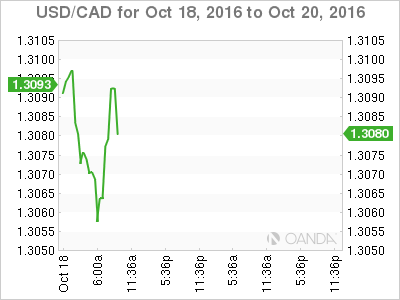

The Canadian dollar has posted slight gains on Tuesday, as the pair trades at 1.3080. The currency continues to rally, as USD/CAD has dropped 200 points in less than a week. On the release front, Canadian manufacturing sales jumped 0.9%, well above the forecast of 0.3%. South of the border, US CPI edged upwards to 0.3%, matching the forecast. Core CPI dipped to 0.1%, shy of the forecast of 0.2%. On Wednesday, the BoC will make its rate announcement, while the US releases Building Permits.

Canadian Manufacturing Sales impressed in August, posting a sharp gain of 0.9%. This marked a 4-month high and points to stronger activity in the manufacturing sector, which has struggled in a weak global economy. Over in the US, consumer inflation numbers were mixed. CPI edged up to 0.3%, up from 0.2% a month earlier. This was the strongest gain since April. Core CPI went the opposite direction, slipping to 0.1%, down from 0.3% a month earlier.

These numbers could have an important bearing on the Fed’s interest rate decision in December. Currently, a December rate hike is currently priced in at 64 percent. Meanwhile, US consumer spending impressed in September. Retail sales gained 0.5%, while core retail sales jumped 0.6%, as both key indicators rebounded from declines in August. PPI was steady at 0.3%, but the UofM Consumer Sentiment Index disappointed, dropping to 87.9 points and missing expectations. This marked the weakest reading since September 2015.

The Bank of Canada will meet for its monthly policy meeting on Wednesday. The markets are expecting the benchmark rate to remain at 0.50%, where it has been pegged since May 2015. With the Canadian economy under-performing, there is little chance of a rate hike in the near future, so monetary divergence will continue to favor the US dollar over its Canadian counterpart. Canada will release CPI numbers on Friday, and the markets are expecting stronger numbers for September, which could fuel further gains for the loonie.

USD/CAD Fundamentals

Tuesday (October 18)

- 8:30 Canadian Manufacturing Sales. Estimate 0.3%. Actual 0.9%

- 8:30 US CPI. Estimate 0.3%. Actual 0.3%

- 8:30 US Core CPI. Estimate 0.2%. Actual 0.1%

- 10:00 US NAHB Housing Market Index. Estimate 64 points

- 16:00 US TIC Long-Term Purchases

Wednesday (October 19)

- 8:30 US Building Permits. Estimate 1.17M

- 10:00 BoC Monetary Policy Report

- 10:00 BoC Rate Statement

- 10:00 BoC Overnight Rate. Estimate 0.50%

- 11:15 BoC Press Conference

- 16:15 BoC Governor Stephen Poloz Speaks

*All release times are EDT

*Key events are in bold

USD/CAD for Tuesday, October 18, 2016

USD/CAD October 18 at 8:45 GMT

Open: 1.3115 High: 1.3117 Low: 1.3053 Close: 1.3076

USD/CAD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.2815 | 1.2922 | 1.3028 | 1.3120 | 1.3253 | 1.3371 |

- USD/CAD was flat in the Asian session. The pair posted slight losses in the European session. The pair posted considerable losses in North American trade but has rebounded

- 1.3028 is providing support

- There is resistance at 1.3120

Further levels in both directions:

- Below: 1.3028, 1.2922 and 1.2815

- Above: 1.3120, 1.3253, 1.3371 and 1.3457

- Current range: 1.3028 to 1.3120

OANDA’s Open Positions Ratio

USD/CAD ratio is pointing to short positions with a majority of (52%), indicative of slight trader bias towards USD/CAD continuing to move to lower ground.