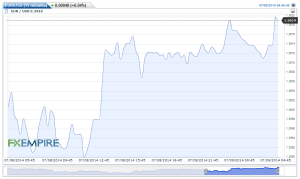

US dollar traders are eagerly awaiting the release of the FOMC minutes due later in the North American session. The minutes will not affect trading until after the close of the European session so markets will be held in suspense until late in the day. The US dollar is in the green this morning at 80.24 after giving back most of last week’s gains. The US Dollar Index traded on a flat note and declined around 0.1 percent in yesterday’s trading session on the back of mixed economic data from the country. However, weak market sentiments led to increase in demand for the low yielding currency along with rise in job openings data which cushioned sharp fall in the DX. The currency touched an intra-day low of 80.19 and closed at 80.22 on Tuesday.

The US JOLTS Job Openings rose to 4.64 million in May as against a rise of 4.46 million a month ago. National Federation of Independent Business (NFIB) Small Business Index dropped by 1.6 points to 95-mark in June from 96.6-level in May. These insignificant economic events took on greater meaning as traders were stressed from lack of news flow and data.

Wall Street posted another negative close last day so its repercussion is seen in Asia this morning. While Chinese CPI and PPI numbers have turned a bit lower to 2.3% and -1.1% respectively from its prior number may keep Asian indices lower and in that regard the domestic equity markets may further trade down today.

In the meanwhile, no major economic data are expected today so possibly volatility would be low. And traders will once again grasp for any news to give them direction.

The euro traded on a positive note and gained around 0.1 percent yesterday on the back of favorable economic data from the region. Further, weakness in the DX supported an upside in the currency. However, weak market sentiments in later part of the trade capped sharp rise in the currency. The EUR/USD touched an intraday high of 1.3617 and closed at 1.3611 and remains flat this morning. The German Trade Balance was at a surplus of 18.8 billion Euros in May from 17.2 billion euros a month ago. The French Gov. Budget Balance was at a deficit of 64.3 billion euros in May as against an earlier deficit of 64.2 billion euros in April. The French Trade Balance was at a deficit of 4.9 billion euros in May with respect to earlier deficit of 4.1 billion euros a month ago.

The Great British Pound recovered a few points this morning to climb to 1.7131 after yesterday’s disappointing UK manufacturing production numbers. The Sterling Pound traded on a flat note and gained marginally yesterday on the back of weakness in the DX. While on the other hand, a decline in country’s manufacturing and industrial production data exerted downside pressure in the currency. The UK’s Manufacturing Production declined by 1.3 percent in May as against a rise of 0.3 percent in April. Industrial Production fell by 0.7 percent in May from rise of 0.3 percent a month ago.