News that U.S. Congress could challenge Trump’s tariffs on Mexico saw a reversal of fortunes for a bruised U.S. dollar, creating a series of potential reversal patterns for some U.S.D markets.

Late on the 31st May in the U.S., President Trump roiled markets by threatening a 5% tariff on all Mexican goods. Naturally this saw a flight to safety with JPY and CHF attracting FX flows, the collapse of U.S. yields and gold rallying close to its 2019 high. However, an interesting feature with this round of tariffs is that the USD hasn’t behaved as a safe-haven like it had during the U.S.-Sino showdown. Trump is effectively fighting a trade war on two fronts which, when combined with weaker economic data and rising expectations of a Fed cut, has proven too much for the greenback which has buckled under the strain.

Yet, despite the gloomy outlook for dollar bulls, it’s worth noting the bullish reversal for USD when markets began to suspect Mexican tariffs may not be implemented. This resulted in a series of hammers across USD markets and could leave potential for further greenback strength if trade talks progress, at least over the near-term.

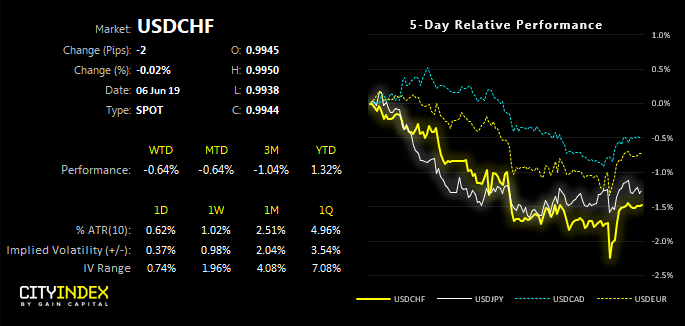

If we look at how JPY and CHF have fared since Trump’s announcement on 31st May, the Swiss franc has been the stronger performer. However, if the negative sentiment surrounding trade improves, we know safe havens get quickly dumped which leaves the potential for USD/CHF and USD/JPY to bounce on a near-term basis, before fundamentals weigh on the USD again.

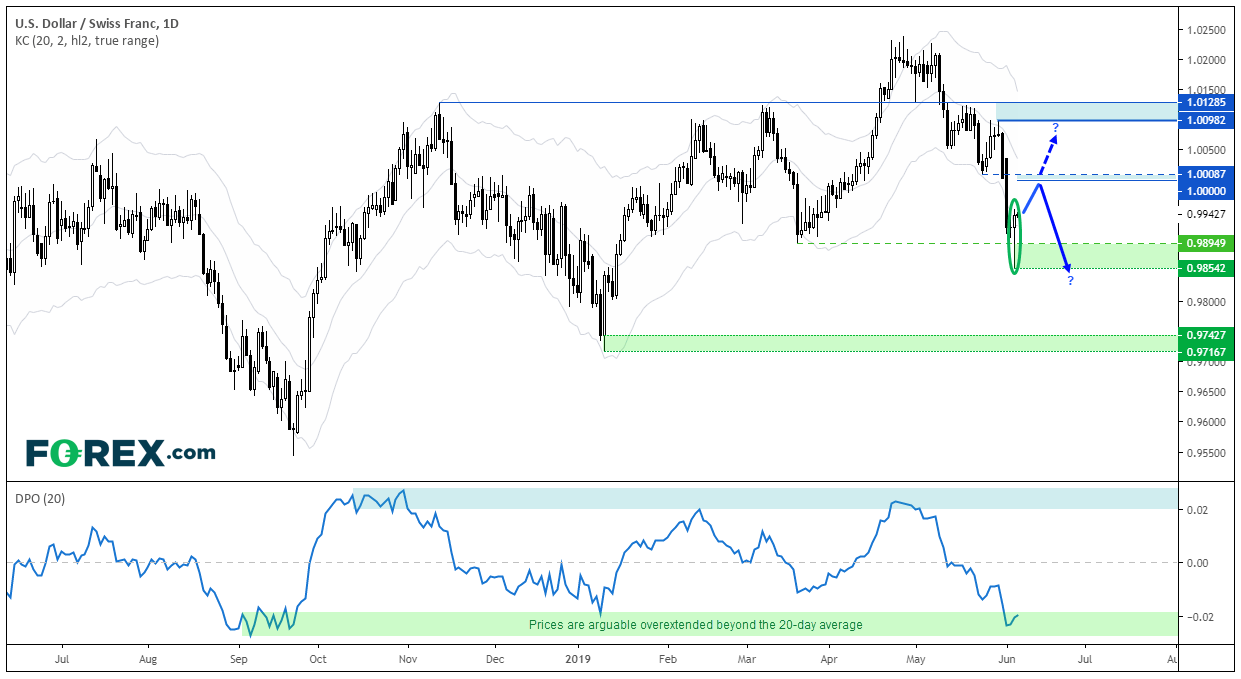

USD/CHF appears set for some mean reversion:

- An elongated bullish hammer failed to close beneath the 0.9895 low yesterday, warning of a fake-out.

- Yesterday’s low was overstretched beyond its lower Keltner band, before closing just back within it.

- By historical standards, prices are overstretched relative to the 20-day average, which can be seen on the DPO indicator (the detrended price oscillator, which simply measure the distance between price and its average).

Over the near-term we see potential for a bounce towards parity / the 1.0008 low. The success (or failure) of U.S.-Mexico trade talks will likely have a large impact on USD direction, so we’ll keep an eye on headline risk as it could make or break this near-term bias. We also have NFP tomorrow to keep a close eye on.

However, given the intraday break of the 0.9850 low following the break of the September 2018 trendline, we’ll be looking to fade into areas of resistance if signs of USD weakness returns, following a phase of mean reversion.