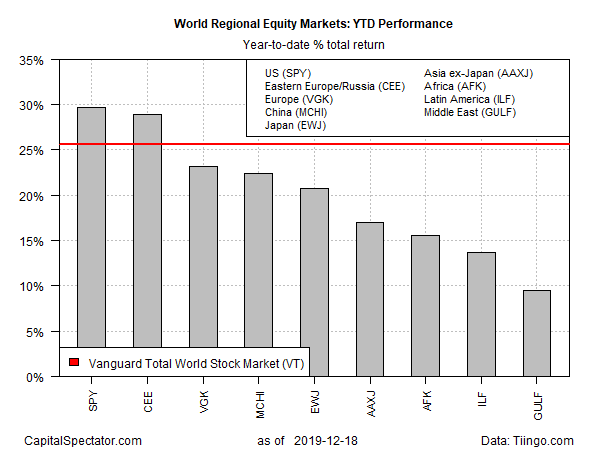

With only days left to the trading year, American shares look set to outperform the rest of the world’s major equity regions, based on a set of exchange-traded products listed in the U.S.

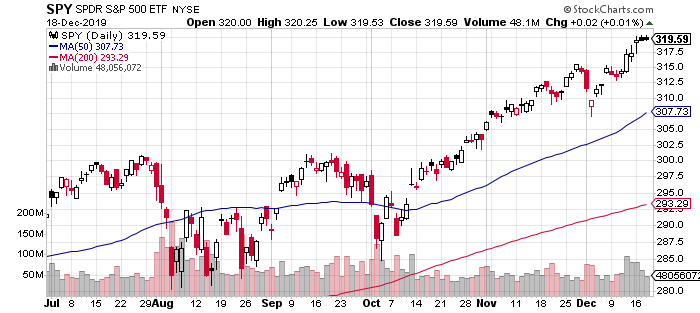

SPDR S&P 500 (NYSE:SPY) is currently in first place for 2019 among funds representing the main slices of the planet’s regional stock markets. Anything can happen between now and the end of the year, of course, and so it’s not over till it’s over. But at the moment, SPY’s in first place, posting a strong 29.7% on a total return basis through last night’s close (Dec. 18). The fractional gain in yesterday’s trading left the ETF at yet another record high.

A close runner-up this year is Central And Eastern Europe Fund (NYSE:CEE), a closed-end fund that offers the only U.S.-exchange-listed product that targets this region of the world. The fund’s current year-to-date gain: 28.9%, just slightly behind’s SPY’s 2019 rally.

Global shares overall are posting a solid gain this year, based on Vanguard Total World Stock Index (NYSE:VT). The ETF ended yesterday’s trading at a record high, posting a 25.6% year-to-date gain.

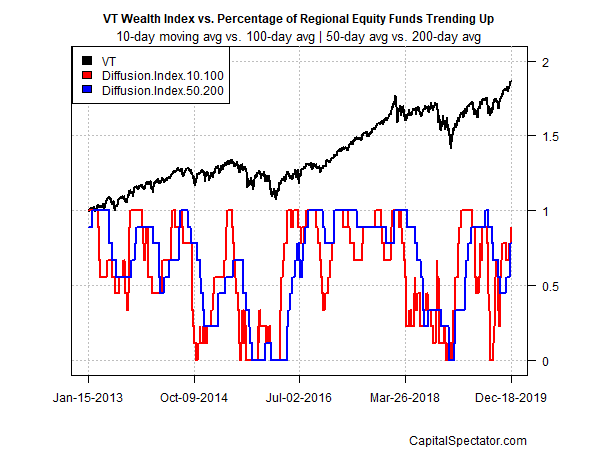

Reviewing all the regional and country funds listed above through a momentum lens shows that the bullish trend has been strengthening lately. The analysis is based on two sets of moving averages, which point to a broad-based upside bias overall for global shares. The first measure compares the 10-day average with its 100-day counterpart — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) represents an intermediate measure of the trend (blue line). Based on these metrics, the near-term momentum profile remains firmly bullish.