The Canadian dollar gained close to one cent on Friday, as Canadian Employment Change jumped, posting its best numbers in three years. In the US, Non-Farm Payrolls beat the estimate, but the unemployment rate nudge higher. Early in Monday’s North American session, the pair was trading in the high-1.01 range. Monday is quiet, with just one release from each country. Canadian Housing Starts rose nicely to 200 thousand, beating the estimate of 176 thousand. In the US, FOMC member James Bullard addresses an economic forum in Montreal.

Canadian key releases were impressive last week. Ivey PMI jumped from 52.2 to 63.1 points, easily surpassing the estimate of 55.3 points. This was followed by an outstanding Employment Change on Friday. The indicator rocketed from 12.5 thousand to 95.0 thousand, its best performance since May 2010. The unemployment rate dipped from 7.2% to 7.1%. The loonie took full advantage of the sharp numbers, gaining close to two cents against the US dollar.

The excellent numbers were not duplicated south of the border, as US employment numbers had a mixed week. ADP Non-Farm Payrolls slipped badly, as the key employment indicator missed the estimate for the third consecutive month. The indicator posted a reading of 135 thousand, well off the forecast of 171 thousand. Unemployment Claims managed to meet the estimate, but the market reaction was lukewarm. On Friday, Non-Farm Payrolls climbed from 165 thousand to 175 thousand. This was above the market forecast of 167 thousand. However, the unemployment rate rose edged higher to 7.6%, above the forecast of 7.5%. With speculation growing that the Fed could scale back QE in the next few months, employment figures have taken on added significance. However, the Fed may decide to hold a steady course if the employment picture does not improve. USD/CAD" width="400" height="300">

USD/CAD" width="400" height="300">

USD/CAD June 10 at 13:40 GMT

USD/CAD 1.0196 H: 1.0213 L: 1.0180

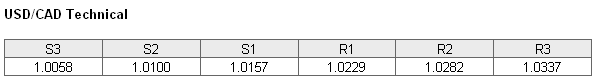

USD/CAD is trading in the high-1.01 range as we start a new week. USD/CAD is receiving support at 1.0157. This line is weak and could be tested if the Canadian dollar continues to improve. The next support level is at the round number of 1.01. On the upside, the pair faces weak resistance at 1.0229. This is followed by a strong resistance at 1.0282.

- Current range: 1.0157 to 1.0229

Further levels in both directions:

- Below: 1.0157, 1.01, 1.0058 and 1.00

- Above: 1.0229, 1.0282, 1.0337, 1.0442 and 1.0502

USD/CAD ratio is pointing to strong movement towards long positions. We are not seeing this in the pair’s current movement, as the Canadian dollar continues to improve against the US currency. The activity in the ratio could be an early sign that the pair will undergo a correction and move upwards. The ratio is now closely split, with short positions comprising a slight majority of open positions.

The Canadian dollar has benefited from strong domestic numbers and a broadly weakened US dollar. Will the loony’s upward movement continue? With no major releases on Monday, we could see an uneventful start to the week.

USD/CAD Fundamentals

- 12:13 Canadian Housing Starts. Estimate 175K. Actual 200K.

- 13:50 FOMC Member Bullard Speaks.