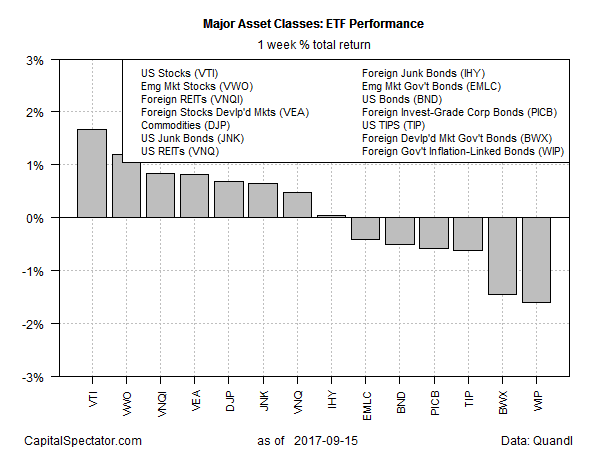

Stocks in the US rebounded last week, posting their strongest weekly gain so far this year and topping the performance ranking for the major asset classes, based on a set of exchange-traded products.

Vanguard Total Stock Market (NYSE:VTI) popped 1.7% for the five trading days through Sep. 15, closing at a record high. Emerging-markets equities posted the second-strongest gain for last week: Vanguard FTSE Emerging Markets (NYSE:VWO) jumped 1.2%.

Fixed-income markets were broadly lower last week. The biggest loser: foreign inflation-linked bonds. SPDR Citi International Government Inflation-Protected Bond (MX:WIP) fell 1.6%, reversing most of the previous week’s 2.0% surge.

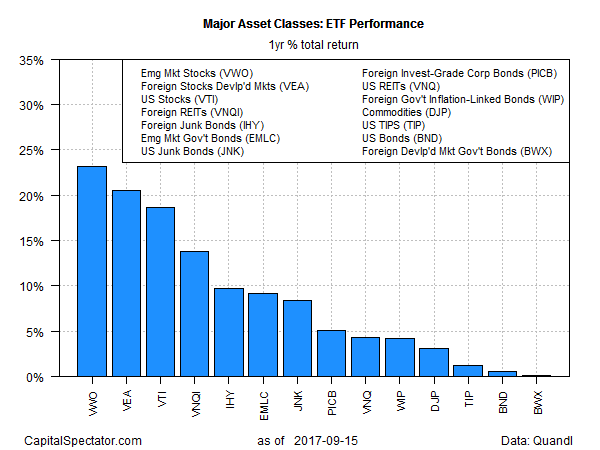

For the one-year trend, all the major asset classes are currently posting gains, although there’s still a wide range of results.

Stocks in emerging markets continue to hold the lead position for the trailing 12-month change. VWO’s total return is currently 23.2% through Friday’s close, modestly ahead of the number-two performer for the trailing one-year change – foreign stocks in developed markets via Vanguard FTSE Developed Markets (NYSE:VEA), which is up 20.5% as of Sep. 15.

Wallowing in last place for one-year results with a fractional gain: foreign government bonds. SPDR Barclays International Treasury Bond (NYSE:BWX) is ahead by a thin 0.3% vs. the year-earlier level.