The US dollar has posted gains in Friday trading, after taking a hit from the Canadian dollar over the past two days. USD/CAD has pulled away from the 1.03 line, and was trading in the mid-1.03 range in the European session. We can expect some activity from the pair, with releases later today from both Canada and the US. The markets are waiting for the Canadian GDP release, one of the most important economic indicators. It’s a busy day in the US, with the major releases being inflation and consumer confidence.

The US dollar was broadly weaker after disappointing US data on Thursday. The loonie took advantage and posted gains, as USD/CAD dropped close to the 1.03 line. Unemployment Claims disappointed this week, as the key indicator jumped from 340 thousand to 354 thousand. This was well above the estimate of 342 thousand. Preliminary GDP rebounded nicely, climbing from 0.1% to 2.4%. However, this missed the estimate of 2.5%. Pending Home Sales was dismal, posting a weak gain of 0.3%, way off the estimate of 1.3%. These readings will once again raise questions about the extent of the US recovery, as the US seems unable to put together a string of solid releases.

On Wednesday, Bank of Canada Governor Mark Carney presided over his final policy meeting. Carney, who has headed the central bank since 2007, will take the reins of the Bank of England next month, and will be replaced at the BOC by Stephen Poloz. There were no farewell surprises from Carney, who kept interest rates pegged at 1.00%. In its rate statement, the BOC stated that the “continued slack” in the Canadian economy as well as a weak inflation outlook justified maintaining rates at their present levels.

In the US, speculation has been growing that the Federal Reserve may wind down the current round of quantitative easing, which stands at $85 billion in asset purchases each month. Fed policymakers, including Fed Chair Bernanke, have not been shy about dropping clues that QE could be altered or even terminated in the next few months. The currency markets have reacted sharply to such talk, and much of the volatility we are seeing is a reflection of market uncertainty as to what action the Fed might take. Talk of an end to QE has given a boost to the dollar, and we can expect the currency markets to continue to be very sensitive to further talk of tapering QE.

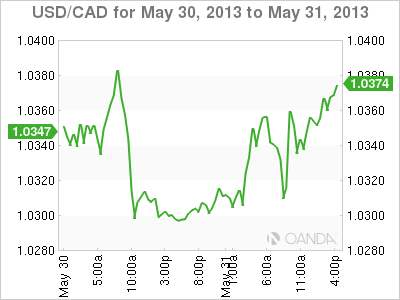

USD/CAD May 31 at 12:00 GMT

USD/CAD 1.0335 H: 1.0366 L: 1.0299

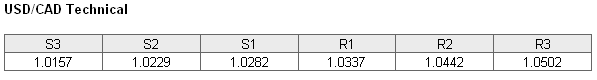

USD/CAD has recovered in Thursday’s session, and pushed away from the 1.03 line. The pair is testing resistance at 1.0337, and we could see this line fall if the US dollar can continue its upward movement. This is followed by resistance at 1.0442. On the downside, 1.0282 continues to provide support. The next support level is 1.0229.

- Current range: 1.0282 to 1.0337

- Below: 1.0282, 1.0229, 1.0157, 1.01 and 1.0041

- Above: 1.0337, 1.0442, 1.0502, 1.0658 and 1.0758

USD/CAD ratio continues to shift directions, and is currently pointing towards short positions. This is not reflected in the current movement of the pair, as the US dollar has posted gains in Friday trading. The ratio has a solid majority of short positions, indicating a bias towards USD/CAD moving upwards.

USD/CAD has had a busy week and we’ve seen sharp movement in both directions. The pair could continue to be volatile on Friday, as Canada releases GDP, which could have a major impact on the pair. As well, the US posts a string of releases later in the day, highlighted by inflation and consumer confidence numbers.

USD/CAD Fundamentals

- 12:30 Canadian GDP. Estimate 0.1%.

- 12:30 US Core PCE Price Index. Estimate 0.1%.

- 12:30 US Personal Spending. Estimate 0.2%.

- 12:30 US Personal Income. Estimate 0.2%.

- 13:45 US Chicago PMI. Estimate 50.3 points.

- 13:55 US Revised UoM Consumer Sentiment. Estimate 84.1 points.

- 13:55 US Revised UoM Inflation Expectations.

- 15:00 US Crude Oil Inventories. Estimate -0.8M.