- PBoC sets yuan firmer again

- Forex liquidity remains thin as participation drops

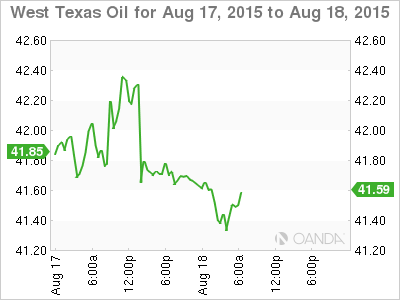

- Crude Oil trades atop of six-year lows

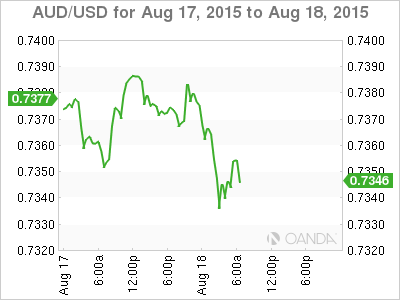

- Aussie bulls get a boost from RBA

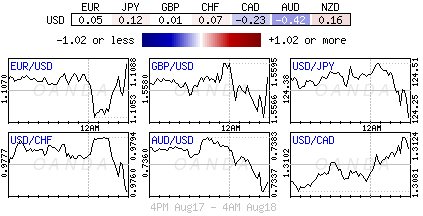

The forex market is clearly lacking direction while it waits for the next set of U.S data points. Investors are pinning some of their hopes on tomorrow’s minutes from the Federal Open Market Committee (FOMC) meeting from July. With tension diminishing in the wake of China’s decision last week to devalue its currency, the market is shifting focus to U.S economic indicators as it looks for clues that the Fed has the justification to begin its rate normalization policy.

Overnight, the PBoC again set the yuan slightly firmer for the third consecutive day (mid point at ¥6.3966 vs. ¥6.3969), thus effectively ending the yuan devaluation ripple that had startled investors across the globe last week. With most participants requiring market guidance, the lack of market participation and liquidity ends up becoming more of a hindrance for directionless trades and reason why so many are pinning their hopes on the Fed. But, will U.S policy makers be willing to provide investors a clue on the first rate hike timing in a decade tomorrow? If there is nothing clear and definitive, August will end up being a very long month for dealers.

With so many investors preferring to remain on the sidelines, there has been little advantage to add more risk to current forex positions. Despite the dollars relatively tight range trading against the euro and the yen, there have been some trading opportunities, and its seems to be occurring mostly on the back of currencies associated with commodity prices.

For many, the recent sell off in oil prices remains a source of concern. A further decline would bode ill for resource-linked currencies, especially CAD and NOK, which are currently trading up against some significant support levels. With crude prices trading atop of its six-year lows near $41.87, it may even lower market expectations for a Fed rate increase any time soon, and reason enough why it’s important to see what the Fed is thinking.

CAD sucking wind at the moment

The continued volatility in commodity markets has been making life rather difficult for Canadian investors so far this year. The USD strength combined with fear of slowing growth in emerging markets, primarily China, is causing commodity prices to remain on the soft side. The reluctance of OPEC to respond with a crude production cut is only creating more pain for Canadian oil producers. The drop in crude prices, combined with two-interest rate cuts from the Bank of Canada (BoC), has caused the CAD to weaken by -11% year-to-date, and reason why many expect further depreciation from the loonie.

Currently, USD pullbacks have been well supported with many long-term CAD bears preferring to buy U.S dollars on dips until proven wrong. The key resistance on the topside remains around this week’s high of $1.3150. Only a break above the key resistance will open the doors for the market to test this years CAD lows above $1.3200.

RBA minutes confirm neutral policy stance

The RBA’s policy meeting minutes from earlier this month reflected the less dovish than anticipated stance. The RBA’s last rate statement removed the language that “further exchange rate depreciation seems both likely and necessary,” and added that their economy was “associated with somewhat stronger growth of employment.” This announcement at the time was a blow to AUD bear’s that were hanging on the RBA’s every last word.

The minutes overnight revealed that while RBA is comfortable with the accommodative policy. This marks a further softening of the RBA’s rhetoric around the AUD – for months Governor Stevens was happy to preach that the Aussie was too high (AUD$0.7360). With Australian policy makers indicating that they see economic activity generally turning more positive, while the downside risks related to China receding, will be a concern to the most ardent of AUD bears. With the glass half-full view on the Australian economy will have fixed income traders reducing their bets for any further rate cuts in the near term, while supporting AUD buying on dips outright.