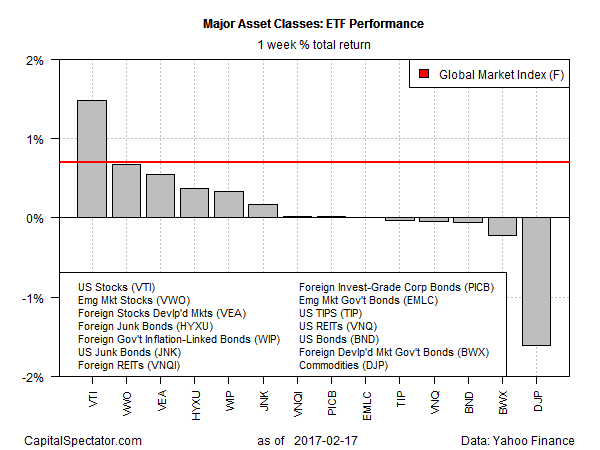

The U.S. equity market was the top performer among the major asset classes for the trading week through Feb. 17, based on a set of representative exchange-traded products. On the flip side, broadly defined commodities tumbled, posting last week’s biggest setback.

Vanguard Total Stock Market (NYSE:VTI) climbed 1.5% over the five trading days through Friday. The gain, the fourth straight weekly advance for the U.S. equity fund, lifted the ETF to a record high at last week’s close.

Last week’s biggest loser: iPath Bloomberg Commodity (NYSE:DJP), which fell 1.6%, reversing most of the previous week’s sharp gain.

The general trend, however, was comfortably in positive territory last week, based on an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights advanced 0.7% last week, the fourth positive weekly total return in a row.

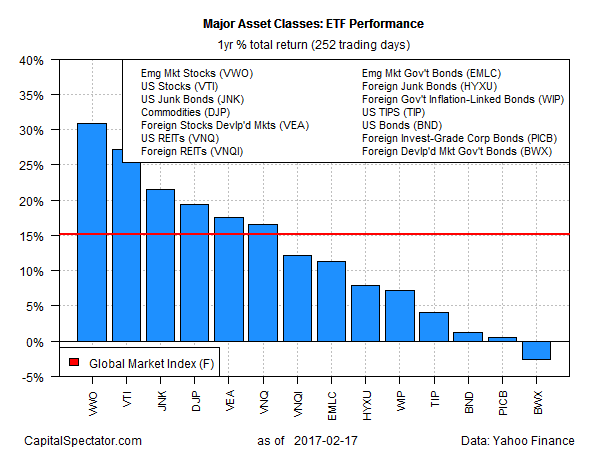

For the one-year performance column, stocks in emerging markets continue to hold the lead. Vanguard FTSE Emerging Markets (VWO) is up nearly 31% for the 252 trading days through Feb. 17 on a total-return basis, moderately ahead of VTI’s 27.2% second-place performance.

The only loser among the major asset classes for the trailing one-year return: foreign developed-markets government bonds. SPDR Bloomberg Barclays (LON:BARC) International Treasury Bond (BWX) is off roughly 2% for the 252 trading days through Friday.

GMI.F’s one-year trend continued to post a strong return for the trailing one-year window, rising 15.1% as of last Friday.