Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

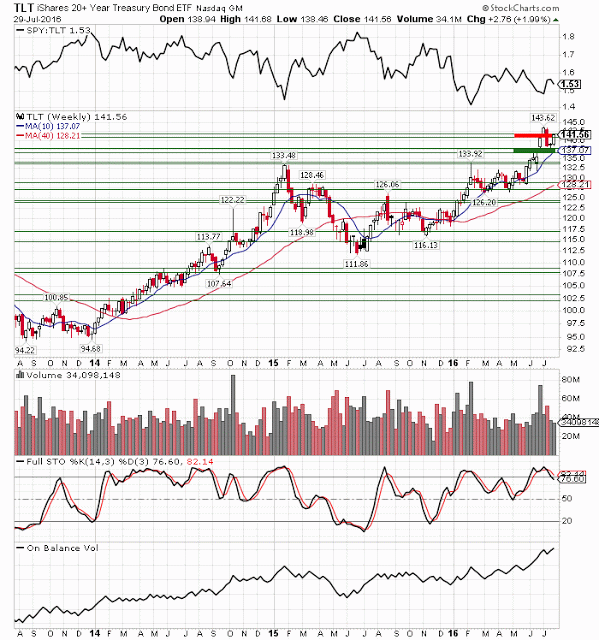

While coordinated 'stimulus' supports a countertrend rally of commodities foreshadowed by negative concentration discussed months ago, it won't reverse defensive global capital flows regardless of the hype. Defensive flows likely includes US Treasury bonds until the wolf pack culls the herd of weak European and Asian debt.

Only after they're thinned will the focus turn to the US. People could very well prefer government bonds, notes, and bills, at least in the initial stages of the next panic.

What Mellow omitted is that investors prefer the public sector (bonds) when confidence in the private sector (stocks) is failing. Investors preferred bonds in 1929 because confidence in the private sector was failing.

While gentlemen could prefer bonds in the initial stages of the next panic, they'll like turn on them as confidence in the public sector falters from an already shaken position. This will burn a majority populated by central bankers and followers of today's bullish headline hype rather quickly.

iShares 20+ Year Treasury Bond (NYSE:TLT)