The Canadian dollar has edged higher against the US dollar in Monday trading. The pair is trading in the high-1.02 range early in the North American session. In economic news, Canadian Core CPI posted a slight gain on Friday, edging past the estimate. On Monday, US Flash Manufacturing PMI, the only release of the day, was well short of the estimate. There are no Canadian releases on Monday.

The markets continue to try and recover their composure after the US Federal Reserve stunned the markets in deciding not to taper QE at its policy meeting on Wednesday. Most analysts had expected the Fed to announce a scaling down of the present bond-buying program of $85 billion/month by as much as $15 billion/month. However, the Fed decided to stay the QE course for now, stating that the US economic data was not strong enough to warrant QE tapering at this time. The Fed also downgraded its forecast for the economy, estimating GDP growth for 2013 at 2.0-2.3%, down from 2.3-2.6% in an earlier forecast. It also lowered its outlook for 2014 from 2.9-3.1%, down from 3.0-3.5%. USD/JPY was up about a cent following the Fed announcement.

Overshadowed by the FOMC Statement were some excellent US releases on Thursday. Unemployment Claims came in at 309 thousand, well below the estimate of 331 thousand. Existing Home Sales rose to 5.48 million, crushing the estimate of 5.27 million, and posting its best level in over three years. The Philly Fed Manufacturing Index rocketed from 9.3 to 22.3 points, its best showing since May 2011. Perhaps if we’d seen this kinds of numbers a week or two ago, the Fed might have introduced QE tapering. These strong numbers helped the US dollar wipe out the losses it sustained following the Fed announcement.

Canadian inflation figures continue to be subdued. Core CPI rose from 0.0% to 0.2% in August, edging out the estimate of 01%. CPI dropped from 0.1% to a flat 0.0% in August, just shy of the estimate of 0.1%. The weak inflation numbers are reflective of a slow Canadian economy, which continues to be outpaced by its southern neighbor. USD/CAD" width="400" height="300">

USD/CAD" width="400" height="300">

USD/CAD Technicals" title="USDCAD Technical" width="592" height="75">

USD/CAD Technicals" title="USDCAD Technical" width="592" height="75">- USD/CAD has edged lower in Monday trading. The pair has touched a low of 1.0276 in the North American session.

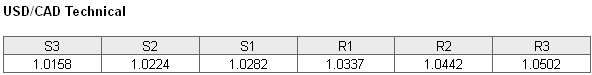

- The pair continues to face resistance at 1.0337. This is followed by a strong resistance line at 1.0442.

- The pair is testing support at 1.0282. Will this line hold steady? This is followed by a support line at 1.0224.

- Current range: 1.0282 to 1.0337

Further Levels

- Below: 1.0282, 1.0224, 1.0158 and 1.0068

- Above 1.0337, 1.0442, 1.0502, 1.0573, 1.0652 and 1.0758

USD/CAD ratio is pointing to short positions, a trend which began in the middle of last week. This is reflected in the current movement of the pair, as the Canadian dollar has posted modest gains against the US dollar. The ratio is currently made up of a slight majority of long positions, indicative of a trader bias towards the US dollar posting gains at the expense of the loonie.

The Canadian dollar continues to trade close to the 1.03 line. The pair has not shown a lot of movement on Monday, and we could see this lack of activity continue in the North American session.

USD/CAD Fundamentals

- 13:00 US Flash Manufacturing PMI. Estimate 54.2 points. Actual 52.8 points

- 13:30 US FOMC Member William Dudley Speaks.

*All release times are GMT

Original post