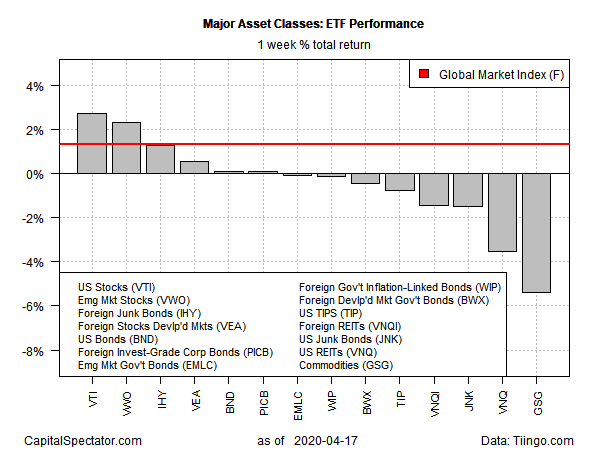

For the first time since February, shares of U.S. companies rose for a second calendar week through the close of trading on Apr. 17. The rally echoed similar gains in foreign shares, based on a set of exchange-traded funds.

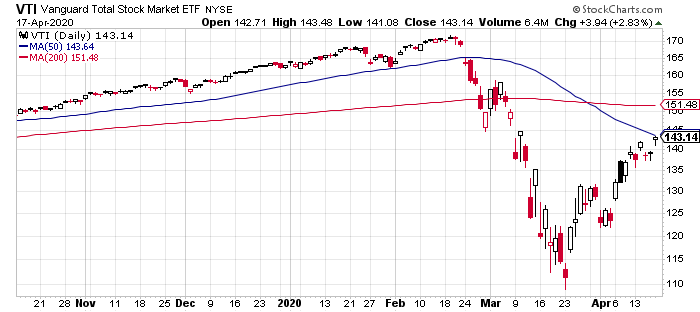

American stocks posted the strongest increase in the major asset classes last week. Vanguard Total U.S. Stock Market (NYSE:VTI) rose 2.7%, building on the previous week’s strong gain. The fund closed at its highest level on Friday in over a month.

The recent upside momentum in stocks around the world has calmed anxious investors to a degree. Some of the renewed bullish outlook is based on expectations that the rate of growth in COVID-19 infections and fatalities has peaked. Perhaps, although even if true some analysts are questioning if the crowd is fully pricing in the risk of a second wave of coronavirus infections.

“In the event that we have a very significant second wave of disease in the United States that causes a further shutdown of the economy … that clearly is not priced into the market,” says David Bailin, chief investment officer of Citi Private Bank. “The other thing that may not be priced into the market is the fact that this virus may take another 18 to 24 months to really cycle through the globe, and ultimately have a vaccine.”

Investors appear to be taking a more cautious view on how the coronavirus evolves in the weeks and months ahead, based on U.S. equity futures in early trading today (Monday, Apr. 20). S&P 500 futures are down 1.9% at the moment (7:40 a.m. eastern).

Despite last week’s risk-on bias in equities, some corners of the major asset classes suffered. U.S. real estate investment trusts reversed course a fell 3.6% via Vanguard Real Estate (NYSE:VNQ). The weekly setback was exceeded only by broadly defined commodities: iShares S&P GSCI Commodity-Indexed Trust (NYSE:GSG) slumped 5.4%, ending last week near the fund’s lowest close since it started trading in 1996.

The rally in equities helped lift an ETF-based version of the Global Markets Index (GMI.F). This unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights via ETFs rose for a second week, climbing 1.3%.

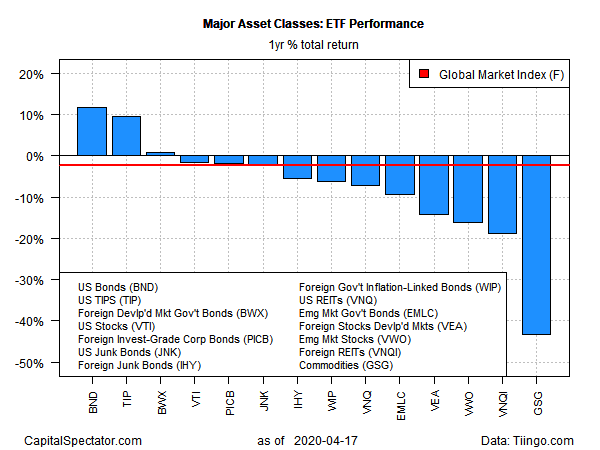

Reviewing asset classes through a one-year lens paints a far-different profile. Bonds are the only gainers, led by U.S. investment-grade debt. Vanguard Total U.S. Bond Market (NASDAQ:BND) is up 11.8% for the trailing 12-month window.

Most of the rest of the field is nursing losses. The deepest: a steep 43.4% one-year decline for commodities (GSG).

GMI.F is also under water over the past year, albeit with a relatively mild 2.3% decline.

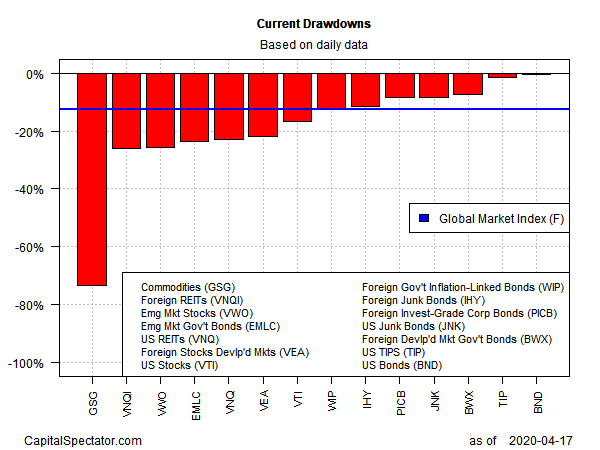

Reviewing asset classes via drawdown continues to show a wide range of results. U.S. investment-grade bonds (BND) are currently suffering the smallest peak-to-trough decline – a mere 0.2% slide from the previous apex. At the other end of the red-ink tally: commodities (GSG), which are wallowing with a stunning 74% drawdown.