Forex News and Events

US yield spread at lowest level since 2008

In the wake of the first interest rate hike by the Federal Reserve since June 2006, the market is wondering whether the US economy is strong enough to weather the actual market turmoil. The long-end of the yield curve has shifted substantially lower since the beginning of the year with the yield on the 10-year treasuries reaching 1.94% last week amid lingering growth and inflation concerns. On the short-end, the monetary policy sensitive 2-Year treasury yield fell to 0.80% - after jumping to 1.09% in late December after Yellen started the tightening process. On Wednesday, the spread between the 10-Year and the 2-year treasury yields reached the lowest level since early 2008 as disinflationary fears overtook markets. The market will have to deal with such conditions for a longer period of time as the combined action of the Fed’s principal and coupon reinvestment policy and weak inflation outlook will maintain the pressure on the long-end.

EUR/USD has been trading in a tight range for months now - between 1.07 and 1.1050 and should remain so. On the long-term, according to the weak inflationary pressure, we think that the Fed will stay on the sidelines for a longer period than actually expected. We do not expect a rate before June and even, we won’t be surprised it the tightening cycle got delayed further.

Swiss sight deposits slightly decline

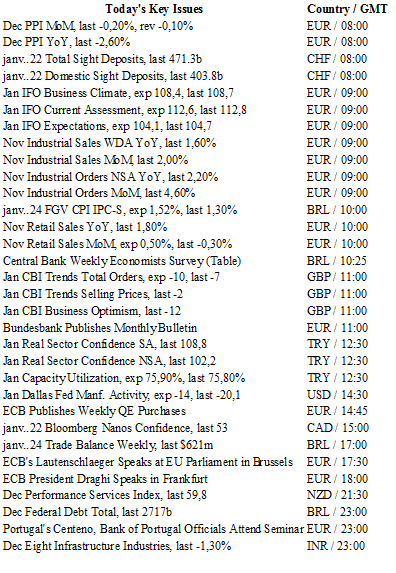

The new sight deposit data that came in this morning showed that the SNB is clearly not intervening to maintain a stronger EUR/CHF despite last week’s dovish performance from Mario Draghi. The domestic sight deposit declined slightly to CHF 403.1 billion from CHF 403.8 billion last week even though the amount of deposit trend remains positive since the abandoning of the floor just over one year ago. We assume from Draghi’s statements last week that March’s meeting will be more significant with bets on for a review of the current monetary policy and an increase in stimulus (currently €60 million per month).

Over the past months, the EUR/CHF has been slightly grown and is currently trading slightly below 1.1000. The Helvetic currency is still feeling the effects of upside risks due to its safe haven status and current global uncertainties, namely lingering low commodity prices and high geopolitical risks.

EUR/CHF – Slowly Rising To 1.1000.

The Risk Today

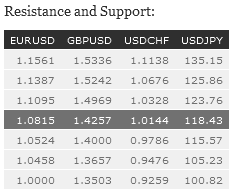

EUR/USD lies in a short-term downtrend channel. Hourly resistance may be found at 1.1096 (28/10/2015 low) while hourly support can be found at 1.0524 (03/12/2015). Expected to show further decrease. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD is bouncing back from the upper band of the downtrend channel. Hourly resistance is given at 1.4363 (22/01/2016 high). Stronger resistance can be found at 1.5336 (19/11/2015 high). Expected to show further weakness below 1.4000. The long-term technical pattern is negative and favours a further decline towards the key support at 1.4231 (20/05/2010 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY is trading mixed. Hourly resistance lies at 123.76 (18/11/2015 high). Hourly support lies can be found at 115.98 (20/01/2016 low). Expected to further bounce toward 120.00. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF's uptrend momentum is stilllively and the pair remains in the upward channel. Hourly support is located at 0.9876 (14/12/2015 low) and hourly resistance can be found 1.0328 (27/11/2015 high). Expected to show continued strength. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.