Forex News and Events

Two more billions for Greece

Negotiations between Greece and Europe have reached a new step towards the release of €2 billion for the country’s restructuring banks. In particular, major disagreement in the debate was mainly on home foreclosures and tax arrears.

However, we know that since the June negotiations, where PM Alexis Tsipras decided to turn down the people’s OXO vote to accept disadvantageous lenders’ terms for an emergency bailout deal, that Greek officials have been capable of providing some important concessions. The only unknown variable in the equation is to know by how much they are willing to compromise. Indeed, with yesterday’s new agreement, only 60% will continue to be offered full protection from foreclosure.

Austerity policies are far from being over in Greece and yet still, despite this, Greek debt is not sustainable over the long haul. Instead, more and more efforts will be demanded from the Greek population. Markets have not reacted strongly to this news but the dollar keeps on the strengthening on the Fed's possible rate hike in December (which would be purely symbolic in our view). We are clearly bearish EUR and we turn our attention to the situation in Portugal.

USD bullish momentum should continued

There seems to be nothing that can stop the USD right now, despite the short-term sell-off. Current trading pattern reflects increased volatility, not risk-off or meaningful directional movement. The greenback has gained significantly on monetary policy divergence. But then the USD picked-up additional momentum from terrorist driven risk aversion. While a Fed rate hike is increasingly fully priced in there is scope for further appreciation. First comes from expectation of ECB easing which is no longer just geared towards weakening the euro but once again holding the EU together. Portuguese, Greek and Spanish short-term bond prices rose, pushing yields lower as investors feel more confidence that the ECB will prime the pumps with additional monetary policy stimulus. Second, while the US data has been mixed, specifically on the consumer side, there is evidence that acceleration is possible. CPI firmed in October indicating stabilization in price indicative of confidence in economic conditions. While manufacturing production increase indicating that primary headwinds are lessening, however weak industrial production was clearly a step backwards. Today’s housing start will be important in defining Q4 GDP growth which is currently tracking above 2.2%. The market is pricing in a slow and gradual Fed tightening cycle. However, should we see any acceleration that sloop will steepen quickly and catch the markets flatfooted.

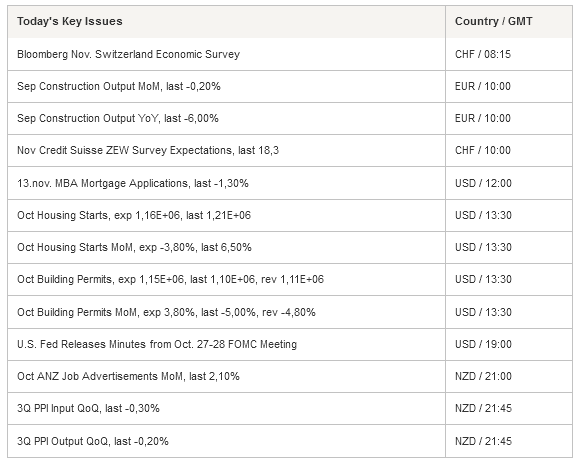

For today, minutes to the FOMC October 27-28 meeting should support the markets expectation for a rate hike in December. With data supportive of a hike (October strong employment report) we would be interest in hear the Fed comment on sensitivity to USD strength and global volatility. We remain constructive on the USD and see the current EUR/USD bounce as an opportunity to reload shorts. USD/JPY is increasingly driven by correlation to short-term yields. As USD/JPY rates continue to diverge we anticipate USD/JPY to trend higher, support by yield seekers.

The Risk Today

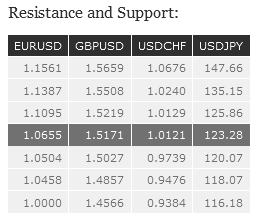

EUR/USD is still in a downside momentum but is now consolidating. Yet, the technical structure is clearly negative. The pair lies above 1.0600. Hourly resistance can be found at 1.0897 (05/11/2015 high). Stronger resistance stands at 1.1095 (28/10/2015 high). Expected further consolidation of the pair. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD is now pausing. Hourly support can be found at 1.5027 (06/11/2015 low). Hourly resistance lies at 1.5264 (13/11/2015 high). Stronger resistance can be found at 1.5529 (22/09/2015 high). Expected to show continued decline as the lower highs suggest a declining trend. The long-term technical pattern is negative and favours a further decline towards the key support at 1.5089 , as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY is strengthening and remains in an uptrend channel. Hourly resistance lies at 123.60 (09/11/2015 high). The short-term technical structure favours a further rise. Strong support lies at 120.80 (22/10/2015 low). Expected further test of the hourly resistance at 123.60. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18(24/08/2015 low).

USD/CHF is increasing confirming persistent buying interest. The pair is riding a uptrend channel. Hourly support is given at 0.9944 (06/11/2015 low) and resistance can be found at 1.0171 (intraday high). Expected to further consolidate. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.