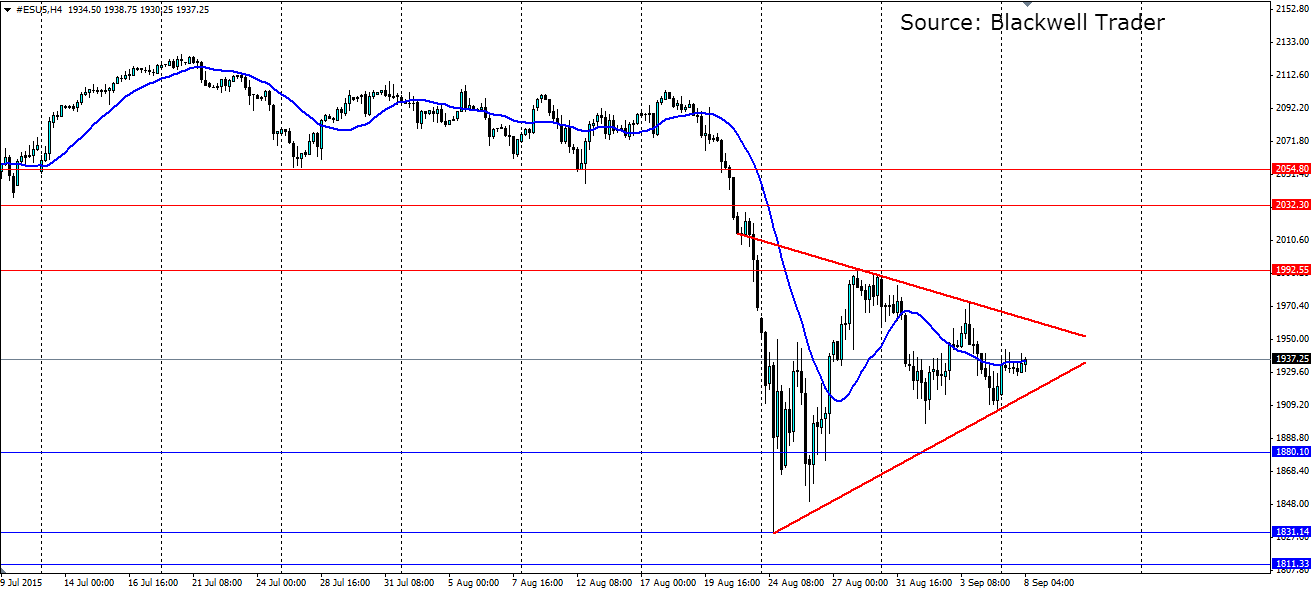

Now that the dust has settled in the US markets, and with a public holiday to boot, US stocks have consolidated into a nice pennant shape. Does this mean they are gearing up for a breakout?

The wild swings in the US stock markets, and indeed global stock markets, have largely cooled off. The move saw the S&P 500 September futures go from 2103.00 to a low of 1830.25. The move wiped out almost a year’s worth of gains and touched a level not seen since October 2014. China was largely to blame for the market turmoil, as its years of boom look to be grinding to a halt.

The slowdown in China has made the markets very nervous that it will spread worldwide and cause a global recession, and the stock markets are the best barometer for the global economy. That fear has given way to relief which has seen stocks consolidate around the current level at 1935.00.

Next week will be a big one for the markets with the US FOMC meeting to set interest rates. They are largely expected to hold rates steady, and if they do, what they say could have a big impact. If they are pessimistic about the near future, we could see a sharp retracement in stocks. If they raise rates, that will also be bearish for stocks, as fixed interest assets will now yield relatively more. Then there is October,the month that so often spooks markets into selling.So there are some reasons to be cautious going forward.

Technicals also suggest a cautious approach is appropriate. In fact they suggest a sharp downside breakout is possible. The consolidation of the S&P500 September futures is a classic pennant shape that, when it fails, will likely see a continuation of the trend, and in this case that is bearish.

Either way a cautious approach is the best option in these nervous times. If we see a breakout lower, look for support at 1880.10, 1831.14 and 1811.33. If we see an upside push, look for resistance at 1992.55, 2032.30 and 2054.80.