modest gains. The ratio is made up of a majority of long positions, indicative of a trader bias towards the US dollar posting further gains at the expense of the loonie.

The Canadian dollar continues to trade very close to the 1.03 line, a pattern we have seen throughout the week. We could see some volatility from USD/CAD in the North American session, as the US releases key manufacturing and housing data later in the day.

USD/CAD Fundamentals

- 12:30 US Core Durable Goods Orders. Estimate 1.1%.

- 12:30 US Durable Goods Orders. Estimate 0.0%.

- 14:00 US New Home Sales. Estimate 422K.

- 14:30 US Crude Oil Inventories. Estimate -1.0M.