USD/CAD remains at high levels, but the US dollar has edged lower as key US numbers disappointed on Thursday. The pair has crossed below the 1.02 line and was trading in the high-1.01 range early in the North American session. In the US, Building Permits beat the estimate, but Core CPI was slightly below the forecast. Unemployment Claims was a major disappointment, climbing to a six-month high. Philly Fed Manufacturing Index also was well off expectations. In Canada, Manufacturing Sales, a key indicator, came in well below expectations. Foreign Securities Purchases also missed the estimate. Later on Thursday, the Bank of Canada will release its quarterly review.

There was a host of key US releases on Thursday, and the news was mostly negative. Building Permits climbed nicely, up to 1.02 million. This beat the estimate of 0.94 million. However, that was it for the good news. Core CPI posted a weak gain of 0.1%, just shy of the estimate of a 0.2% gain. Unemployment Claims had reeled off three strong readings, but this time the key indicator jumped to 360 thousand, blowing past the estimate of 332 thousand. The Philly Fed Manufacturing Index dropped into negative territory, posting a reading of -5.2 points. This was well off the estimate of 2.5 points. In Canada, Manufacturing Sales was a major disappointment, as the indicator declined by 0.3%. The estimate stood at a gain of 0.6%. Foreign Securities Purchases was up sharply to $1.19 billion, but this still fell well short of the forecast of $5.36 billion.

The US dollar has shown some broad strength against the major currencies, in part due to speculation that the Federal Reserve might terminate its current round of quantitative easing, thanks to an improving employment picture in the US. The Fed has not given any clues that it might scale back QE, which involves asset purchases of $85 billion every month. However, if the US recovery shows stronger signs of recovery, pressure will increase on the Fed to ease up on the QE, which would be dollar-positive. Any statements from the Fed regarding QE could affect the movement of USD/CAD.

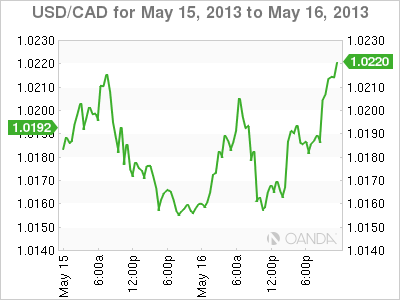

USD/CAD May 16 at 14:15 GMT

1.0163 H: 1.0208 L: 1.0152 USD/CAD Technical" title="USD/CAD Technical" width="598" height="78">

USD/CAD Technical" title="USD/CAD Technical" width="598" height="78">

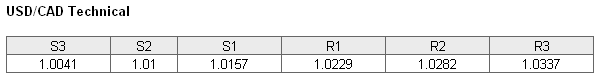

USD/CAD has edged below the 1.02 level. The pair is testing support at 1.0157. We could see this line fall if the Canadian dollar continues to show improvement. There is a stronger support level at the round number of 1.01. On the upside, the pair is facing resistance at 1.0229. This is followed by resistance at 1.0337.

- Current range: 1.0157 to 1.0229

Further levels in both directions:

- Below: 1.0157, 1.01, 1.0041, 1.00, 0.9930 and 98.42

- Above: 1.0229, 1.0282, 1.0337 and 1.0442.

USD/CAD ratio is not showing a lot of movement in Thursday trading. This is consistent with what we are seeing from the pair, which has moved slightly downwards. Traders should continue to monitor the ratio, as an increase in activity could be an early sign that the pair will show more volatility.

USD/CAD has edged lower following some weak US numbers earlier. We can expect the pair to remain fairly steady as it trades in the mid-1.01 range.