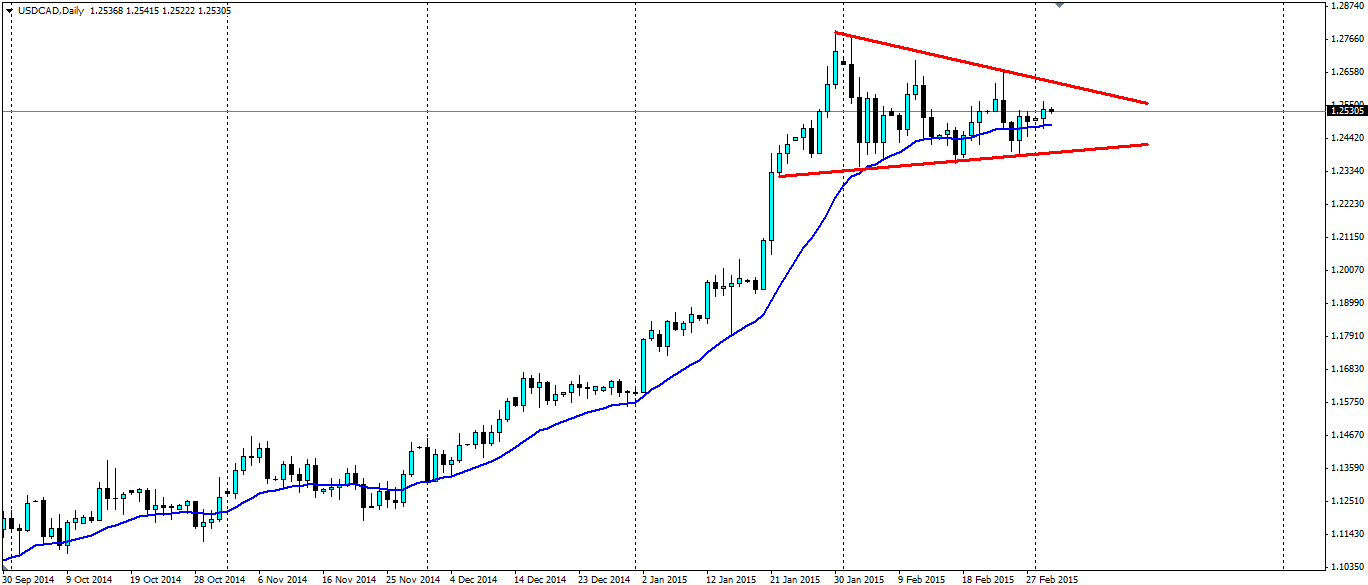

A large consolidation pattern is forming between the US dollar and the Canadian dollar on the daily/H4 charts. The strength in the US dollar and weakness in the oil price has seen a large push up the USD/CAD charts, but for now it consolidates as it awaits the next move from oil.

Source: Blackwell Trader

The Canadian dollar has weakened considerably over the last six to nine months thanks to a sharp drop in oil prices. Canada exports a considerable amount of Crude Oil to the US, which make up a large portion of export receipts. So it’s no real surprise to see the Canadian dollar fall alongside oil.

To counteract falling oil receipts, the Bank of Canada recently cut interest rates, which surprised the market. They are not expected to cut again when they meet later this week, but another cut would certainly push the USDCAD pair up to the recent highs.

US dollar strength has also played its part. The market expects the US Federal Reserve to begin to raise interest rates by September this year. Last week two Fed officials said that interest rates may rise sooner than the market expects. Yellen herself has remained committed to raising interest rates by “mid-year”. Certainly the contrast of the two central banks alone is enough to drive the pair higher.

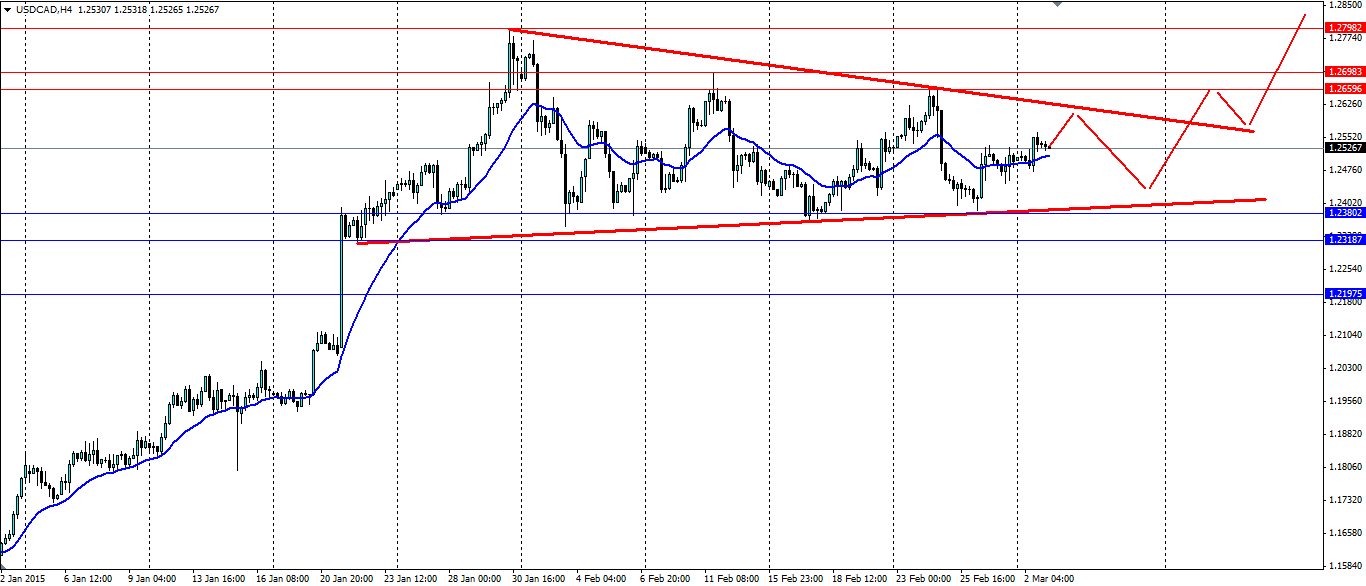

The below H4 chart shows clearly the consolidation seen in the USDCAD pair. Oil seems to have found its new equilibrium price for now and the dollar bulls take a breather. This has kept the pair within the range of the pennant shape. Before we see a breakout, we are likely to have another wave within the shape which trades may look to play. Sell off the dynamic resistance at the top or buy off the dynamic support at the bottom, either way the range play will keep you occupied while the consolidation plays out.

A breakout is likely to be towards the upside given that a pennant is known as a continuation pattern, therefore we are looking for a continuation of the recent bullish trend. For an entry, look for a pull back to the top of the shape which will act as support and will confirm the breakout if it holds. Resistance is likely to be found at 1.1259, 1.2698 and the previous high of 1.2798. Support is likely to be found at 1.2380, 1.2318 and 1.2197.

The USDCAD pair has been consolidating as the market looks for direction from either oil or the US dollar. A breakout to the upside is the likely outcome, but a range play within the shape may keep traders busy in the meantime.