USD/CAD Hikes to 2017 highs Ahead of Retail Sales Report

USD/CAD extended the bullish momentum and the loonie failed to corner U.S dollar although the index collapsed to 2017 lowest at 98.55 yesterday. The pair clocked 1.3626 Feb-2017 fresh highs, peeking 134-pips in a single day after Trump waived the NAFTA negotiation terms with north partner, Canada.

The main items on NAFTA menu were lumber and dairy items. Trump tweeted saying that Canada, and included Mexico in his tweet, saying that both counties has been taking advantage of the U.S, putting them on TRADE NOTICE. Although markets can never be sure how serious Trump is giving his past history of controversial tweets, then backing up like nothing happened, but the USD/CAD responded really well.

Bearish crude oil levels also added additional losses for the Loonie, but the pair has made some recovery today with 1.3572 low, currently trading 1.3567, and on the path of additional gains.

Today, eyes are focused on Trump's tax plan which in case delivered, expectation for USD/CAD to tweet higher given that U.S index has recovered with 98.94 high today. On the other hand, the loonie awaits local retails sales, set to release at 12:30 PM GMT, which could increase the bullish pace pedal for USD/CAD in case of negative outcome. The last Canadian retail sales recorded 1.7%, and expectation are negatively at 0.2%.

Fundamentals:

1- CAD - Core Retails Sales today at 12:30 PM GMT.

2- USD - Trump Tax Plan delivery today.

3- USD - Core Durable Goods Orders m/m and Unemployment Claims tomorrow at 12:30 PM GMT.

Technical overview:

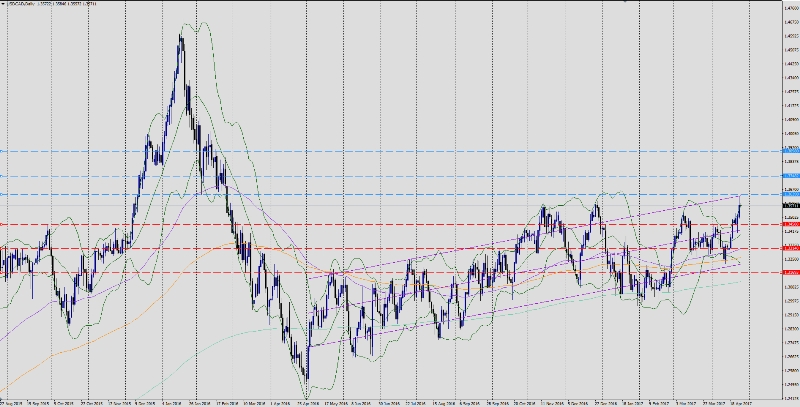

Trend: Bullish

Resistance levels: R1 1.3639, R2 1.3748, R3 1.3898

Support levels: S1 1.3458, S2 1.3314, S3 1.3169

Comment: The above fundamentals will determine how the rift will settle between U.S and Canadian Dollar. U.S Crude inventories will contribute to USD/CAD levels indirectly given that Canada is a major oil producer. A close below S2 level alerts for bullish trend reversal and closing below S3, bearish trend is confirmed 100%.