The unexpectedly hawkish FOMC guidance surrounding yesterday's meeting pushed the USD stronger almost across the board. This has sent many of the USD pairs through key levels, as discussed in the chart section below. What will be interesting to establish in the coming days will be whether we shall see follow-through in the hot, fresh momentum built into this new USD trend. As well, the focus will be on the direction for risk appetite in the wake of this meeting, which will affect the JPY pairs most heavily. USD/JPY is pushing at the key local 102.50/102.75 resistance area while the other JPY crosses have failed to establish a direction (weak risk appetite pulled them lower yesterday while higher rates are trying to pull them higher).

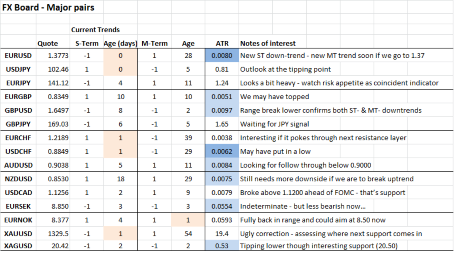

FX Board (beta) for March 20, 2014

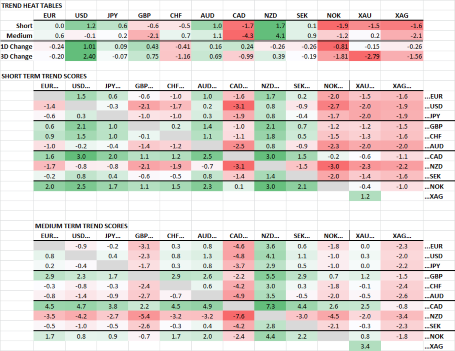

FX Trend Head (beta) for March 20, 2014

USD is showing tremendous short-term momentum now and is crossing into positive trend territory everywhere except in the AUD/USD and NZD/USD holdouts. Gold is the big loser, with NOK bringing up the rear of the G10 momentum picture today.

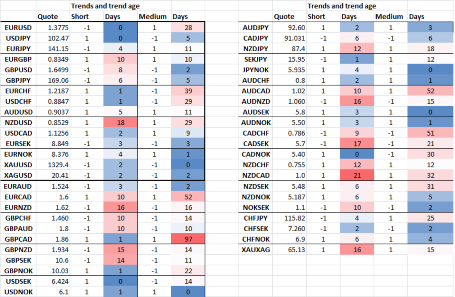

Overall G10 FX Short- and Medium-Term Trends

It turns out that the GBP/CAD medium-term trend has stayed intact after the strong snapback on Tuesday and remains the longest of the extant trends. Note all of the USD pair crossovers (0s) and 1s.

Chart: EUR/USD

EUR/USD is breaking important support in the 1.3800/1.3775 area and looks broken if it can trade all the way to 1.3700 before trying to bounce.

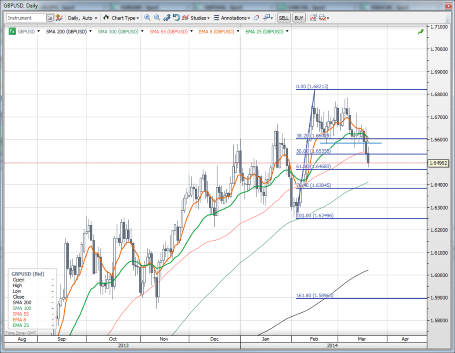

Chart: GBP/USD

Cable has finally taken out the range and is in play to the downside. 1.6250 is the main structural area of interest up next if the 61.8 percent Fibo can be taken out.

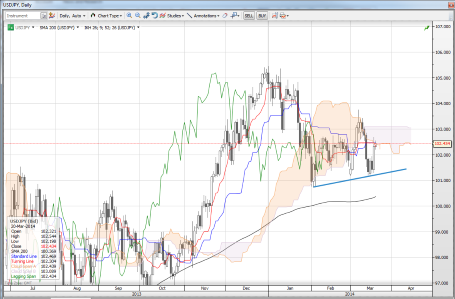

Chart: USD/JPY

USD/JPY posted a smart rally but is still in the shadow of the previous sell-off and has yet to prove that it can work back through the Ichimoku cloud. The next day or two of trading will be important for providing directional signals. The bears need a break of that 101.20 area on the downside.

Chart: EUR/CHF

EUR/CHF is looking interesting for a new uptrend if it can work through 1.2200/25 next.

Chart: XAU/USD (gold)

Gold and silver have lost their lustre after the Ukraine effect has cooled, and hawkish central banks are anathema for safe- haven hard assets. The next supports are 1325 and 1300, particularly the latter as it also comes in as the 200-day moving average.