The US manufacturing sector appears to be feeling the strain of President Trump’s efforts to level the playing field on trade.

How resilient is the US economy?

President Trump has talked of the US economy’s resilience to any negative fallout from the intensifying trade tensions with China and other key trade partners, but the economic data is telling us a different story. The data suggests that firms are running down large inventory holdings and with orders appearing to be drying up, the US growth prognosis is turning more negative.

We still assume a positive conclusion to trade talks, but the longer the standoff lasts, the more damage for the economy and the more pain for the equity market. This, in turn, boosts the chances of Federal Reserve rate cuts and increases the likelihood of a Democrat challenger defeating Trump at next year’s Presidential election.

Durable goods post steep fall

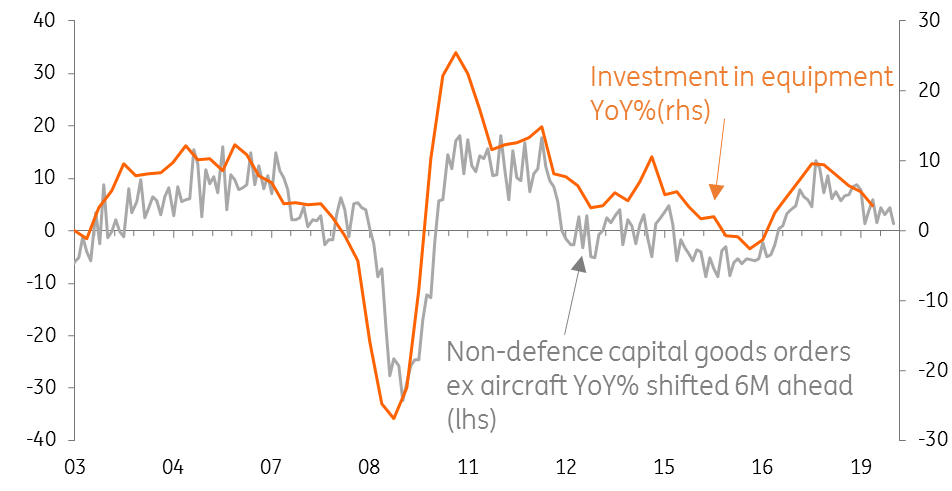

Yesterday’s manufacturing purchasing managers’ index fell to its lowest level since September 2009, with the new orders component dropping to the lowest level since August 2009. Today’s April durable goods orders report also posted a steep decline, led by a 25.1% drop in the volatile aircraft component. The core figure, which strips out aircraft and defense orders, fell for the first time since December, while there were sizeable downward revisions to recent orders data. The chart below points to investment spending having stalled in 2Q19.

US durable goods orders points to stagnating investment

Impact on GDP

International supply chains and the prospect of tariff hikes for foreign components saw businesses run up significant inventory levels in recent quarters. Inventory building contributed 2.3 percentage points of 3Q18’s 3.4% GDP growth, 0.1 percentage points of 4Q18’s 2.2% growth and 0.65 percentage points of 1Q19’s 3.2% growth. It now appears that firms want to offload a large proportion of this stock and are ordering less as a result. As such, a run down in inventories will also drag headline 2Q GDP growth lower.

This will, in turn, mean weak manufacturing output in coming months and could stall employment gains, too. For now, President Trump remains in an ebullient mood that his pressure on China will bear fruit and America will benefit in the long run. However, with financial markets looking on warily and US business seemingly feeling a cold wind, he may start to tread more cautiously. Falling equities and concerned voters will not help his re-election chances.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.