Market Brief

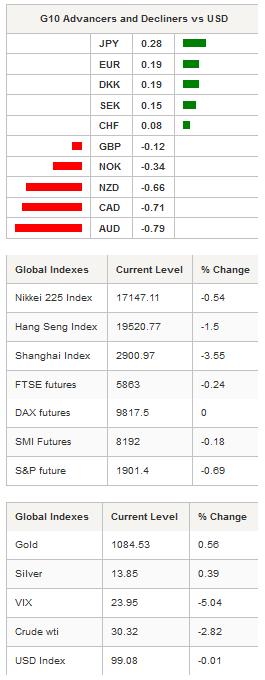

Once again, crude oil remained the main driver in overnight trading and drove both equity indices and commodity currencies lower. Crude oil has had a roller coaster ride throughout the entire week as prices swing at least 2% every single day and this Friday is no exception. During the Asian session, West Texas Intermediate fell more than 3%, down to $30.25 a barrel after surging as much as 3.05% in London yesterday. Its counterpart from the North Sea, the Brent crude, plummeted roughly 2% in Tokyo after climbing 2.90% in Europe yesterday.

Consequently, commodity currencies suffered another sell-off in Asia with the CAD, NOK, AUD and NZD trading deeply in negative territory. The Australian dollar got hammered in Sydney as it lost another 0.80% against the greenback, down to $0.6933, in spite of an encouraging job report released yesterday. AUD/USD is about to test the key resistance area at around 0.6896-0.69 - it corresponds to the low from September 7 -- for the second time this week. From our standpoint, there is still downside potential for the Aussie against the greenback, especially in light of its exposure to Chinese demand (exports to China represents roughly 33%). The next key support can be found at $0.6250 (low from February 2009), while on the upside the main resistance area lies at around $0.74.

The Canadian dollar has been printing fresh multi-year lows on a daily basis over the last 2 weeks. USD/CAD is currently trading at 1.4455 after testing 1.4529 in overnight trading, the lowest level since early May 2003 (!). The market seems to have completely given up the idea of a potential loonie recovery, accelerating the sell-off. USD/CAD appears to be unstoppable as the road toward the next key resistance at 1.6187 (high from January 2002) is wide open. However, we believe that a period of stabilization is increasingly likely, we therefore would be surprised if the loonie consolidates between 1.40 and 1.45 over the next few weeks.

It has been a year. The Swiss National Bank unpegged the Swiss franc from the euro one year ago to the day. This morning EUR/CHF is back above 1.09 after hitting 1.0982 yesterday in London as evidence mounts that the Swiss economy will cease to outperform its trading partners in a strong CHF environment. It is always the same story, either the exchange rate adjusts to the upside or the economy will. We believe that the second is the more likely scenario.

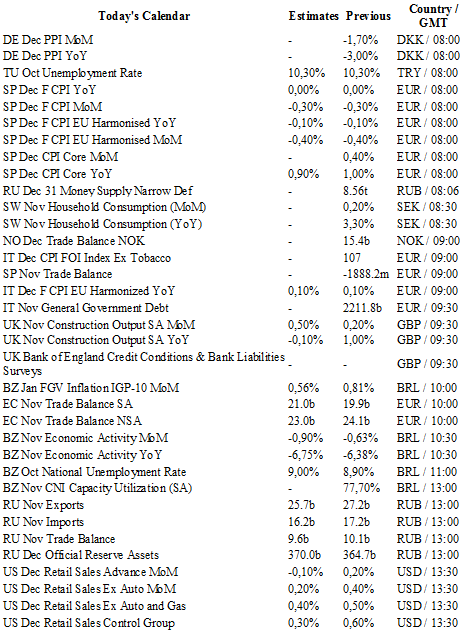

Today will be a busy day for the US dollar as a fresh batch of important economic data is set for release. Traders will be watching December retail sales, PPI, industrial production and Michigan sentiment index from the US; trade balance from India and Russia; CPI from Italy and Spain.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0893

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5529

R 1: 1.5242

CURRENT: 1.4389

S 1: 1.4231

S 2: 1.3657

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 117.54

S 1: 115.57

S 2: 105.23

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 1.0046

S 1: 0.9786

S 2: 0.9476