Key Points:

- USD/CAD rises within an ascending channel.

- HH point reached and corrective pullback likely.

- USD/CAD outlook remains bearish in short term.

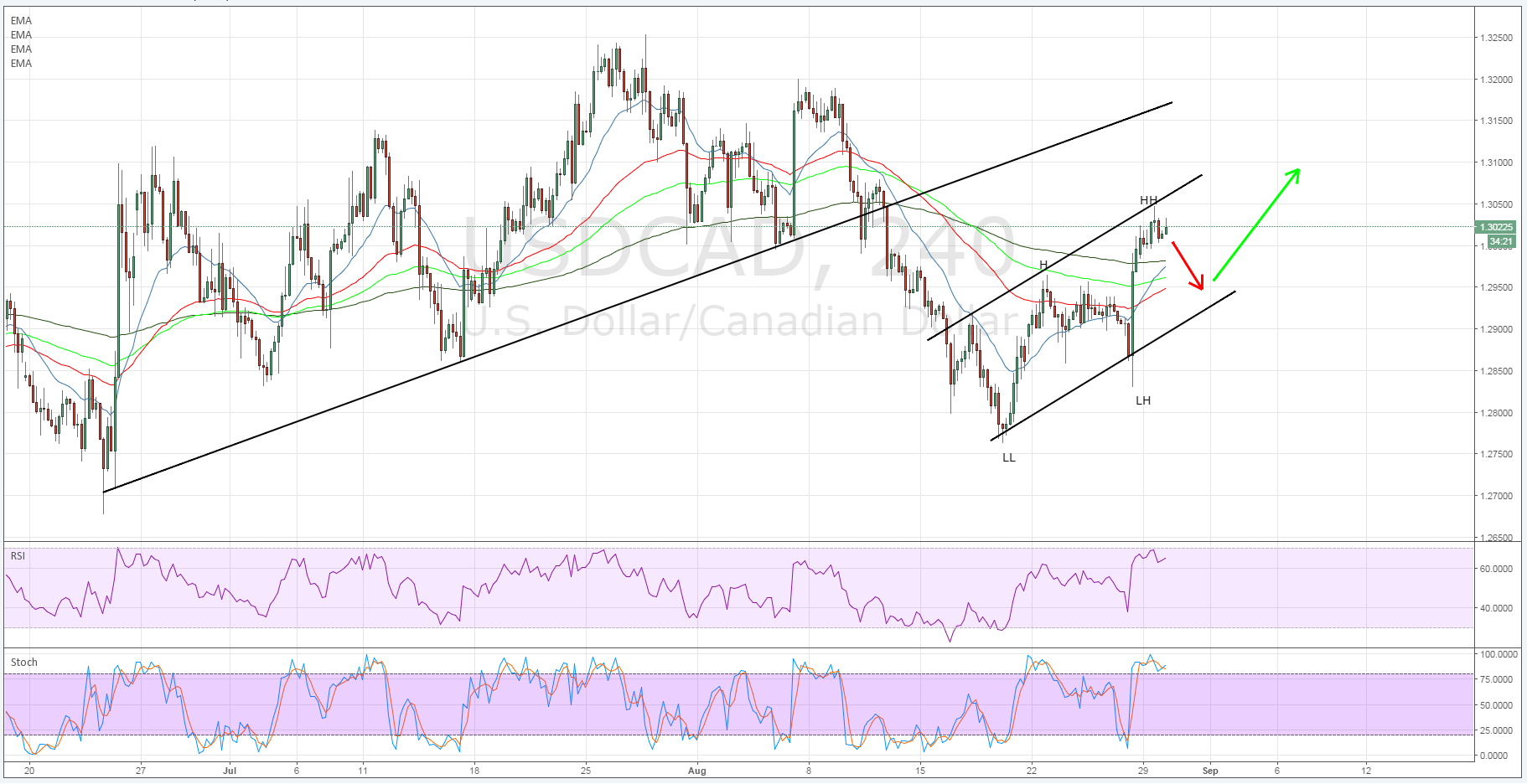

The Loonie has been one of those currencies that I have loved to hate over the past few months as it has seemingly defied logic and regularly moved against both technical and fundamental factors. However, the last ten days has seen price action fall into a relatively clear ascending channel that is likely to dominate proceedings in the coming week.

In fact, taking a look at the 4-hr chart demonstrates an impulse wave from price action as it continues to travel higher within the channel constraints. However, the last 24 hours have seen a HH level reached at the top of the channel and the RSI Oscillator has now entered into overbought territory. Subsequently, despite price action’s rise above the 100MA, the pair is likely to see a short term correction towards the bottom of the channel in the coming session before recommencing its bullish push.

In addition, the Stochastic Oscillator has also entered into reversal territory which further supports an argument for a short term pullback. Subsequently, a pullback below the 1.30 handle is likely to signal the start of the retracement towards the bottom of the channel with a downside target around the 1.2950 mark. Once that point is reached, the pressure is likely to have been relived from the RSI Oscillator and we could then see a return to bullishness and a further challenge of the HH point.

Additionally, from a fundamental perspective the pair is predisposed to medium term bullishness given the large disparity in monetary policy between the two countries. In fact, as speculation of a rate hike from the FOMC mounts so too does the positioning ahead of September’s meeting and subsequent Dollar buying. Adding to the pair’s upside potential are forecasts of falling crude oil prices in the near term which would put further pressure on Canada’s flagging current account balance and cause the fundamental disparity to grow.

Ultimately, there are plenty of reasons to be medium term bullish for the Loonie but the short term is likely to require a corrective pullback to ease some of the pressure on the various oscillators. Subsequently, watch the pair closely over the next few days as a concerted break of the 1.30 handle could signal the start of a short term bearish push.