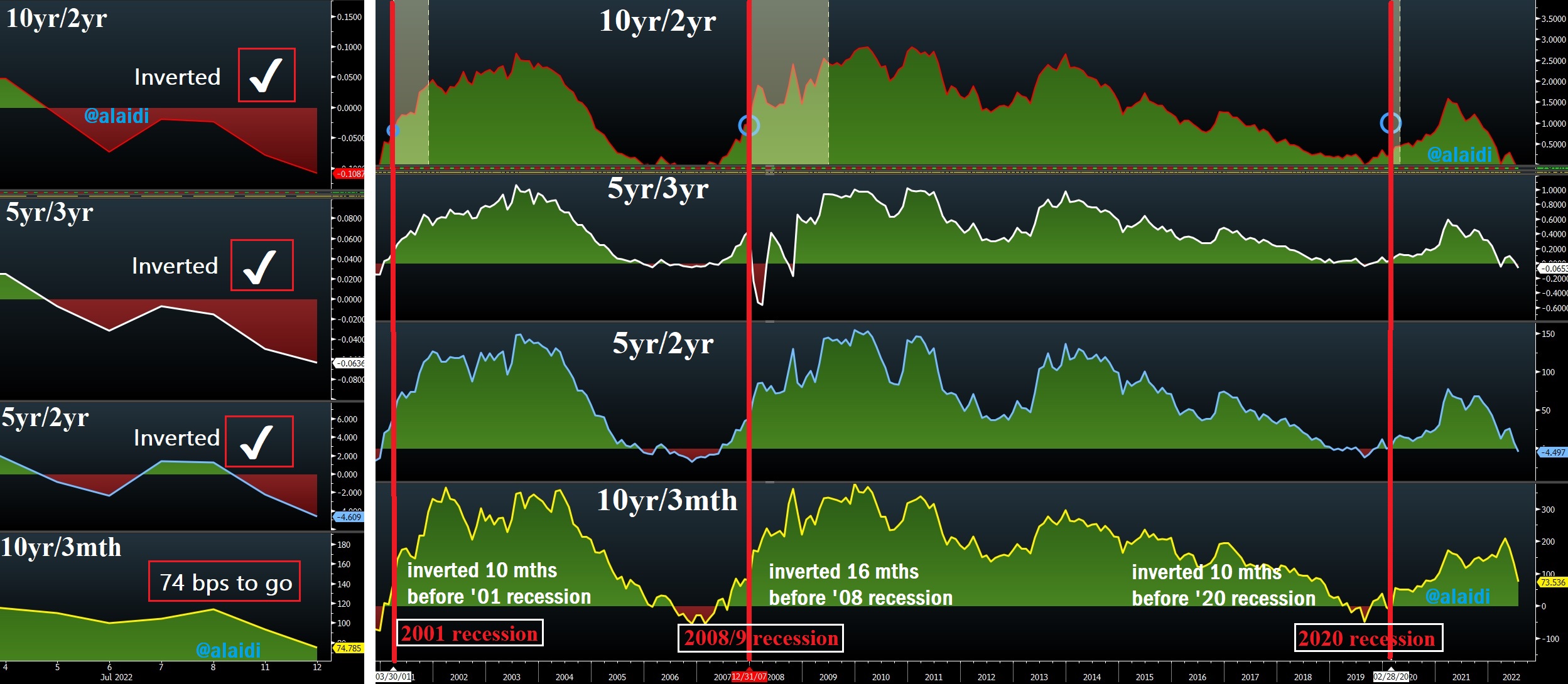

As growth concerns clash with further tightening from the Fed, all popular measures of the US yield curve are inverting, except for one—the 10-year/3-month spread, which, although flattening furiously (from 120 bps last week to 75 today), has yet to fall below zero officially.

Is the 10yr/3mth so important? How long does it take for the US to enter a recession after the yield curve has fully inverted?

The chart above shows that three of four yield curve measures have inverted. The 10yr/3mth has yet to fall below zero.

However, it’s worth noting that since not all economic slowdowns are alike, the reaction across different yield tenors (different yields across the curve) differs according to treasury supply/demand (issuance and demand of new government bonds, extent of post-tapering runoff from the Fed and inflation breakevens).

Let’s take the 2020 recession as an example; the US National Bureau of Economic Research gave an official duration of 2 months…yes…2 months. By summer 2019, three of the four measures shown in the chart went into inversion, except for the 10yr/2yr, which inverted for a mere 4 days. The duration of the inversion can also give an idea about the length of recessions.

The contrast between short-term yields remaining “stuck higher” relative to the rapid descent in inflation breakevens is more relevant and unique for today’s dynamics. One thing worth noting, which is weighing on commodities--including metals—is that shorter-term inflation breakevens (such as 2-year) are falling faster than their longer-term counterparts (such as 10-year), which means that inflation expectations are repriced down more sharply in the short-term. This especially poses a drag on metals. I’ve written about this last month in this piece

As we head into tomorrow’s release of the June CPI, it’s worth focusing on the real average earnings release part of the report, especially after earnings slowed in last week’s release of the June jobs report.

Finally, if we look at the duration between the point of inversion in the 10yr/3mth and the start of each of three recessions, we find an average duration of 12 mths [ (10+16+10)/3 as seen in the chart]. Does this mean an inversion of the 10yr/3mth this summer would imply the official start of recession by Q2 2023? Very likely…if not before.

Most importantly, what would such analysis imply for the timing of the Fed pivot? Buyers of treasuries, yen, and metals may have different ideas as to what actually constitutes a pivot? Will it be the official pause from rate hikes? Or a bigger-than-expected dovish dissent at the September FOMC? Do not limit your thinking to only “rate cuts.”

Finally, these cycles are shortening, and we could well enter a prolonged period of 'slowflation' mixed between contractionary and expansionary sectors.

Look at USD/JPY vs. US 10-year yields. What do you notice?