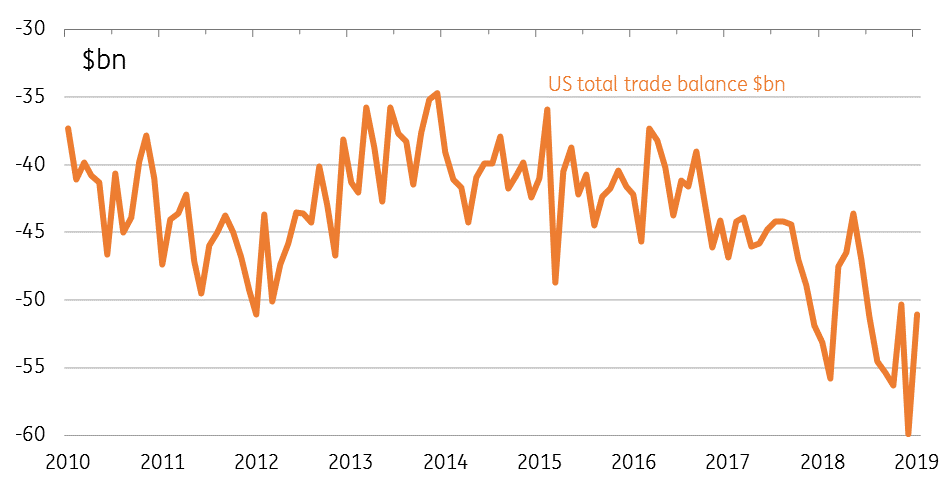

The US trade balance improved markedly in January to only -$51.1bn after companies cut imports on assumption of 1 January tariff hikes. That said, 'twin deficits' will be a key theme for the dollar this year.

A Temporary Trump 'Win' On Trade Balance

The US trade balance improves in January to -$51.1 billion from a deficit of $59.9 billion in December. This is also better than the -$57.0 billion figure the market had expected and was largely due to a 2.6% month on month drop in imports while exports increased 0.9%MoM.

We’d seen the US’ trade position deteriorate very sharply towards the end of last year, which we attribute largely to US firms ramping up imports from China ahead of anticipated tariff increases from 1 January 2019. The tariffs were subsequently delayed in mid-December by President Trump, but businesses could not have known that would happen. Given the time it takes to ship products across the Pacific it appears, unsurprisingly, that they ordered fewer imports for January – imports of goods fell 3% MoM.

US Monthly Trade Balance (USD bn)

We suspect we may see a further decline in the trade deficit in February for the same reasons, which should be supportive for 1Q GDP growth – we continue to look for a figure of 1.5-2% annualised GDP growth, despite the current bout of market pessimism on the US economic outlook. However, this improvement in the trade position may only be temporary as US business reverts back to more 'usual' import practices in 2Q.

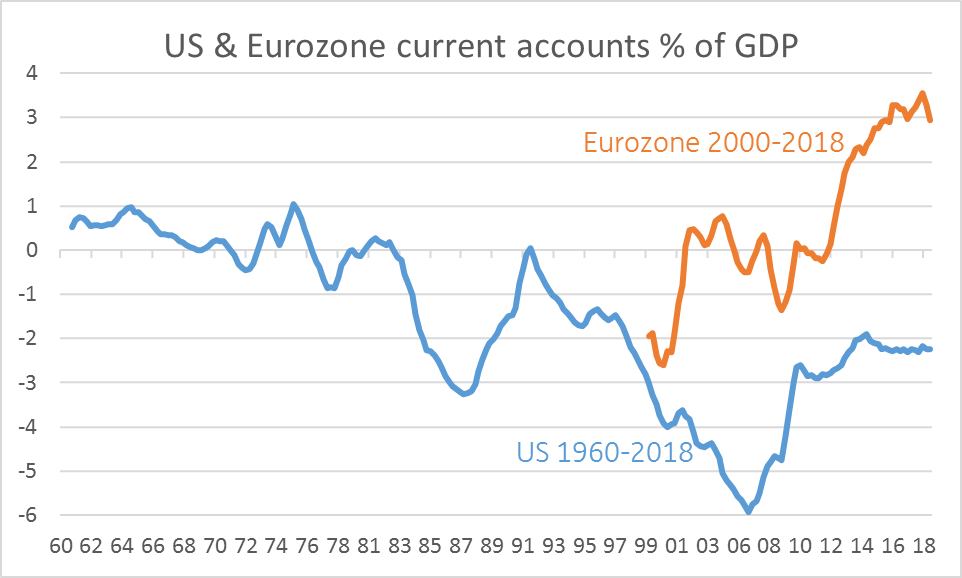

Twin Deficits To Weigh On Dollar

The US current account balance for 4Q18 will be released shortly and is likely to have widened to around $130 billion due primarily to the deterioration in the trade balance through 2H18. As a proportion of GDP, it's likely to hold at around 2.3% of GDP, which isn’t bad relative to recent history.

However, thanks to President Trump’s expansionary fiscal policy - through both aggressive tax cuts and spending increases - the fiscal deficit is soon going to be up at 5%. We believe that this 'twin deficit' issue is a clear headwind for the US dollar. Europe has a large current account surplus and a far more modest fiscal deficit, so in an environment where both the Federal Reserve and the ECB are signalling little prospect of interest rate rises, our FX team look for EUR/USD to hit 1.20 by year-end.

US and Eurozone Current Account Balances

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more