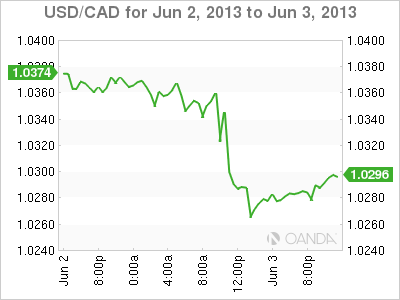

After posting gains on Friday, USD/CAD has started the new trading week with a whimper. The pair is trading quietly in the mid-1.03 range early in Monday’s North American session. On Friday, Canadian GDP beat the estimate, but this wasn’t enough to prevent the US dollar from moving higher. The markets are keeping an eye on US ISM Manufacturing PMI, the first major release of the week. There are no Canadian releases on Monday.

On Friday, Canadian GDP came in at 0.2%, lower than the previous release of 0.3%. However, the key indicator managed to beat the estimate of 0.1%. Canadian releases have not impressed lately, and a very small increase in GDP will certainly not inspire confidence in the Canadian economy. In the US, Friday’s releases were mixed, but Chicago PMI was red hot, jumping for 49.0 points to 58.7 points. This blew past the estimate of 50.3 points. USD/CAD improved on Friday, pushing away from the 1.03 level into the mid-1.03 range.

There’s a changing of the guard at the Bank of Canada, as Governor Mark Carney presided over his final policy meeting last week. Carney, who has headed the central bank since 2007, has taken over the Governor position at Bank of England, and will be replaced at the BOC by Stephen Poloz. There were no farewell surprises from Carney, who kept interest rates pegged at 1.00% last week. In its rate statement, the BOC stated that the “continued slack” in the Canadian economy as well as a weak inflation outlook justified maintaining rates at their present levels.

In the US, there is growing speculation that the Federal Reserve could scale back quantitative easing in the next few months. Fed policymakers, including Fed Chair Bernanke, continue to hint that QE could be wound up in the next few months. However, with the US continuing to alternate between good and bad economic releases, the Fed is unlikely to act before it is convinced that the US economy is improving. Much of the volatility we are seeing from the US dollar against the major currencies can be attributed to market uncertainty about what action the Fed will take, and further hints from the Fed about scaling back QE will continue to impact on the currency markets.

USD/CAD June 3 at 13:30 GMT

USD/CAD 1.0356 H: 1.0375 L: 1.0334 USD/CAD Technical" title="USD/CAD Technical" width="589" height="86">

USD/CAD Technical" title="USD/CAD Technical" width="589" height="86">

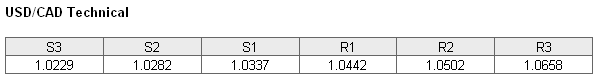

USD/CAD is unchanged in Monday trading, as the pair trades in the mid-10.3 range. USD/CAD is receiving support at 1.0337. This is a weak line, and saw activity earlier in the day. It could face more pressure if the pair moves downward. The next support level is at 1.0282. On the upside, the pair faces resistance at 1.0442. This line has held firm since June 2012, but could face pressure if the US dollar can push above the 1.04 line and maintain momentum. This is followed by resistance at 1.0502.

- Current range: 1.0337 to 1.0442

- Below: 1.0337, 1.0282, 1.0229, 1.0157, 1.01 and 1.0041

- Above: 1.0442, 1.0502, 1.0658 and 1.0758

USD/CAD ratio has continued were it left off on Friday, and is pointing to movement towards short positions. This is not reflected in the current movement of the pair, as the pair is showing very little movement on Monday. The ratio movement could be an indication that the Canadian dollar will rebound from Friday’s losses and post gains against the US dollar.

USD/CAD has settled down after last week’s volatility. We could see increased movement after the US releases key manufacturing data later today. We can expect a busy Tuesday from the pair, as both Canada and the US release Trade Balance numbers.

USD/CAD Fundamentals

- 13:00 US Final Manufacturing PMI. Estimate 52.0 points. Actual 52.3 points

- 14:00 US ISM Manufacturing PMI. Estimate 50.6 points

- 14:00 US Construction Spending. Estimate 1.1%

- 14:00 US ISM Manufacturing Prices. Estimate 49.6 points

- All Day: US Total Vehicle Sales. Estimate 15.2M