It’s been a strong year for American equities. Although US shares have been trading in a tight range recently, the market is holding on to the bulk of its robust year-to-date gain in 2023.

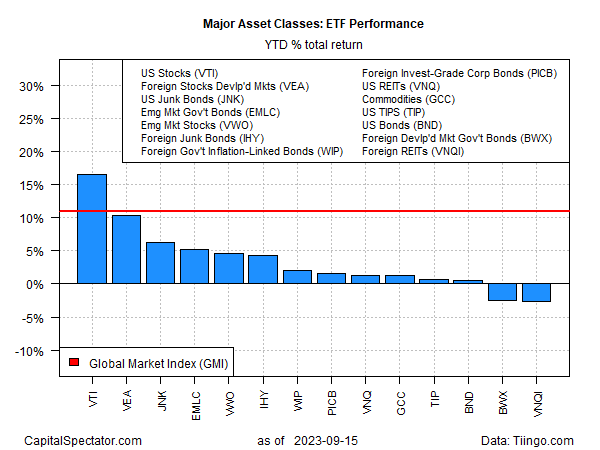

Stocks in the world’s biggest economy also continue to outperform the rest of the major asset classes, based on a set of ETFs through Friday’s close (Sep. 15). Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) is up 16.5% in 2023, which is only moderately below its 20%-plus year-to-date peak reached in August.

The next-best advance for the major asset classes this year is a distant but still solid 10.4% rise for stocks in developed nations ex-US (VEA). Meanwhile, the worst performer this year is still global property shares ex-US (VNQI) via a 2.6% loss.

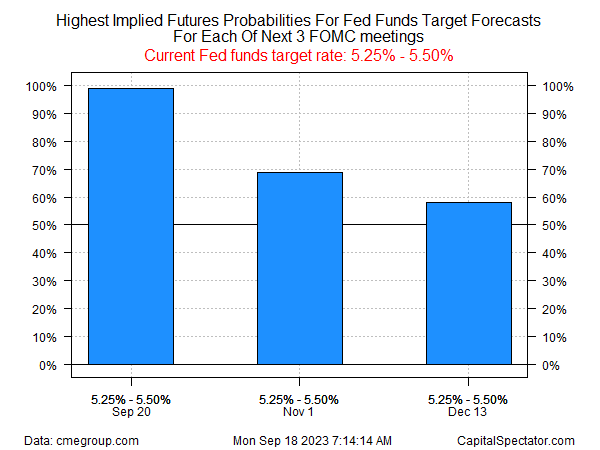

Investors are debating if the recent flatlining in US shares is a pause that refreshes or a peak in what will eventually be seen as a bear market rally following last year’s sharp correction. A key factor for deciding what comes next is linked to upcoming Federal Reserve decisions on interest rates. The central bank is widely expected to leave rates unchanged at Wednesday’s policy announcement on Sep. 20.

Even if the forecast is correct, analysts continue to debate if rates are set to peak.

“How the Fed delivers the pause is crucial for November and December rate expectations, but whether it’s presented with a dovish or hawkish tilt is what matters most for financial markets,” advises Quincy Krosby, chief global strategist for LPL Financial (NASDAQ:LPLA).

A poll last week by Reuters reports that less than 20% of economists anticipate a rate rise before the end of the year.

Fed funds futures are also leaning toward the view that the Fed will leave its target rate unchanged for the rest of the year, although the implied probability of extending a pause at the November and December FOMC meetings is only moderate at this point. By contrast, the futures market is pricing in a near certainty for no change on Wednesday.

A source of uncertainty, notes Wilmington Trust chief economist Luke Tilley, is the Fed’s focus on repairing its credibility after reacting too slowly to surging inflation in 2021-2022.

“They are being very risk averse and they’re still worried about making the mistake of the 1970s of letting inflation go back up,” he says.

“They don’t want the market to take any kind of signal of dovishness and run with it. They need to keep financial conditions tight.”

Until the investors become confident on the question of when and where rates peak, the odds appear more than trivial that the stock market will be in a holding pattern.

Meanwhile, the latest consumer inflation data for August convinced some analysts that the Fed will be inclined to lift rates. The US Consumer Price Index accelerated slightly to 3.7% last month vs. the year-earlier level, in part because gasoline prices spiked.

“Ultimately, this release showed that there is still real work to be done to get inflation back to the Fed’s 2% target,” advises Sam Millette, fixed income strategist at Commonwealth Financial Network.