DuPont’s (NYSE:DD) Protection Solutions unit has launched DuPont Tyvek Fluid Applied WB+ System – the next generation of fluid applied air/water barriers under its Building Envelope platform.

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Dow Chemical Company (The) (DOW): Free Stock Analysis Report

BASF SE (BASFY): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research

The company developed this new solution by combining superior air and water barrier and industry-leading vapor permeability into a reformulated fluid-applied membrane for the ease of use on commercial substrates.

Offering an ideal combination of air and water holdout, DuPont Tyvek Fluid Applied WB+ System has some of the highest vapor permeability among the competition at 22Perms.

The STPE technology combined with high solids in the DuPont Tyvek Fluid Applied WB+ System enables low membrane shrinkage, high elongation, and elastic recovery. Additionally, the new product allows flexibility in construction schedules by preventing nine months of UV exposure.

The Tyvek Fluid Applied WB+ System helps prevent air and water leakage at the vertical walls of the building envelope. This further allows for more sustainable structures through enhanced energy efficiency and can provide protection from mold and mildew.

The fluid applied system comes with a 10-year limited warranty and employs the Certified Installer Program. The system has a shelf-life of 12 months from the time of manufacture and can be easily cleaned with mineral spirits and common citrus-based cleaners.

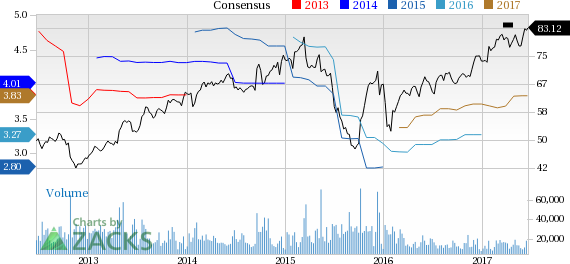

DuPont has outperformed the Zacks categorized Chemicals-Diversified industry over a year. The company’s shares have rallied 22.1% over this period, compared with the industry’s gain of around 18.6% over the same period.

DuPont is well placed to gain from its cost-cutting measures and new product launches. It has numerous new products in its pipeline that should contribute to the top-line growth.

Moreover, the proposed mega-merger with Dow Chemical (NYSE:DOW) is expected to deliver cost synergies of around $3 billion. The companies recently secured the U.S. antitrust clearance for the planned merger and expect the closing of the deal to take place in Aug 2017.

However, DuPont is exposed to raw material cost pressure and currency headwinds. The company also faces certain challenges in its nutrition & health and electronics businesses. Its agriculture business is still plagued by several industry-wide challenges.

E.I. du Pont de Nemours and Company Price and Consensus

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Dow Chemical Company (The) (DOW): Free Stock Analysis Report

BASF SE (BASFY): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research