- Markets quickly shook of the initial disappointment after Fed chairman Bernanke’s statement before Congress and the US stock market recovered strongly supported by a couple of well-received US corporate earnings. The S&P 500 closed up 0.7% after an initial drop of 1.2% while Dow Jones industrial Average finished up by 0.6%. US 10-year benchmark Treasurys rose 3bp to 1.5078% but have dropped back below 1.50% again overnight. In the Asian trading session, focus turned towards the poor economic outlook and Nikkei and Topix are two of only a few regional markets to stay in positive territory. Both indices are up by 0.2% while Hang Seng is down by 0.8%. In FX markets, the EUR/USD regained the initial drop from 1.2280 to 1.2189 after Bernanke’s speech and is this morning trading around 1.2290.

- There was no hint of imminent QE in Bernanke’s statement before the US Congress. In general, the content of the statement did not deviate substantially from the content of the statement from the Fed’s June meeting. It appears that Bernanke certainly does not feel confident that there will be enough support for further QE on the FOMC board to make any commitments at this stage. Based on Bernanke’s comments, it looks less likely that there will be announced additional QE in connection with the August meeting. QE in connection with the September meeting is still possible, but it will be data-dependent.

- Data released overnight showed that prices for new homes in China increased for the first time since June 2011. Prices for existing homes also increased 0.1% m/m in June after declining 0.1% m/m in May. Sales of new homes also improved markedly in June for the second month in a row and even though most restrictions on the property market remain in place, it appears that the recent sharp decline in mortgage rates has lured buyers back in the property market. All in all, today’s release is in line with other recent data that suggests that the Chinese property market has started to stabilise.

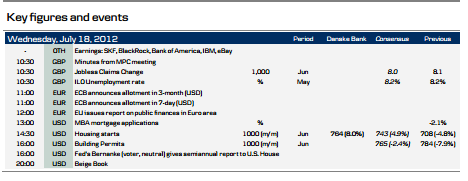

- Focus today will be on minutes from the 5 July meeting of the Bank of England and UK jobless figures. Today’s release will get attention after the central bank added GBP50bn to its asset purchase programme this month and the market will look for hints of further easing as UK consumer prices released yesterday showed the biggest June drop since 1996. Fed Chairman Bernanke gives his semi-annual report to the US House. However, based on yesterday’s statement before the US Congress, it is very unlikely that his speech today will reveal anything new. Tonight the Fed releases its Beige Book survey ahead of the coming FOMC meeting on 31 July. The report is likely to confirm that the economic growth will continue at a moderate pace going forward. In the US only tier 2 data releases are in the calendar today. However,look out for housing starts to surprise on the upside. The earnings season continues with Bank of America and BNY Mellon reporting today.

- There are no major market events in Scandinavia today.

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research analyst’s personal view about the financial instruments and issuers

covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation by the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of the Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. Employees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over-all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate

finance or debt capital transactions.

Financial models and/or methodology used in this research report

Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be

obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis of relevant assumptions, are stated throughout the text.

Expected updates

This publication is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without

limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not

undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S.

Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors”.

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.