- US Dollar fails to break significant resistance

- Risk of an important Euro and British Pound reversal is high

- Our focus remains on USD pairs as the Dollar remains the driver

The US Dollar trades in a tight price range versus the Euro and other major currencies, but here’s why we see growing risk of an important USD reversal.

Professional traders have bought aggressively into the recent US Dollar rally versus the Euro and other major counterparts, and the currency’s inability to break key technical resistance leaves it at risk if traders decide to shed USD-long positions.

Indeed, recent Commitment of Traders data shows large speculators are their most long the US Dollar versus the Euro (short EUR/USD) since it traded near $1.20 over two years ago. This in itself does not guarantee that the Dollar is at an important turning point. Yet it highlights that many of those traders are likely to get rid of EUR/USD-short positions in a hurry and send the Euro sharply higher on a short-covering rally.

Dollar Index Stalls at key Resistance, Increasing Risk of Pullback

Source: FXCM Trading Station Desktop, Prepared by David Rodriguez.

In terms of trading strategy we thus look to key resistance levels in the Euro and Sterling in particular. Last week we highlighted similar risks of an important GBP/USD low, and our Senior Market Strategist writes that the Euro is at danger of a “short-squeeze rally”. Staying above $1.3300 keeps our short-term bullish bias intact, while the Sterling should hold key lows at $1.6660 to realistically rally through the foreseeable future.

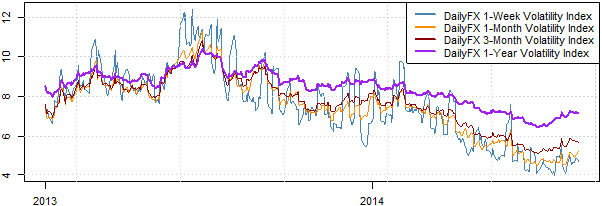

Of course if traders show fear of a sharp USD reversal they’re not necessarily showing it; forex volatility prices have fallen off of recent multi-month peaks. In short, this suggests that few are betting on or hedging against sharp currency moves through the foreseeable future.

Data source: Bloomberg, DailyFX Calculations

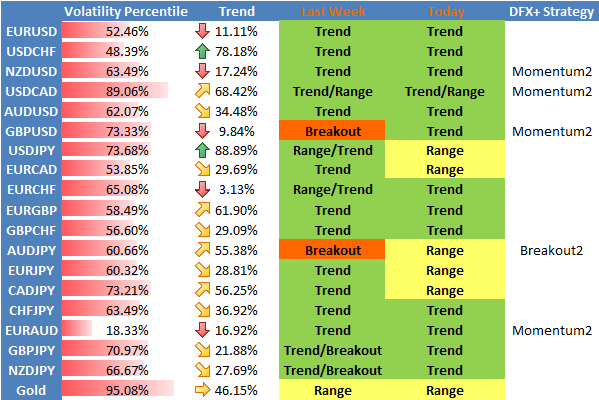

DailyFX Individual Currency Pair Conditions and Trading Strategy Bias

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com