US growth probably hit 4% in 2Q - twice the rate recorded for 1Q18. Strong momentum, a robust jobs market and rising inflation mean the Fed will continue hiking rates despite Trump, trade and yield curve doubts.

The "typical" 2Q bounce

It is an interesting statistical quirk that US GDP readings for the first quarter are by far the weakest for any quarter in a given year while second-quarter figures are invariably the strongest. Given “seasonal adjustment” to remove the influence of predictable events such as weather patterns, school term dates and national holiday this really shouldn’t be the case.

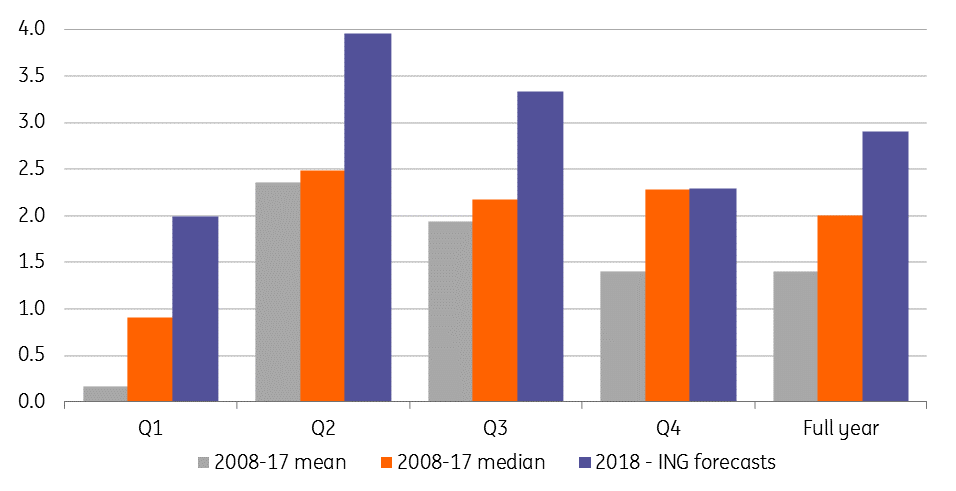

Over the past ten years, the mean Q1 growth outcome was just 0.2% quarter on quarter (QoQ) annualised while the median was slightly higher at 0.9%. However, over the same ten year period (see chart) the mean and median readings for second-quarter growth is 2.4% and 2.5% respectively. We suspect this pattern has continued into 2018 with first quarter’s 2% growth rate dwarfed by the 4% figure for 2Q18 we expect on Friday.

Q1 always disappoints - Q2 always brings good news - GDP growth 2008-17 & 2018

A rebound in consumer spending is likely to be the driving force. The bad weather clearly hurt spending in Q1, but high-frequency data suggests that households opened their wallets as the weather improved. Meanwhile, business surveys have been strong, and so investment is likely to have held up well. There should also be a stronger positive contribution from trade, given the improving monthly trade balance numbers, while inventory building should also provide a positive boost.

If we are correct with our 4% figure, this would be the fastest growth rate since 3Q14, but the Atlanta Federal Reserve’s GDPNow model suggests it could be even stronger at 4.5%. The consensus forecast amongst analysts has risen rapidly from around 3% two weeks ago to 4.3% as we approach to release with the range of forecasts starting at 3% while the high is 5.4%!

But there are risks for the future

Markets may be worried about trade wars and the potential for doom and gloom that typically follows a yield curve inversion, but for now, the US economy continues to power on.

We think there is strong momentum for the second half of the year and more evidence to suggest that wage pressures are mounting – note the Fed’s own Beige Book commented that there was growing evidence of firms “raising compensation to attract and retain employees” while a couple of Fed Districts “cited a pickup in the pace of wage growth”.

That said, we are not complacent. An escalation of trade tariffs certainly poses a threat with tomorrow's meeting between the EU's Jean-Claude Juncker and President Trump unlikely to yield a positive outcome given the EU's refusal to negotiate so long as steel and aluminium tariffs are in place and there are threats of tariffs on cars. The longer the trade uncertainty continues, the more it is likely to weigh on business sentiment, which could translate into lower capex spending and a slowdown in employment hiring. However, we have to remember there is a lot of stimulus in the system to provide a cushion – the $1.5 trillion of tax cuts and the $300bn of extra government spending this year - while the tax hike effect of the tariffs enacted so far are only measured in the tens of billions.

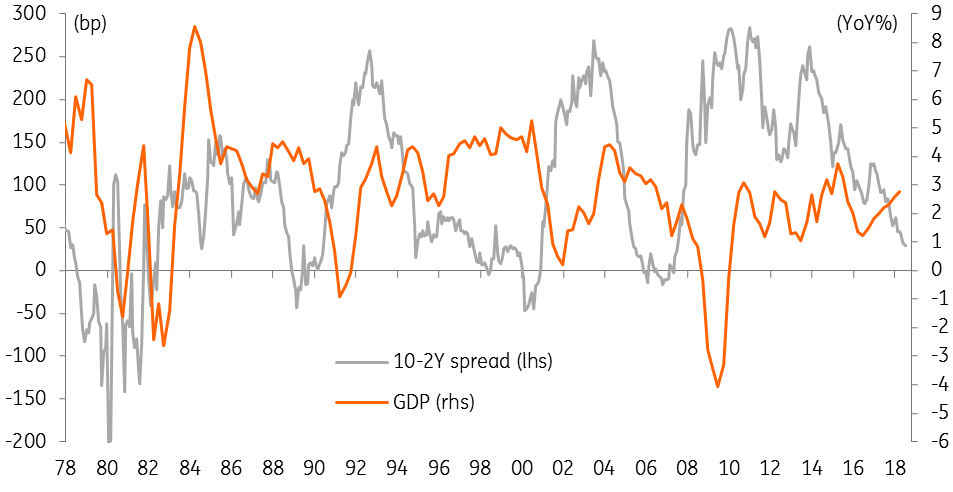

Recession typically follows a yield curve inversion

The Fed keeps hiking... for now

There also continues to be concern that the flattening yield curve (2-10Y spread is currently 29bp) could soon invert, a development that has preceded all nine recessions since 1955. Long-dated Treasury yields remain anchored by the fact that longer-term inflation expectations are subdued. As such there is some discussion that the Federal Reserve could moderate its pace of interest rate rises to prevent inversion - something that would please Donald Trump given he's "not thrilled" about the recent moves by the Fed.

However, we have to remember that the core and headline inflation readings for inflation are rising and headline CPI could soon hit 3%. If wages are picking up too then, inflation expectations could become less anchored, leading the bond market to re-steepen. With the Federal deficit set to hit 5% of GDP next year and the Federal Reserve running down its balance sheet, there could be renewed upward impetus at the longer end of the yield curve later this year. These moves could intensify if we are correct and Trump sounds a little more conciliatory on trade once the mid-term elections are out of the way in early November.

Taking this all together we continue to feel that the Federal Reserve will stick to its 'gradual' policy normalisation plan, as reiterated by Fed Chair Jerome Powell last week, which essentially means a rate hike every quarter for at least the next three.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”