The rise of the USD/CAD paring has faded early in the week, when it collided with an important resistance level. This was a good opportunity for traders to take profit by pushing the pair lower, back to a support level 150 points lower.

This rise in the loonie was accentuated by the November Canadian GDP figures, which beat economists' expectations (0.3% vs. 0.2% expected). However, the pair that received the most attention last week was the EURUSD. This pairing has fluctuated in a range of 270 points, even reaching its highest level in 14 months! This sharp rise of the single currency is due to the fact that many European banks have begun to repay the funds that they borrowed from the ECB through its long-term refinancing operation (LTRO). From the 1 trillion Euros that was borrowed for 3 years, 137 billion was repaid last week.

We offer this week to revisit a topic we've discussed in previous columns and that seems to enjoy a growing presence in the international media as of late, namely, the currency wars. The term certainly captivates the attention evoking large countries leading efforts to conquer or defend economic interests. In fact, the term "currency wars" refers to the various measures implemented by central banks to instigate the devaluation of their national currency in order to boost their export sector and thus boost overall economic growth. So one tries to get ahead by boosting its exports at the expense of its economic partners who see their local markets invaded by foreign goods at artificially low prices. We must not go too far geographically or in time to find an example of the implementation of these strategies; Canada has applied them in the mid-1990s with the results we know. The country was then crumbling under debt and economic growth was anemic. Fast forward a few years and investors are scrambling to invest in Canada based on its healthy finances. However, there are significant differences with the current situation, the global economy was significantly better then and Canada essentially acted alone.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

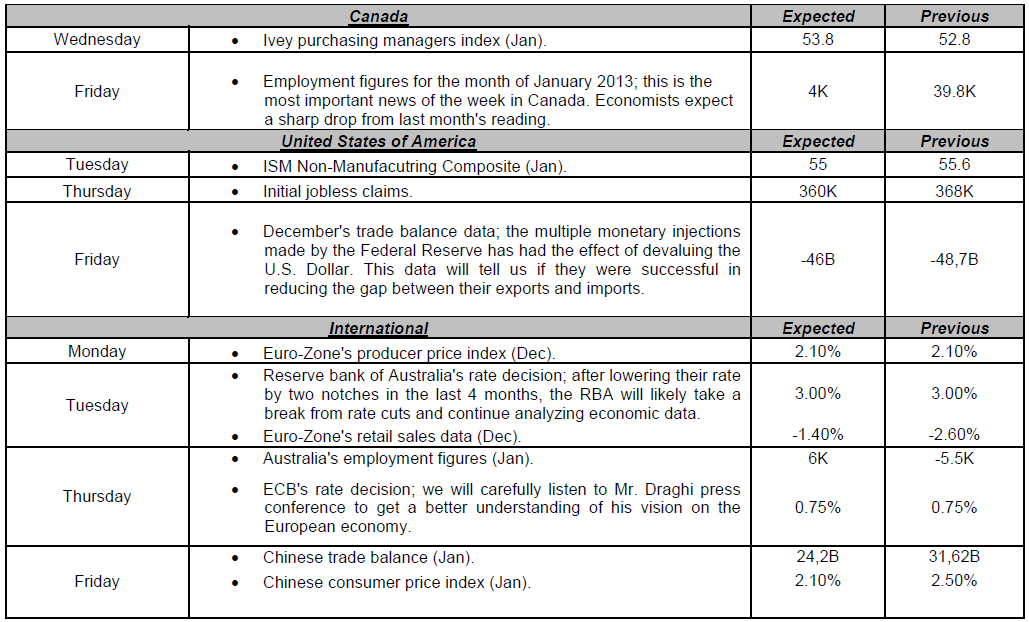

USD/CAD Major News This Week

Published 02/05/2013, 05:54 AM

Updated 05/14/2017, 06:45 AM

USD/CAD Major News This Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.