- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

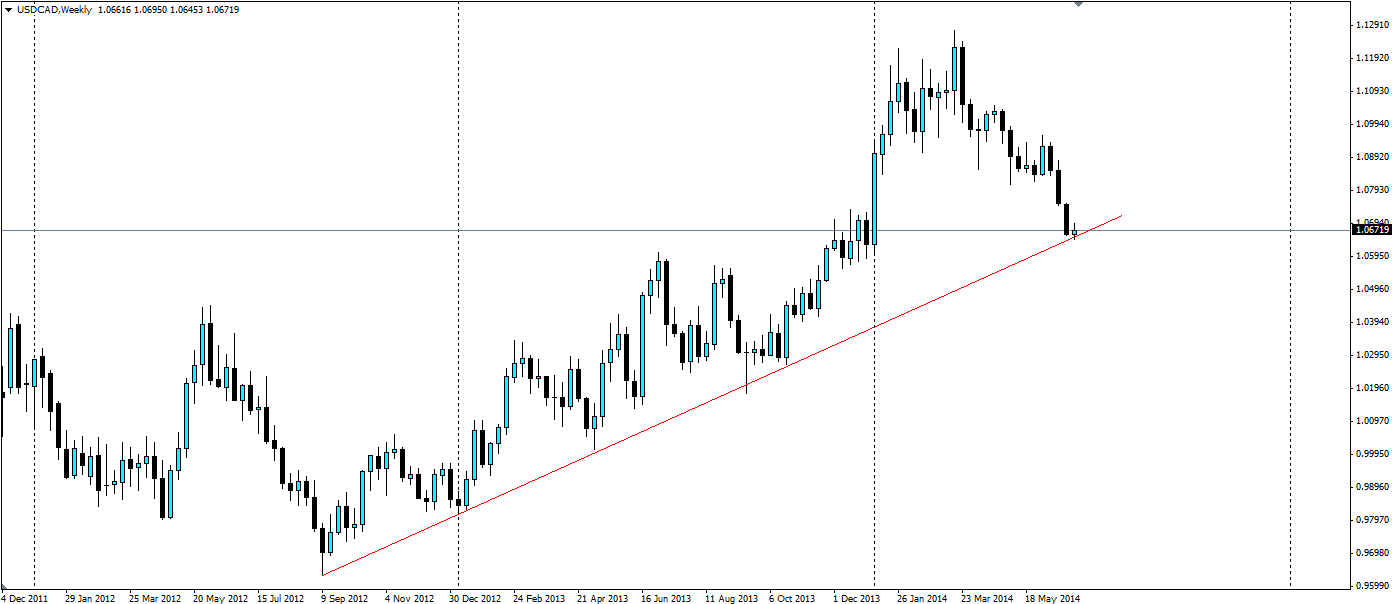

USD/CAD Touches Long Term Trend Line

The USD/CAD pair touched a long term trend line which will provide traders a good entry spot in a long USD position.

September 2012 signalled the beginning of an uptrend for the US dollar versus the Canadian dollar. Since then the uptrend has been tested 5 times and held firm so far. The signals over the last couple of years have been looking more positive for the US over Canada, however, recently the wheels may have come off with the latest US GDP figure at -2.9% (annualised) for the quarter.

Canada on the other hand is facing increasing inflation that does not correlate with GDP growth. The Band of Canada will have a tough year as it will be reluctant to increase interest rates while GDP lags. The market has begun to speculate an increase in interest rates may be coming, hence the reversal in the USD/CAD pair, however this may be some time off.

Source: Blackwell Trader

The result has been a touch of the long term trend line which has held firm so far. Will we see a bounce off the trend or a breakdown completely? For now a bounce is looking the likely option, especially with nonfarm payroll data due out on Thursday. The US has been adding over 200,000 jobs per month recently and the GDP data was a lagging indicator from Q1, so the upcoming nonfarm data should stay around the 200k mark.

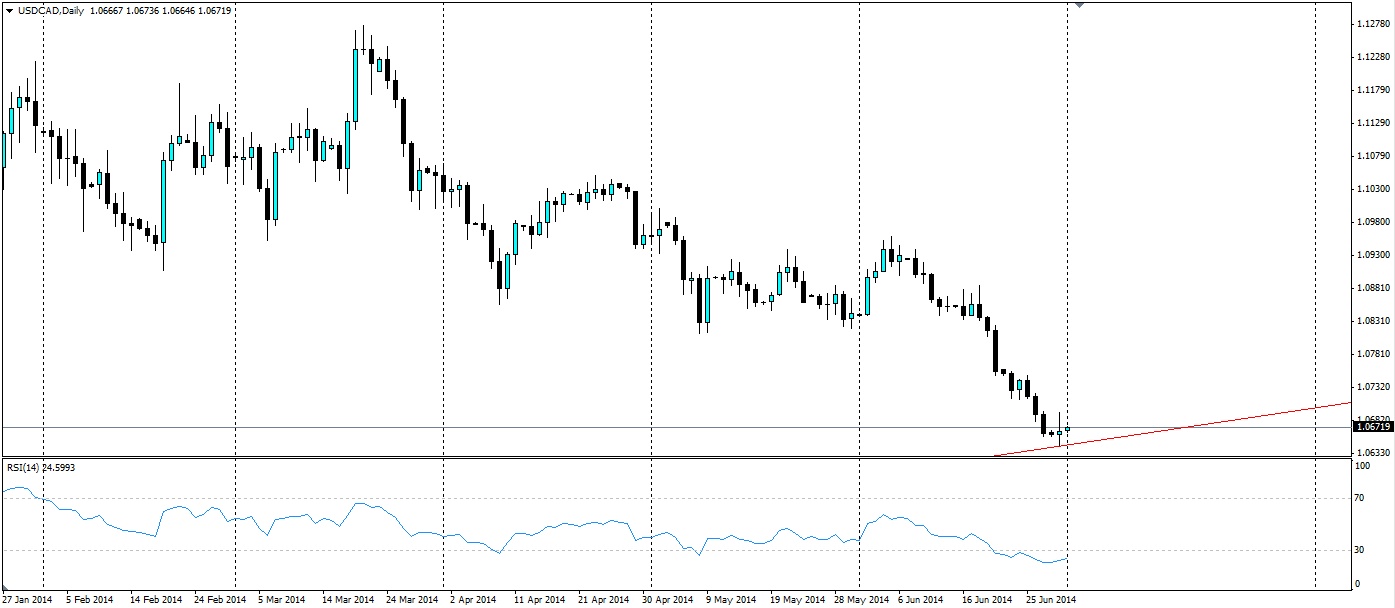

The USD/CAD D1 chart shows the price has already rejected off the trend line, and indeed the RSI confirms this. We can see the RSI hit a low of 21.22, which is extremely oversold, and is now heading back to a more neutral position.

Source: Blackwell Trader

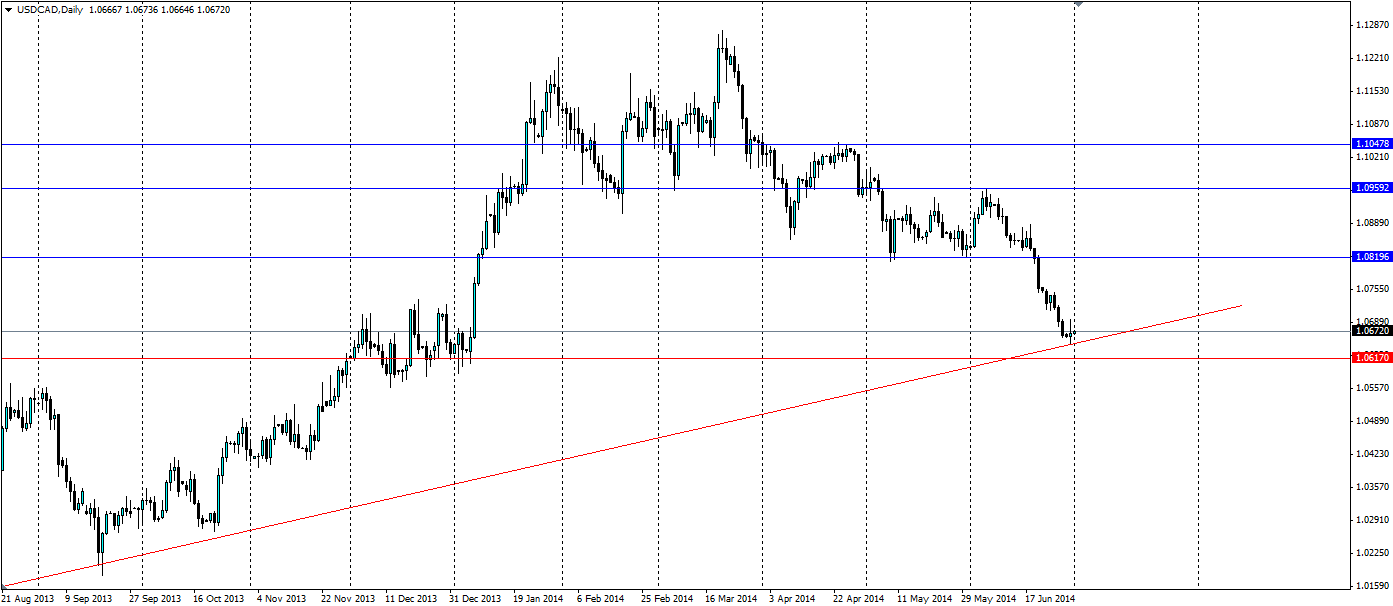

Any traders looking for an entry can wait for the current resistance at 1.0696 to break as the price moves upwards. Ensure a stop loss is set below the trend line to minimise losses in the event the trend breaks down. Previous levels of support/resistance will act as targets for a movement higher. 1.0819 will be relatively tough to break, with 1.0959 and 1.1048 further beyond likely to act as sticking points.

Source: Blackwell Trader

The USD/CAD pair has tracked back down to the long term trend line and a bounce higher off it could provide an opportunity for traders to follow the pair back up.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.