Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

The Canadian dollar is steady in the Monday session. Currently, USD/CAD is trading at 1.3420. Markets in Canada and the US are closed for New Year’s, so there are no economic events on the schedule. On Tuesday, US ISM Manufacturing PMI is the key release, with the indicator expected to rise to 53.7 points.

The Federal Reserve will be back in market focus on Wednesday, with the release of the minutes from the December policy meeting, when the Fed finally raised rates for the first time since December 2015. Analysts will be combing through the minutes, looking for clues as to the Fed’s future monetary policy. The US economy is performing very well, and the markets are hopeful that this continues as Donald Trump takes office. Trump’s economic policies remain sketchy, although he has promised to increase fiscal spending while lowering taxes. If the economy’s positive momentum continues in early 2017, the Fed could be inclined to raise rates another quarter point in order to prevent the economy from overheating. A rate hike would lead to broad gains for the US dollar.

As the Canadian dollar is a commodity-sensitive currency, any movement in crude oil prices can affect the movement of USD/CAD. Crude prices remain strong, as the recent agreement between OPEC and other oil exporters, which calls for production cuts, is expected to begin on January 1. Under the agreement, production is expected to drop 1.8 million barrels per day. Saudi Arabia, OPEC’s largest producer, has agreed to bear most of the cuts in production. However, even if oil exporters abide by their commitments under the deal, it’s questionable if crude prices will continue to rise, as US shale producers are likely to step in if oil prices move above the $60 level.

USD/CAD Fundamentals

Monday (January 2)

- There are no Canadian or US releases on the schedule

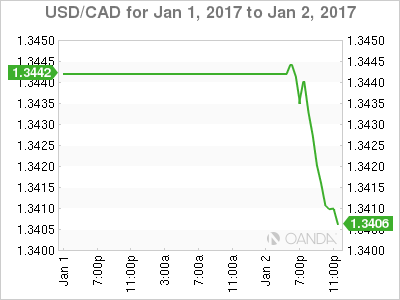

USD/CAD for Monday, January 2, 2017

USD/CAD January 2 at 9:55 EST

Open: 1.3425 High: 1.3455 Low: 1.3381 Close: 1.3418

USD/CAD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.3120 | 1.3253 | 1.3371 | 1.3457 | 1.3589 | 1.3759 |

- USD/CAD showed limited movement in the Asian session. In European trade, the pair lost ground but then recovered

- 1.3371 is providing support

- 1.3457 is under pressure in resistance

Further levels in both directions:

- Below: 1.3371, 1.3253 and 1.3120

- Above: 1.3457, 1.3589, 1.3759 and 1.3889

- Current range: 1.3371 to 1.3457

OANDA’s Open Positions Ratio

USD/CAD ratio is showing movement towards long positions. Currently, short positions have a majority (60%). This is indicative of trader bias towards USD/CAD reversing directions and moving lower.