Asian markets opened sharply higher on Thursday in response to the announced cooperative central bank liquidity effort. The Hang Seng soared 5.6%, climbing 1013 point to 19002, leading the region. The Shanghai Composite rose 2.3%, the ASX 200 gained 2.6%, and the Nikkei advanced 1.9%. In Korea, the Kospi rallied 3.7% as Samsung Electronics surged 7% to a new record closing high.

Hong Kong's Hang Seng Index Surges 5.6%

In Europe, the major indexes closed lower after Wednesday’s sharp rise. The DAX fell .9%, the CAC40 dropped .8%, and the FTSE slipped .3%, as investors locked in gains from the previous session.

US stocks closed mixed after a choppy session, with the Nasdaq gaining .2%, while the Dow and S&P 500 declined .2%.

Currencies

The currency market ended mixed after Wednesday’s steep dollar selloff. The Euro edged up .2% to 1.3459, and the Canadian Dollar advanced .5% to 1.0142. The Australian Dollar slipped .4% to 1.0226, and the Swiss Franc and Japanese Yen both declined by .2%.

Economic Outlook

Weekly unemployment claims unexpectedly rose to 402K from last week’s 396K reading. ISM manufacturing PMI was slightly better than expected at 52.7 vs. 51.6, and monthly auto sales rose to 13.6M from 13.3M last month.

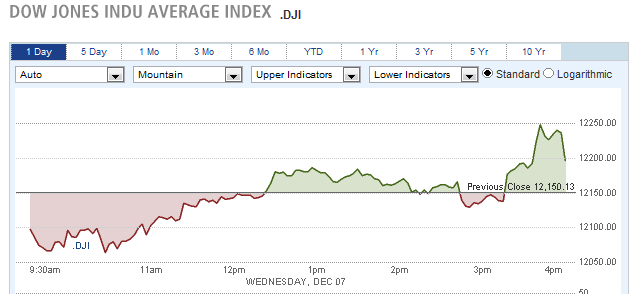

US Unemployment Rate Drops to 8.6%

Equities

Asian markets closed mixed as investors awaited key US payroll data later in the day. The Nikkei rose .5% to 8644, gaining 5.9% for the week, its largest jump in 2 years. Australia’s ASX 200 climbed 1.4%, soaring 7.6% for the week. In China, the Shanghai Composite fell 1.1%, while the Hang Seng ticked up .2%.

European markets advanced, as the banking sector surged 4.2% amid hopes for the upcoming EU summit. The FTSE gained 1.2%, the CAC40 rose 1.1%, and the DAX closed up .7%.

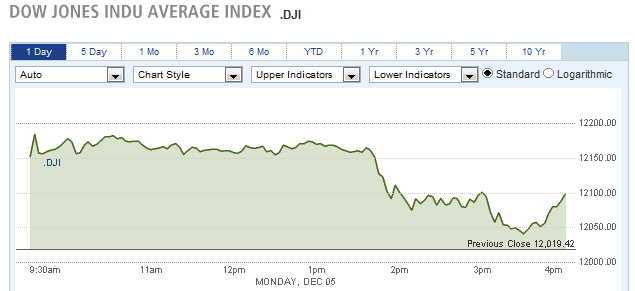

Dow Forfeits Early Gains to Close Flat

Blackberry-maker Research in Motion plunged 9.7% after warning it would fall short of forecasts due to struggling sales of its Playbook tablet.

Currencies

The US Dollar advanced against global currencies. The Euro, Pound, and Swiss Franc each fell .6%, while the Yen eased .3% to 77.98. The Australian Dollar edged lower .1% to 1.0216, reversing a morning spike up to 1.0304.

Economic Outlook

Non-farm payrolls rose by 120K last month, slightly less than the 126K forecast, but stronger than last month’s 100K reading. The unemployment rate unexpectedly dropped to 8.6%, from 9.0% previously. The recent data suggests the US recovery is picking up steam.

Equities Gain, Italy Announces Austerity Measures

Equities

Over the weekend, Italy announced a $30 billion austerity package which helped lift Asian markets The Nikkei rose .8% to 8696, the Kospi edged up .4%, and the ASX advanced by .8%. Tha Hang Seng climbed .7%, while China’s Shanghai Composite lagged the region, dropping 1.2% on weak economic data which dragged down small-cap stocks.

An agreement between French and German leaders concerning the spiraling debt crisis was cheered by European markets. The CAC40 rallied 1.2%, the DAX gained .4% and the FTSE rose .3%. Italy’s MIB index surged 2.9% in response to the new austerity measures.

US markets opened sharply higher, but trimmed their gains later in the day. S&P announced it is placing all 17 Euro zone nations on credit review, due to the spreading debt crisis. The Dow gained 78 points to 12098, the S&P 500 climbed 1%, and the Nasdaq closed up 1.1%.

Stocks Gain, but well off Highs

SAP announced it will acquire SuccessFactors for $3.4 billion. SuccessFactors’ stock soared 51%, while SAP shares slipped 2%.

Currencies

The US dollar eased modestly on Monday. The Euro inched up 9 pips to 1.3398, the Pound rose .3% to 1.5649, and the Yen gained .3% to 77.71. The Australian Dollar posted an outsized gain of .6% to 1.0279, while the Canadian Dollar edged up .2% to 1.0173.

Economic Outlook

Monday’s economic data came in slightly below expectations. The ISM non-manufacturing PMI unexpectedly fell to 52 from last month’s 52.9 reading, and factory orders dropped by .4%, more than forecast.

Equities Close Mostly Lower on Debt Jitters

Equities

Asian markets slumped in response to a warning by S&P that it was placing 15 euro zone nations on credit watch for a possible downgrade. The Nikkei declined 1.4% to 8575, but Olympus shares jumped more than 9% amid expectations the stock will recover from its scandal induced losses. In Australia, the ASX 200 shed 1.5%., despite a .25% rate cut by the Reserve Bank of Australia. The Kospi fell 1%, the Hang Seng dropped 1.2%, and the Shanghai Composite eased .3%.

Currencies

The Canadian Dollar rose .7% to 1.0098, lifted by solid Ivey PMI data, while the Dollar was firm against other currencies. The Euro ended flat at 1.3398, the Pound slipped .3% to 1.5595, and the Australian Dollar declined .2%. The Swiss Franc dropped .6% to 1.0794, while the Yen inched up .1% to 77.74.

Economic Outlook

The news continues to be dominated by the Euro debt crisis, and the focus is now on the proposed stability fund changes, due to be discussed at the EU summit later this week. It remains to be seen if the officials have the will to tackle the enormity of the debt problem.

Rumors of $600 Billion IMF Loan Boost US Markets

Equities

Asian markets were lifted by a report by the Financial Times that European leaders were trying to strengthen the region’s bailout fund. The Nikkei jumped 1.7% to 8722, the Kospi gained .9%, and the ASX 200 rose .7%. The Hang Seng rallied 1.6% while China’s Shanghai Composite rose .3%, snapping a 3-day losing streak.

Meanwhile, European markets posted moderate losses, surrendering earlier gains. The DAX fell .6%, the FTSE slipped .4%, and the CAC40 eased .1%. S&P has threatened to cut the credit rating on the ESFS bailout fund, and the threat may help force European leaders to agree to a deal at Friday’s summit.

US stocks closed mostly higher. The Dow gained 46 points to 12196, the S&P 500 rose .2%, while the Nasdaq ended flat.

Stocks Rally on IMF Loan Rumor

Rumors circulated that the G20 is considering a $600 billion loan to the IMF to help Europe, but the IMF denied the claim.

Energy stocks fell after a bearish oil report showed an unexpected rise in oil inventories. Halliburton shares slumped more than 6%, and Peabody Energy fell 3.4%.

Currencies

The Dollar traded mixed as the market prepared for the upcoming EU summit. The Pound rallied .7% to 1.5707, and the Australian Dollar gained .4% to 1.0286. The Euro, Canadian Dollar and Yen all closed little changed. The Swiss Franc slipped .2% to 1.0827.

Economic Outlook

Consumer credit increased to $2.457 trillion, slightly more than expected. Weekly mortgage applications also increased, thanks to a recovering economy and low interest rates.