Domestic steel prices continue to slide. This is an unusual divergence, given that the rest of industrial metals continue to rise in price. Then why are steel prices falling in the U.S.?

The reason is pretty clear by now. Steel prices rose significantly in the first half of the year, both in the U.S. and globally. However, the price increase was much more significant domestically thanks to trade cases. U.S. steel imports from China plunged, inflating domestic prices. This is particularly true in flat products like cold-rolled coil (CRC). Prior to trade cases, China accounted for more than half of U.S. CRC imports. Imports from China were effectively shut down, thanks to super-high anti-dumping duties of 265%.

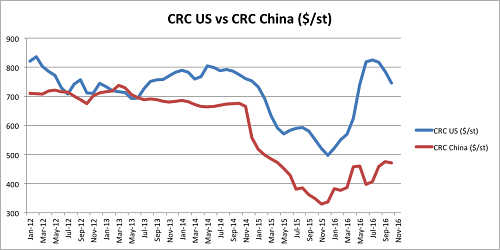

U.S. CRC vs Chinese CRC since 2012.

China is what moves international prices. China accounts for more than half of global steel consumption and production. China WAS the biggest steel exporter. Not anymore in the U.S., thanks to trade cases.

If steel prices increase in China, they also increase elsewhere, whether it’s Vietnam or Turkey, since Chinese exporters would increase their selling price. Therefore, we’ll take China as the benchmark for international prices.

The arbitrage between U.S. and Chinese prices widened to record levels in the first half. But enough holes exist in the anti-dumping duties to allow material to reach U.S. shores. Indeed, imports are already coming from other sources.

In August, CRC imports rose almost 11% from last year, recording the highest levels in 13 months. Currently, U.S. steel companies are filing a case against transshipments of Chinese steel products from Vietnam. We suspect that since imports are already rising, this price arbitrage peaked in July and is set to keep narrowing.

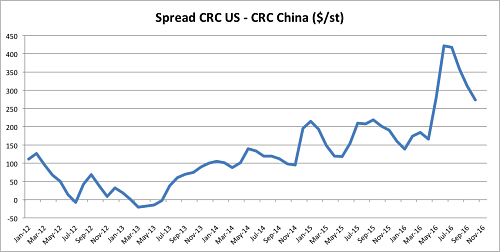

The spread between U.S. CRC US and Chinese C.R.C. prices. Source: MetalMiner.

The chart above represents the spread between domestic steel and Chinese steel (the U.S. CRC price minus the Chinese CRC price). Notice how this spread peaked in July near $400 per ton and has declined sharply in the third quarter, when imports started to pick up. This is because prices in China held well in Q3, while U.S. prices fell.

Why Is This Important?

We suspect that if prices in China continue to hold well, the downside in U.S. steel prices should be limited. Once this spread comes down to normal levels (below $200/ton), domestic steel prices will follow prices in China. Therefore, once that happens (probably in Q4) the key trend to watch will be prices in China. So as long as prices in China don’t fall, domestic flat products shouldn’t fall more than $100 per ton from where they are now.