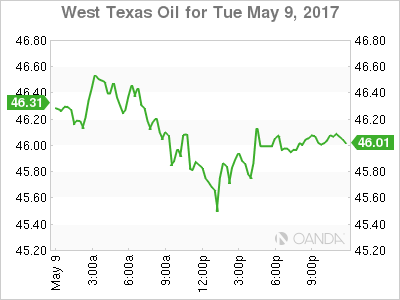

The Canadian dollar fell on Tuesday as the US dollar surged against all major pairs. The price of oil continues under pressure despite the efforts of the Organization of the Petroleum Exporting Countries (OPEC) to reassure markets an extension to its production cut deal is in the works. Global demand for energy has not grown significantly and with US producers increasing the best the OPEC could hope for is stable prices at current levels.

Canada’s largest non bank lender Home Capital Group rose 18.6 percent after the announcement that there is a third party interested in buying C$1.5 billion of its mortgage book. The institution got in trouble for lack of disclosure that has seen its deposits erode as investors have lost trust in the lender. The Canadian mortgage business continues to be strong but Home Capital is running out of liquidity to keep it afloat. The firm had about C$1.4 billion on April 24 and it expects to be left with C$146 million when it finishes settling yesterday’s withdrawals.

Canadian building permits fell in March for a second month in a row. There were 5.8 percent fewer permits than last month, and short of the forecast of a gain of 5.5 percent. There has been a multitude of stories on the Canadian housing bubble and its imminent pop. The narrative is gaining traction as Ontario joined the government of Vancouver in passing legislation to tax foreign buyers higher to try and cool the market. The issues with Home capital as well as lower building permits also support a change in the price expectations of investors going forward.

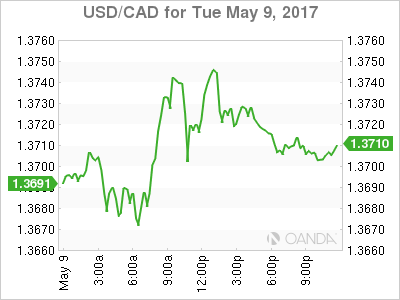

The USD/CAD gained 0.172 percent in the last 24 hours. The currency is trading at 1.3722 after the USD rose against major pairs as a June rate hike is still on the table. The dollar has risen against safe havens as there is more appetite for risk and the expectation of higher rates in the US is keeping the greenback bid.

Oil prices lost 0.536 percent on Tuesday. The price of West Texas is trading at $45.84 ahead of Wednesday’s US crude inventory data. Demand or energy, in particular gasoline has been sluggish as reflected by large inventories in the US. Shale producers in the US have ramped up their operations and have offset the efforts of the OPEC and other major producers to boost oil prices. Stability is the most the group led by Saudi Arabia has been able to get as prices have remained in a $45 to $55 range, far from the $30 price levels that spelled doom for the industry.

Weekly US crude stocks are forecasted to have fallen by 1.8 million barrels but traders will be looking for gasoline inventories as demand ahead of the US driving season is still low.

Market events to watch this week:

Wednesday, May 10

10:30am USD Crude Oil Inventories

5:00pm NZD Official Cash Rate

5:00pm NZD RBNZ Rate Statement

6:00pm NZD RBNZ Press Conference

9:10pm NZD RBNZ Gov Wheeler Speaks

Thursday, May 11

4:30am GBP Manufacturing Production m/m

7:00am GBP BOE Inflation Report

7:00am GBP MPC Official Bank Rate Votes

7:00am GBP Monetary Policy Summary

7:00am GBP Official Bank Rate

8:30am USD PPI m/m

8:30am USD Unemployment Claims

Friday, May 12

All day G7 Meetings

8:30am USD CPI m/m

8:30am USD Core Retail Sales m/m

8:30am USD Retail Sales m/m

10:00am USD Prelim UoM Consumer Sentiment

Saturday, May 13

All day G7 Meetings