The US dollar was trashed today on what may prove to be misguided euphoria over a successful Greek debt renegotiation. How does the EU lending money to Greece so that Greece can repay a previous outstanding debt to the EU create value? And how does it solve the issues in Greece that created the mess? It doesn't.

Money Talks or Shot Down in Flames

Australian rocker’s (now geriatric rockers) AC/DC penned two tunes whose titles best describe the state of the Greek debt renegotiation headlines this week; Money Talks or Shot Down in Flames. Today’s news reports suggesting that Greece and the EU are close to a deal which could be announced by Friday has led to a predictable EUR/USD reaction bounce. Before you take to the dance floor and start flinging the china consider the following:

1) EUR/USD speculative positions, although well down from their peak, are still short, which tends to exaggerate corrections.

2) The EUR/USD downtrend from October 2014 remains intact while trading below 1.1400 while the medium-term downtrend from a year ago remains active while trading below 1.1740.

3) The 1.1480-1.1500 area represents significant resistance from multiple tops and we are a long way from even testing those levels.

4) The USDX uptrend from the August 2014 low is in place while the USDX is above 94.00 and the EUR/CAD downtrend is also intact

5) Anecdotally, nonfarm payroll weeks tend to inflame trading volatility in the days preceding the release with position adjustments being a key driver.

USDX daily with uptrend line

Source: Saxo Bank

Oil and Loonie – a trial separation?

WTI and the Loonie have been well correlated throughout March and April. Gains or losses in oil prices translated to gains or losses in USD/CAD. Then May came along and the spring romance appears to have ended, although it’s more than likely that the WIT/Loonie pair is merely on a break.

That could change on Friday with the Opec meeting. Most reports suggest that the cartel is unlikely to announce a cut in production, exposing WTI prices to renewed selling on oversupply fears. Just last Wednesday, a Bloomberg story alluded to the oil tanker market signalling that the oil rally is under threat.

Perhaps the USD/CAD rally is a harbinger of an oil price fall. Then again, maybe not. On Monday, the Saudi oil minister was reported as saying that he expected oil demand to pick up in the second half while supply decreased.

At the moment, USD/CAD appears content to ignore WTI price swings within a $57-$62.00/bbl range.

USD/CAD and US oil daily

Source: Saxo Bank

Canadian employment data ahead

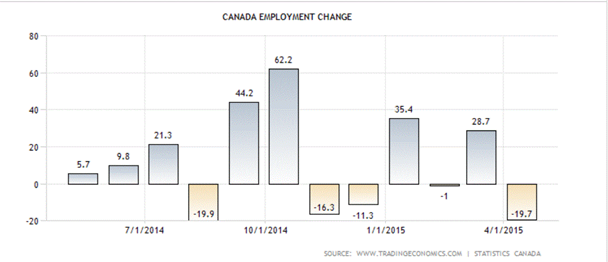

Lost in the shadows of the US nonfarm payrolls release is the Canadian employment report. This is a fickle, volatile and mostly unreliable piece of data which still manages to attract a lot of attention. Friday’s report for May is expected to rebound from last month’s dismal showing with a gain of 10,000 jobs, although the unemployment rate will remain unchanged.

Keep in mind that any reaction to this data will be short lived as USD/CAD is being driven by US dollar direction vs. the majors.

The following chart highlights the volatility in the data:

Source: TradingEconomics/Statistics Canada

USD/CAD technical outlook

The intraday USD/CAD technicals are bearish following this morning’s break of support at 1.2490. So far, two attempts to break below the 1.2440 support area have failed. Is the third time a charm? A break below 1.2440 would suggest a short-term top is in place at 1.2560 which would be confirmed by the loss of 1.2410. A move below the 1.2380-1.2410 zone suggests further weakness to 1.2000

The short-term downtrend line from the March peak of 1.2820 survived a couple of tests in the past few days and this downtrend remains intact while trading below 1.2550-60.

Failure to break 1.2410 suggests additional 1.2140-1.2560 consolidation until Friday.

USD/CAD daily with competing trend lines

Source: Saxo Bank

– Edited by Clare MacCarthy

Michael O'Neill is an FX consultant at IFXA Ltd.