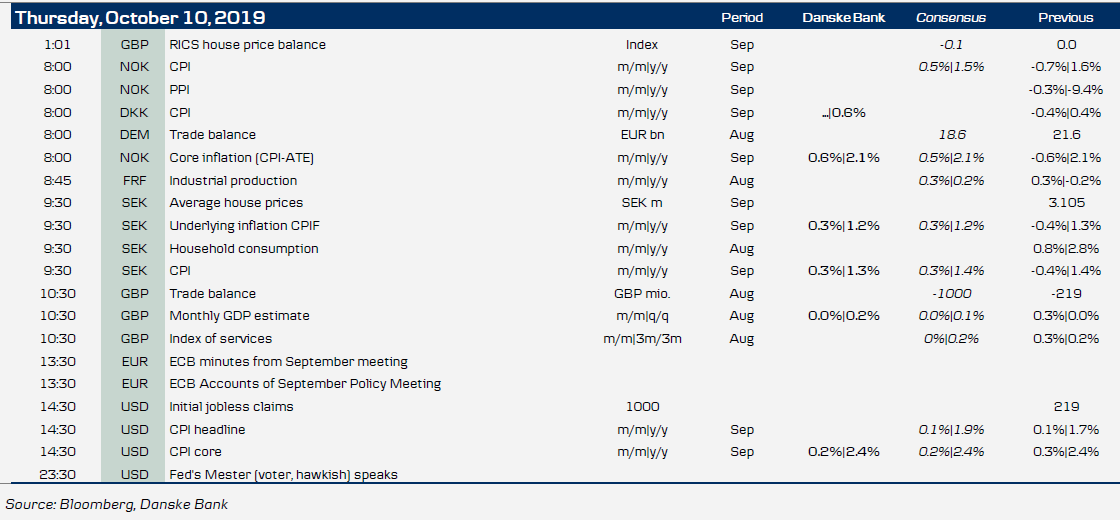

Market movers today

- Today the 13th round of high-level US-China trade talks kick off in Washington and continues tomorrow. We still see a good chance of an interim deal after China yesterday said it was still ready to make such a deal despite the US blacklisting of Chinese companies. FT also reported that China would offer to buy 10 million tons of soy beans in return for the US taking coming tariff hikes off the table. We do not know exactly when statements will come out of the talks but a good guess is late Friday (European time).

- The main event in the Scandies is the inflation numbers for September from Sweden and Norway. Swedish inflation is set to be crucial for the Riksbank outlook, see more on page 2.

- The minutes from the recent ECB meeting are set to be interesting reading. Since the meeting there have been frictions within the Governing Council, which peaked with the resignation of ECB board member Sabine Lautenschläger. Furthermore, we have seen conflicting comments in the media, in which Chief Economist Philip Lane said that he did not believe that the ECB had delivered a big package and that it could cut rates further.

- The US releases core inflation numbers and weekly initial jobless claims. We expect core inflation to stay unchanged at 2.4% y/y in line with consensus. Jobless claims are still at a low level around 220k, signalling a low rate of layoffs despite the slowing economy.

- UK PM Boris Johnson is set to meet with his Irish counterpart Leo Varadkar on Thursday. A deal looks increasingly unlikely and an extension beyond 31 October and a UK election are more likely.

Selected market news

The FOMC minutes were a bit outdated after the weak ISM data and the mixed picture from the US jobs report that was released after the September meeting and thus the market reaction to the minutes was muted. The minutes showed that the FOMC committee remains very divided on the number of future cuts and 'several' participants thought the Fed should clarify its intensions, so we could see change in the forward guidance language at the upcoming meeting. The Fed also discussed the liquidity conditions but we already know from Powell's recent comments that the Fed will make an announcement in October on 'organic growth' in the balance sheet. We believe consumer confidence tomorrow and retail sales on Wednesday next week are going to be key for the Fed's decision on 30 October, when we expect another 25bp cut.

It is a mixed picture on the Asian equity markets this morning, while we are awaiting the trade talks between China and US. Interest rates rose yesterday on the back of some optimism that a partial deal could be reached. Asian government bond markets have followed the move with a modest rise in bond yields this morning.

Scandi

In Norway, the inflation figures have faded into the background now that everything is about whether or not growth is set to hold up. Higher capacity utilisation and higher wage growth mean that domestic inflation will be pushing up and a weaker krone probably spells higher imported inflation. Nor do there tend to be any major monthly variations in September, so we expect the core rate to be unchanged at 2.1%, with the risk possibly slightly to the upside this time around.

In Sweden, we are spot on consensus on all three different inflation metrics (CPI, CPIF and CPIF ex energy), which is somewhere between 0.1-0.2pp below the Riksbank’s forecasts. Singling out CPIF, our forecast is 1.17% versus the Riksbank’s 1.32%. Potential upside risks to our forecast are mainly related to food prices, whereas clothing prices might not rise to the full extent as our forecast dictates and hence the risks are quite balanced. Always a key input, we argue that today’s reading is perhaps even more crucial than usual and that the Riksbank cannot afford inflation to fall short of its already quite moderate forecast, especially since inflation expectations continue their downward drift as evidenced by yesterday’s Prospera report. Although overshadowed by the inflation data, the household consumption indicator is also worth mentioning, where we expect a meagre 1% increase y/y.

Fixed income markets

The European core government bond markets sold off yesterday given speculation about a trade deal between US and China, even though it is only going to be partial. The Italian USD-bond auction was heavily oversubscribed and prices were tightened. The Italian debt office sold some USD7.5bn with an order book that was above 18bn. On top of this, the yield spreads on the bonds were tightened relative to government bonds.

Today, we have Ireland selling in its Green bond IRISH 10/31. We expect to see decent demand despite the risk of a hard Brexit. See more here.

FX markets

It is a crucial day for Scandi FX with a Norwegian, Swedish and Danish inflation hat trick. While the latter will not matter for EUR/DKK, both the Norwegian and Swedish releases have the potential of shaking up markets. Starting with Norway, our call is in line with consensus and Norges Bank’s projection but importantly we see topside risks to this call from imported inflation as illustrated by this chart. While global news on trade developments could dominate any surprise later in the day, there is a potential for a rebound in the NOK, especially early on in the session. For Sweden, we think even our call in line with consensus (but far below the Riksbank’s forecast) could firm SEK bears’ positions, leading to even more headwinds for the heavily battered krona.

Yesterday, EUR/GBP initially went lower on news that the EU might encourage a temporary backstop arrangement, but optimism in GBP quickly faded. Today, the GDP estimate for August is due for release. As Bank of England is starting to turn dovish, a worse-than-expected outcome is likely to take EUR/GBP higher, as it adds to the need for easing in an already weak economy. We think EUR/GBP will continue to face upside risk in the coming month(s) as Brexit, politics, the domestic and foreign economy remain major headwinds.

USD/JPY has come down from nearly 108.5 to 107.4, as global commodities and US interest rates have tapered some of the optimism that was built over September (on trade and global macro) but news on the trade war is the key short-term driver this week (as negotiations are ongoing). Though headlines are somewhat volatile, we think the US and China will be able to reach an interim but small deal. In light of that view, USD/JPY could snap higher on an initial positive announcement on or before Monday morning, depending on when such is announced. We would tend to fade that move, as the global economy remains on the back foot and we do not expect that to materially change in the short term, which is also why we keep our 3M (NYSE:MMM) forecast of 106.0.

Key figures and events