Asian markets skidded on Thursday, as another delay in Greece’s bailout package unnerved investors. The Kospi slumped 1.4% to 1997 as shipbuilders dropped, and the ASX 200 shed 1.7%, pulled down by disappointing earnings from Westpac, a major bank. The Hang Seng and Shanghai Composite both fell .4%, and the Nikkei edged down .2%.

European markets closed little changed, as an afternoon rally helped erase earlier losses. The FTSE and DAX declined .1%, while the CAC40 gained .1%. Greece reached an agreement with lenders on additional budget cuts for 325 million euro, bringing the resolution of the situation a step closer.

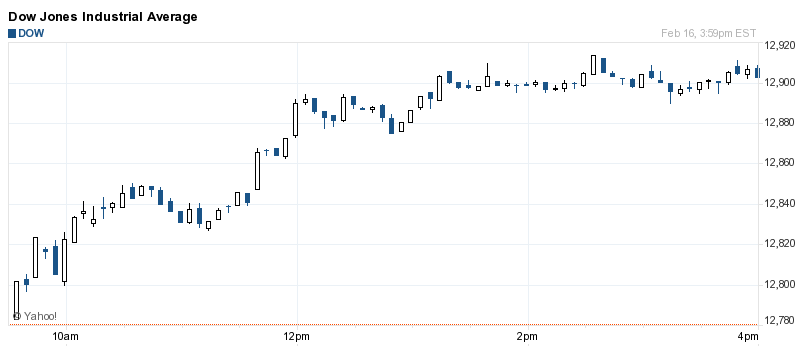

US stocks rallied thanks to upbeat economic data, led by tech shares. The Nasdaq jumped 1.5%, the Dow climbed 123 points to 12904, and the S&P 500 advanced 1.1% to 1358.

Dow Rallies 123 Points

GM shares soared 9% after reporting record profits, even though the figure fell shy of expectations. Groupon shares jumped 4.1% after announcing plans for a new VIP subscription service.

Currencies

The US Dollar skidded on Thursday, as market participants shifted in to “risk on” mode. The Pound climbed .7% to 1.5802, the while the Euro, Swiss Franc, and Australian Dollar all advanced .6%. The Canadian Dollar rose .3% to .9970. Bucking the uptrend, the Yen dropped .7% to 78.91, extending its recent declines.

Economic Outlook

Thursday’s busy economic calendar was full of positive economic news. Weekly jobless claims unexpectedly fell by 13K to 348K. Analysts had expected a slight increase to 364K from last week’s 361K. Housing starts also surprised analysts, climbing to 700K, from last month’s annualized rate of 690K. Building permits rose to 680K, inline with estimates, and PPI jumped to .4% from last month’s .1% increase. Finally the Philly Fed manufacturing index blew past estimates, jumping to 10.2 from last month’s 7.3 reading.

Stocks Trade Higher on Greek Hopes, Economic Data

Equities

Thursday’s rally on Wall Street gave Asian markets a boost on Friday. The Nikkei jumped 1.6% to 9384, the ASX 200 added .3%, and the Kospi gained 1.3%, as Samsung Electronics advanced 3.6% to a record closing high. In greater China, the Hang Seng rallied 1% to 21692, while the Shanghai Composite closed flat.

Expectations for an imminent Greek bailout lifted European markets. The DAX and CAC40 climbed 1.4%, and the FTSE edged up .3%. Shares in Lafarge, the world’s largest cement maker, soared 8.3% after the company announced it would cut costs to offset losses tied to Greece.

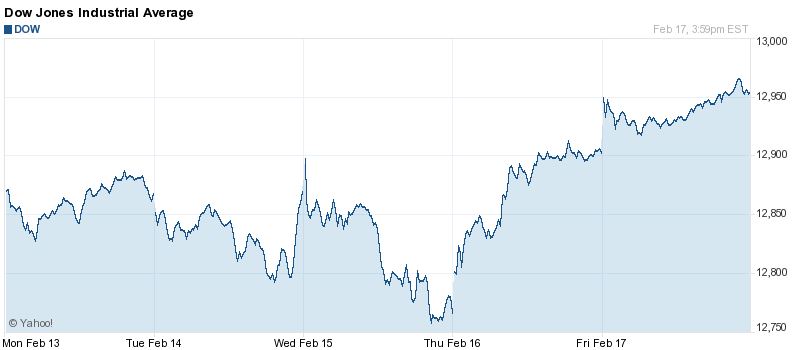

US stocks traded mixed in light trading, as traders prepared for the long weekend. The Dow added 46 points to 12950, the S&P 500 rose .2%, and the Nasdaq declined .3%.

Dow Rapidly Approaching 13000 Level

In the biotech world, Vivus shares surged 7.3% o hopes the FDA would approve its diet pill, while Gilead Sciences tumbled 14.3% after announcing disappointing news concerning its experimental Hepatitis C drug.

Currencies

The Yen continued to drop, shedding .8% to 79.57. The Pound rose .2% to 1.5831, and the Euro inched up .1% to 1.3148, while the Swiss Franc and Canadian Dollar traded flat. The Australian Dollar declined .4% to 1.0712.

Economic Outlook

Leading indicators rose to a 3.5 year high of 94.1, up .4%, posting its 4th straight monthly gain. CPI data showed prices rose .2%, slightly less than expected.

China Eases Reserve Requirements, Stocks Rally

Equities

China announced a new stimulus plan to cut bank reserve requirements, pushing up most markets in the region, although much of the initial gains did not last. The Nikkei advanced 1.1% to 9427, and the ASX 200 rallied 1.4%, as miners jumped, encouraged by the Chinese announcement. China’s Shanghai Composite rose as much as 1.3%, but closed up a mere .2%, and the Hang Seng declined .3%, as energy shares sold off. Korea’s Kospi inched up .1%, sliding back from a 6-month high.

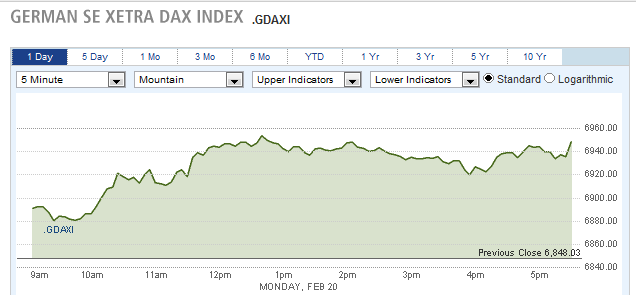

European markets rallied, with the DAX leading the advance, climbing 1.5% to 6948. The CAC40 gained 1% to 3473, and the FTSE rose .7% to 5945. JPMorgan said the DAX is its preferred European index, contributing to outsized gains for the German benchmark.

DAX Climbs 1.5% Thanks to Nod by JPMorgan

US stock and bond markets were closed for Presidents Day.

Currencies

The Dollar declined, as expectations for a successful Greek bailout encouraged risk taking. The Euro advanced .7% to 1.3241, and the Swiss Franc push up .8% to 1.0967. The Australian Dollar rose .4% to 1.0752, and the Canadian Dollar gained .3%% to .9938. The Yen closed flat after touching a 6-month low of 79.70.

Economic Outlook

Tuesday’s sole report will be the Chicago Fed’s national activity index.

Greece Secures Bailout Packag

Equities

Greece received approval for its long awaited bailout package from lawmakers, but Asian markets traded mixed on the news. The Nikkei eased .2% to 9463, as Mazda shares tumbled 10% after announcing it would raise $2 billion in a share offering. The ASX 200 advanced .8%, the Hang Seng edged up .3%, and the Shanghai Composite climbed .8%. Korea’s Kospi closed flat, as significant losses in ship builders offset gains in other sectors.

European markets declined, as the Greek debt deal failed to inspire investors. The DAX shed .6%, the FTSE dropped .3%, and the CAC40 slid .2%.

The Dow briefly crossed the 13000 mark for the first time since May 2008, but failed to hold those gains as US stocks ended mixed. The Dow settled at 12966, up 16 points, the S&P 500 inched up .1% to 1362, while the Nasdaq slipped .1% to 2949.

Currencies

The Australian Dollar dropped .7% to 1.0666, despite the spike in metal prices, as the US Dollar gained. The Pound slipped .4% to 1.5784, the Canadian Dollar declined .3% to .9966, and the Yen eased .1% to 79.72. The Euro and Swiss Franc closed flat.

Economic Outlook

Wednesday’s key report will be existing home sales, which analysts expect to rise to an annualized rate of 4.66M. Also due are weekly mortgage applications.

Asia Gains, West Slips, on Mixed Economic Data

Equities

Chinese manufacturing climbed to its highest level in 4 months, encouraging markets around the region. The Nikkei advanced 1% to 9554, with exporters gaining as the Yen moved back above the psychologically significant 80 level. The Shanghai Composite rallied .9% to 2404, the Hang Seng edged up .3%, and the Kospi rose .2%. In Australia, the ASX 200 erased early losses to close flat.

Meanwhile, European markets skidded on weaker than expected economic data. The service sector’s PMI data unexpectedly contracted, slipping to 49.4 from last month’s 50.4 reading. The DAX slumped .9%, the CAC40 dropped .5%, and the FTSE eased .2%.

Fitch cut its rating on Greece to C from CCC, explaining that a near term default is highly likely, despite the recent bailout efforts.

US stocks traded moderately lower as well. The Nasdaq shed .5% to 2933, the Dow slipped 27 points to 12937, and the S&P 500 declined .3% to 1358.

Currencies

The Dollar traded mostly higher against global currencies. The Pound sank .7% to 1.5668, the Australian Dollar fell .3% to 1.0635, and the Swiss Franc lost .2%. The Yen declined .7% to 80.29. The Euro inched up .1% to 1.3244, after trading in a narrow range all day.

Economic Outlook

January’s existing home sales data was strong, rising by 4% to a 1.5 year high. However, the gains were based on a steep downward revision of December’s data, so the results fell shy of expectations. Mortgage applications declined last week.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Stocks Rally on Upbeat Economic Data

Published 03/19/2012, 05:26 AM

Updated 05/14/2017, 06:45 AM

US Stocks Rally on Upbeat Economic Data

Equities

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.