USD/CAD was unchanged in Monday’s North American session, as the pair trades in the low-1.03 range. With the US markets closed for the Memorial Day holiday, we can expect thin trading and little movement from the pair. There were no Canadian releases on Monday.

After posting strong employment and housing numbers, the US wrapped up last week with strong manufacturing data. Core Durable Goods Orders jumped at 1.3%, easily beating the estimate of 0.6%. Durable Goods Orders kept pace with a 3.3% increase, well above the estimate of 1.6%. The markets were pleased that both indicators bounced back from declines in the previous month. We’ll get another look at US consumer confidence, with the release of CB Consumer Confidence on Tuesday.

The US Federal Reserve was in the spotlight last week as Bernard Bernanke testified before a Congressional committee. Bernanke initially stated that tightening monetary policy could hurt the US recovery. However, he later said that a decision to scale back QE could be taken in the “next few meetings” if the US economy improves. The bottom line? Bernanke’s comments still leave the markets guessing as to the Fed’s plans regarding the current quantitative easing (QE) program. The Fed is not making any changes to its monetary policy, but that could change if the US economy improves and unemployment falls.

Almost overshadowed by Bernanke’s remarks in Congress was the release of the minutes from the FOMC’s last policy meeting. The minutes indicate that the US recovery will have to gain more traction before the Fed winds down QE. Policy members were split, as some suggested scaling back QE in June (at the next policy meeting), while others wanted to increase QE, given the weak inflation readings we are seeing. It should be noted that the FOMC minutes relate to a meeting which took place at the beginning of May, in contrast to the fresh testimony of Bernanke on Wednesday.

It was a quiet week for Canadian releases, as retail sales were the only numbers released. Core Retail Sales slipped badly, dropping from 0.7% to -0.2%. This marked a three-month low for the key indicator. Retail Sales brought no relief, as the indicator slid from 0.8% to 0.0%. The markets had expected a 0.2% gain. These readings point to weakness in consumer spending, a key engine of economic growth. The US dollar took advantage of these numbers, and tested the 1.04 level last week. Will the pair break above the 1.04 barrier this week?

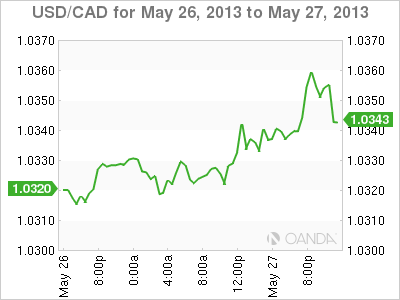

USD/CAD May 27 at 14:40 GMT

USD/CAD 1.0328 H: 1.0334 L: 1.0314 USD/CAD Technical" title="USD/CAD Technical" width="596" height="78">

USD/CAD Technical" title="USD/CAD Technical" width="596" height="78">

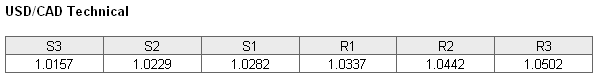

USD/CAD continues to trade above the 1.03 line. There is weak resistance at 1.0337. This line could be tested if the US dollar shows some upward momentum. There is a stronger resistance line at 1.0442. On the downside, there is support at 1.0282. There is a stronger support level at 1.0229.

- Current range: 1.0282 to 1.0337

- Below: 1.0282, 1.0229, 1.0157, 1.01 and 1.0041

- Above: 1.0337, 1.0442, 1.0502, 1.0658 and 1.0758

USD/CAD ratio has been showing movement towards long positions. We are not seeing this movement from the pair, which has been trading in a tight range since Friday. The ratio is now close to an even split between long and short positions, indicating a split in trader sentiment as to what we can expect from USD/CAD.

With the US markets enjoying a long weekend, and no Canadian releases to start off the week, we can expect a quiet start to the week. This will likely change as the markets keep an eye on the Bank of Canada, which will set new interest rates later in the week.

USD/CAD Fundamentals

* There are no Canadian or US releases on Monday.