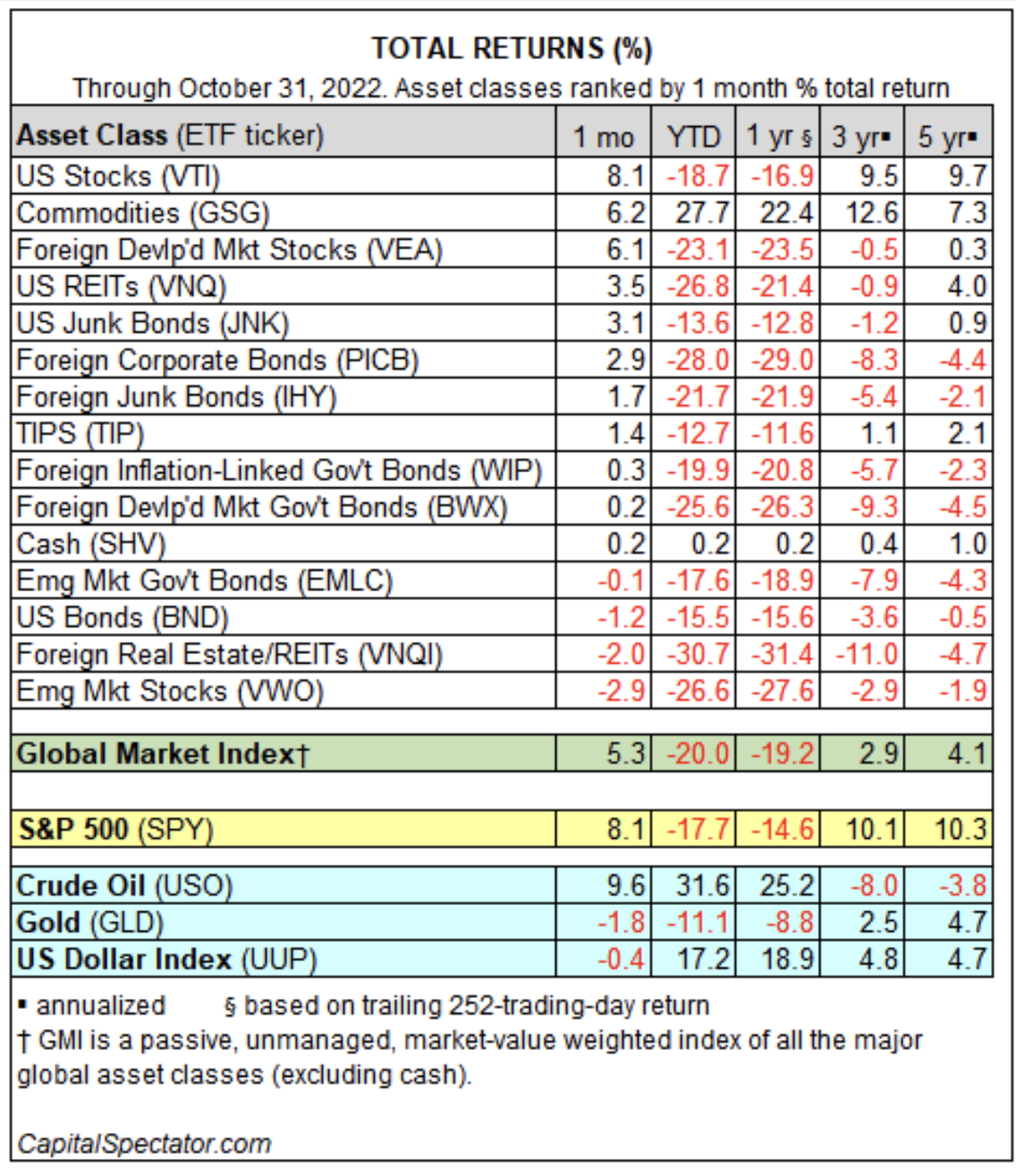

Most markets around the world rebounded in October, reversing some of the losses that have dominated the major asset classes for much of the year to date, based on a set of proxy ETFs.

US stocks led the October bounce. Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) surged 8.1%. Despite the impressive rally, VTI is still down nearly 19% for the year through last month’s close.

Commodities, through iShares S&P GSCI Commodity-Indexed Trust (NYSE:GSG), posted the second-best performance in October for the major asset classes, rising 6.2%. In fact, GSG is the only gainer in 2022 other than cash, through iShares Short Treasury Bond ETF (NASDAQ:SHV).

Despite a broad-based recovery last month, several slices of global markets continued to slide. Notably, equities in emerging markets declined again, falling for a fifth straight month and posting the steepest loss in October for the major asset classes. Vanguard FTSE Emerging Markets Index Fund ETF Shares (NYSE:VWO) shed 2.9% and is now in the red this year with a near-27% tumble.

The Global Market Index recovered in October, registering its first monthly gain since July. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, rose 5.3% in October. Year to date, however, GMI remains underwater by 20%.

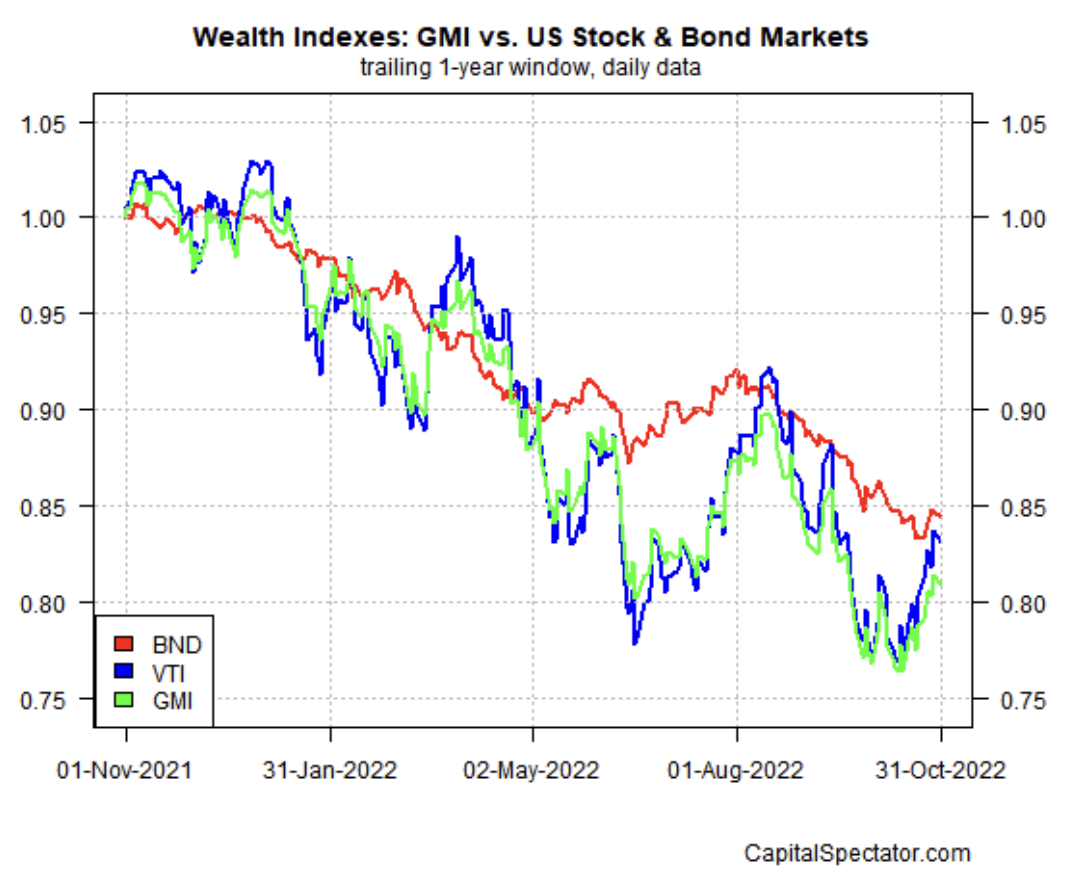

Comparing GMI’s performance to US stocks, through Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI), and bonds, through Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND), over the past year shows that multi-asset-class portfolios continue to fall in line with losses for equities and fixed income.