Talking Points:

- Pound May Look Past BOE Minutes as Scotland Referendum Looms Large

- USD and JPY to Rise as AUD Declines if FOMC Stokes Rate Hike Bets

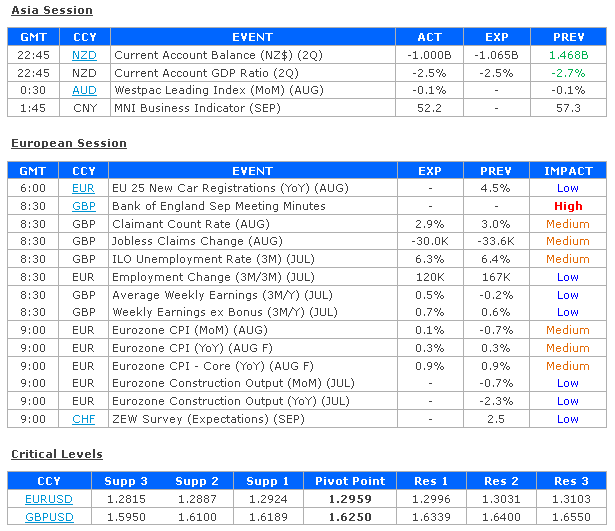

The publication of minutes from September’s Bank of England policy meeting headlines the economic calendar in European trading hours. Investors will be watching for the continued evolution of the voting pattern on the rate-setting MPC committee following Augusts’ split 7-2 decision.

UK economic news-flow has broadly improved relative to consensus forecasts and commentary from BOE officials has been broadly supportive over recent weeks. This means that it is quite possible that the hawks added new members to their ranks this month.

While such an outcome may offer a short-term boost to the British Pound, significant follow-through seems unlikely. Indeed, traders are likely to withhold directional conviction until the outcome of this week’s Scottish Independence referendum is behind them.

Later in the day, the spotlight turns to the FOMC policy announcement. This outing will be accompanied by release of an updated set of forecasts for key metrics of US economic activity as well as press conference from Chair Janet Yellen.

The Fed has warned about complacently buoyant risk appetite as the end of QE3 looms ahead next month. If policymakers opt to shake things loose with upbeat activity projections and/or a hawkish outing from Ms Yellen, the US dollar may renew its advance after yesterday’s pullback.

Critically, the onset of risk aversion may also materialize if traders perceive the Fed’s tone as having shifted toward the hawkish side of the spectrum. Successive rounds of QE have proven supportive for risk appetite. Fear of a relatively sooner unwinding of stimulus may reverse this dynamic, with sentiment-geared Australian, Canadian and New Zealand dollars likely to bear the brunt of selling pressure while the Yen gains amid an unwinding of carry trades.