Talking Points

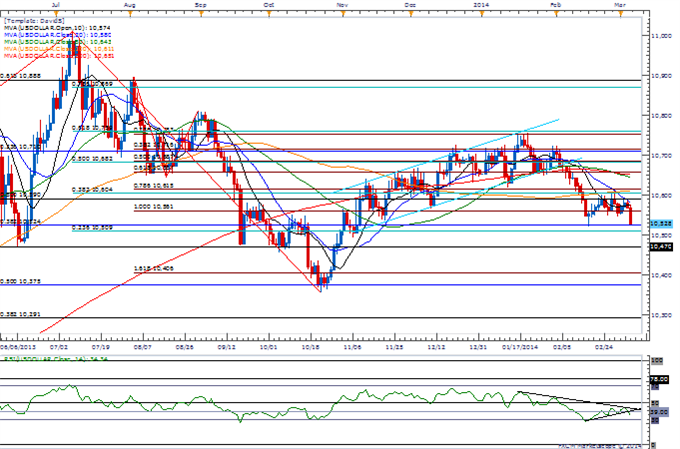

- US DOLLAR to Eye Fresh Lows as Bearish RSI Momentum Gathers Pace

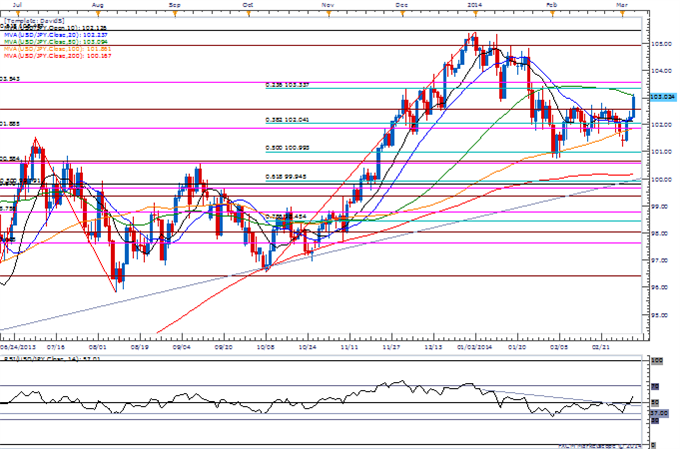

- USD/JPY Coming Up Against Key Resistance Ahead of Non-Farm Payrolls (NFP)

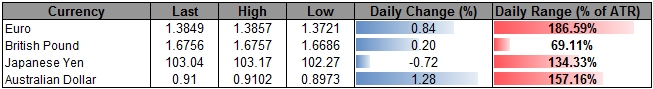

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

DJ-FXCM Dollar Index |

10528.21 |

10577.2 |

10528.21 |

-0.39 |

134.33% |

Chart - Created Using FXCM Marketscope 2.0

- Needs to Retain Bearish RSI Momentum to Confirm Lower High

- Interim Resistance: 10,657 (61.8 expansion)- Former Support

- Interim Support: 10,509 (23.6 retracement) to 10,524 (38.2 retracement)

|

Release |

GMT |

Expected |

Actual |

|

Fed's William Dudley Speaks on U.S. Economy |

13:15 |

||

|

Non-Farm Productivity (4Q F) |

13:30 |

2.2% |

1.8% |

|

Unit Labor Costs (4Q F) |

13:30 |

-0.5% |

-0.1% |

|

Initial Jobless Claims (MAR 1) |

13:30 |

336K |

323K |

|

Continuing Claims (FEB 21) |

13:30 |

2970K |

2907K |

|

Factory Orders (JAN) |

15:00 |

-0.5% |

-0.7% |

|

Fed's Charles Plosser Speaks on Monetary Policy |

18:00 |

||

|

Fed’s Dennis Lockhart Speaks on U.S. Economy |

23:00 |

The Dow Jones-FXCM U.S. Dollar Index looks well on its way to fresh lows as the bearish momentum in the Relative Strength Index (RSI) gathers pace.

Indeed, the highly anticipated Non-Farm Payroll (NFP) report may generate a further decline in the greenback should the release drag on interest rate expectations, and a pronounced slowdown in job growth may also lead to a greater shift in the policy outlook as Fed Chair Janet Yellen retains a rather dovish tone for monetary policy.

With that said, the US DOLLAR may ultimately come up against the 10,470 pivot as it searches for support, and we may continue to see a series of lower highs & lower lows in the first-half of 2014 as the recent slowdown in economic activity dampens the Fed’s scope to start normalizing monetary policy.

USD/JPY: Daily" title="USD/JPY: Daily" align="bottom" border="0" height="242" width="474">

USD/JPY: Daily" title="USD/JPY: Daily" align="bottom" border="0" height="242" width="474">

- Yen Weighed by Risk Appetite; Bullish RSI Break to Brings Up Former Support

- Interim Resistance: 103.30 (23.6 retracement) to 103.50 (100.0 expansion)

- Interim Support: 100.50 (61.8 expansion) to 100.70 (61.8 expansion)

Three of the four components strengthened against the greenback, led by a 1.28 percent rally in the Australian dollar, while the Japanese Yen shed another 0.72 percent as market participants continued to raise their appetite for risk.

It looks as though the USDJPY will respect former support (103.30-50) ahead of NFPs, but the topside break in the RSI certainly suggests that dollar-yen will resume the upward trend carried over from the previous year as it carves a higher low in February.

As a result, we’ll watch the topside targets ahead of the Federal Open Market Committee’s (FOMC) March 19 meeting, but the bullish outlook may unravel if the Bank of Japan (BoJ) shows a greater willingness to halt its easing cycle even before achieve the 2 percent target for inflation.

--- Written by David Song, Currency Analyst