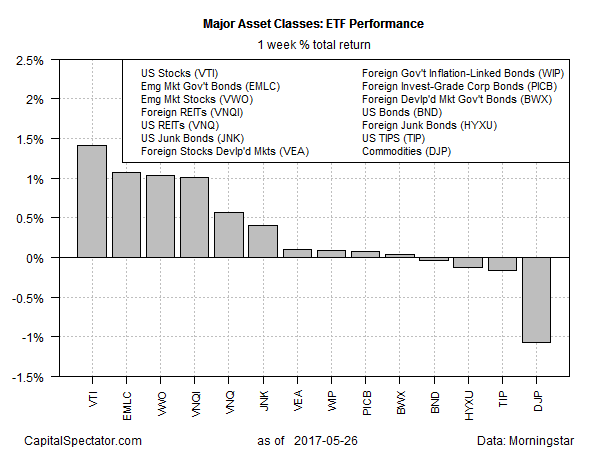

Equities in the US increased last week, closing on Friday at just below a record high. The advance through May 26 reflects the strongest weekly performance for the major asset classes, based on a set of representative exchange-traded products.

Vanguard Total Stock Market (NYSE:VTI) gained 1.4% last week. The ETF was up every day last week until Friday, when it slipped fractionally below Thursday’s close, which marked a record high.

Last week’s big loser: broadly defined commodities. iPath Bloomberg Commodity (DJP) slumped 1.1%, posting its first weekly loss for May.

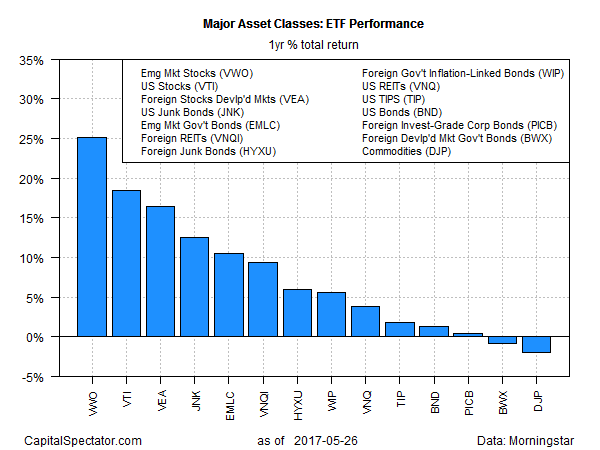

For one-year returns, emerging markets stocks continue to hold the first-place title. Vanguard FTSE Emerging Markets (NYSE:VWO) climbed 25.1% on a total return basis through May 26. The fund’s rally at last week’s close left it just below its previous peak, set on May 16 — a two-year high.

Meanwhile, broadly defined commodities are in last place for one-year results. DJP was off 2.0% for the trailing 12 months at last week’s close, the deepest year-over-year setback for the major asset classes.