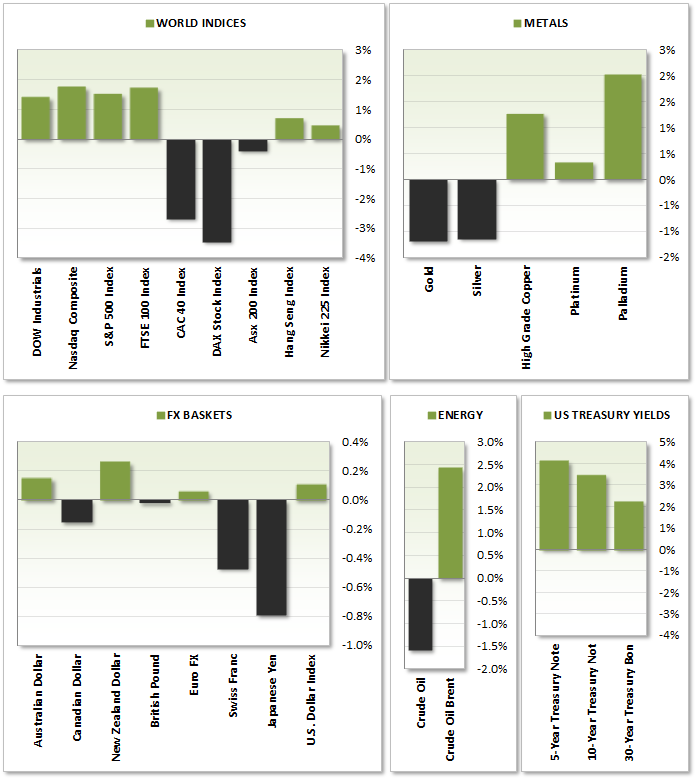

MARKET SNAPSHOT:

NYLON ROUNDUP (New York - London)

Tensions eased over Ukraine as US offer them $1bn in guaranteed loans, and use of their experts to help with security

- INDICES: SP500 printed new record highs with Nasdaq and Dow Jones recouping losses from Monday

- COMMODITIES: Commodities plunged with WTI down -1.5%, Brent -1.7% and Gold back down to $1335

- USD: USD Index closed higher for a 2nd successive day with USD/CHF back above 0.8850 resistance. Technically, the Greenback is still bearish and trading within Friday's candle range.

- EUR: Spanish unemployment rate lowest in 12 months; Eurozone PPI came in at -0.3% vs 0% expected;

- GBP: Construction PMI disappointed following last month's record high but still healthy at 62.6

ASIA ROUNDUP

- AUD: Australian GDP beat expectations by 0.1% to see QoQ up at 0.8% and YoY at 2.8% vs 2.5% expected. Moments after the release AUD/USD tested 0.90, AUD/JPY back up to 91.90 and AUD/CHF up to 0.798

- CNY: HSBC Services PMI

- JPY: Continued to weaken following withdrawal ofr Russian tropps. AUD/JPY analysis yesterday invalidated as traded above 91.3

- COMMODITIES: Gold continued to edge lower from recent highs following positive data from Australian GDP

COMING UP:

- CAD: Overnight rate and BOC rate statement

- EUR: Spanish, Italian and Eurozone PMI; Retail sales m/m and Revised GDP q/q

- GBP: Servics PMI;

- USD: ADP Nonfarm employment change; Crude Oil inventories

CHARTS OF THE DAY:

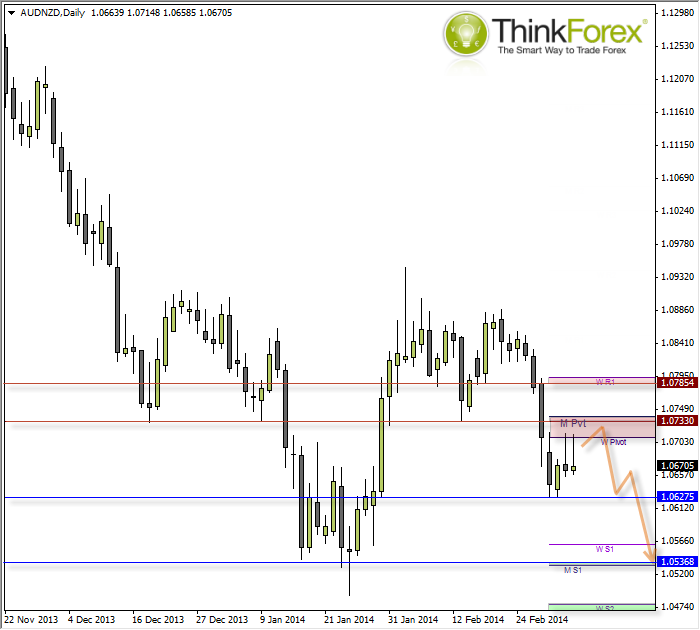

AUD/NZD: Bearish below 1.074 AUD/NZD Daily Chart" title="AUD/NZD Daily Chart" width="474" height="242" />

AUD/NZD Daily Chart" title="AUD/NZD Daily Chart" width="474" height="242" />

The original trade set-up for the pair was highlighted a few weeks ago. Then it proceeded to go nowhere, at all, then down she went.

At present we have found interim support at 1.0627 and trading sideways while the markets in general wait for a prod in the right direction. However, due to the dominant downtrend and the resistance zone close by underneath 1.074 then this is an ideal candidate for a swing-trade short.

One approach is to set a sell-limit within the sell zone to increase your potential reward/risk ratio. However, be warned that you risk a rather fast stop-out if the AUD gather strength, or missing the trade all together if it goes south without you.

So, another option is to use a sell-stop beneath 1.0672 support but this may reduce your reward to risk ratio, while providing you extra confirmation of anther move down.

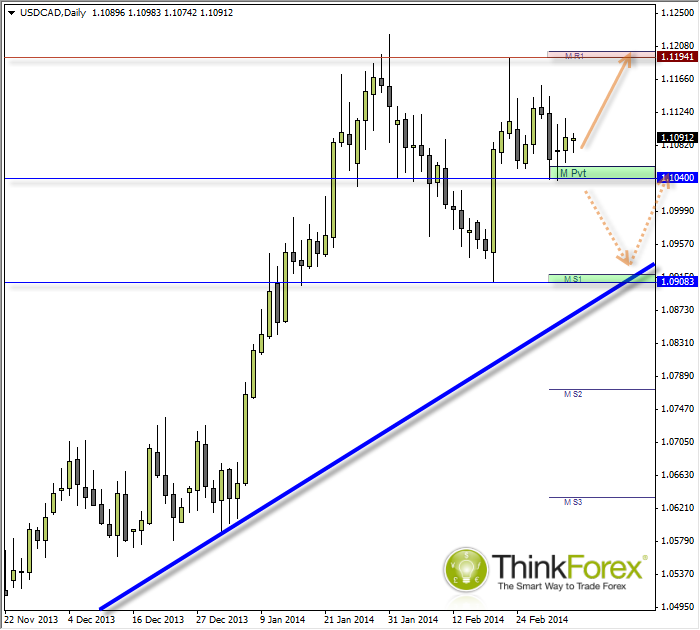

USD/CAD: Above 1.104, targets 1.12 highs

Later tonight we have the USD and CAD new. While I doubt this in itself will see either of the targets hit, hopefully it will shake some life into the pair (and all other USD pairs for that matter) to break them out of their tight ranges.

The reason I favour the upside scenario is because, despite the USD weakness so far this week we have held above the Monthly pivot, yesterday’s low was higher and overall we are in an uptrend.

In the event we break beneath the monthly pivot then we can see bearish set-ups on the intraday timeframes to target around 1.10 over the coming sessions.